13th Century Interest Rates

Source material: A History of Interest Rates, Fourth Edition by Sidney Homer and Richard Sylla (1963, 2005). This book covers interest rate history dating back to ancient times and contains very interesting charts, tables, and analysis which I will attempt to modernize and summarize. This data can expand our understanding of different eras of monetary and financial information to make us better investors.

The 13th Century

The 12th century did a masterful job of pulling Europe out of a centuries old malaise and, with that firm foundation set into place, enabled the 13th century to endow posterity with some of Europe's finest craftmanship. It was in the 13th century that the French Gothic cathedral, Notre-Dame, was completed. It was also in this century that work began on London's Westminster Abbey, the great cathedral that would serve as the final resting place for many of England's monarchs for centuries to come.

Europe was dominated by many colorful personalities at this time. In Florence, the arts flourished under Dante and Giotto while their Venetian contemporary, Marco Polo, traveled to the heart of the great Mongol Empire. Edward I, more famously known as Longshanks, battled William Wallace and the Scots and began a period of expansion that would lay the foundation for future English dominance on the continent. Other famous names include King John, infamous for playing the villian in the Robin Hood epic as well as being the monarch forced by his nobles to sign the Magna Carta, as well King Louis of France, and Saint Thomas Aquinas.

The Hanseatic League dominated trade in northern Europe while the Venetians battled the Genoese for martime supremacy in and around the Mediterranean Sea. It was also during this time that the Fairs of Champagne were gradually phased out and supplanted by a more permanent marketplace in Bruges.

In this missive we will be covering 13th century money, banking, and credit as well as focusing our attention on the types of loans that existed during this time along with a few examples but we will begin our study with 13th century money and banking.

Money, Banking, and Credit in 13th Century Europe

International banking was dominated by the Italian Peninsula, principally by the Florentines, who had representatives of their banks placed all throughout Europe. Under them, banking reached its most advanced form up to that period in history. Long term loans were being extended to English wool growers for example, a profitable occupation in and of itself. Credit sales and installment sales, where the buyer would make payments to the seller over a period of time, became commonplace and bank accounts were now being used by both businesses and individuals. Through these innovations in banking people were able to speculate on both foreign money and shares of public loans (public loans consisted of loans to municipalities, examples being loans to the cities of Genoa and Venice, topics which were briefly touched on in the prior article but will be covered in more detail here).

Up to this point it was the Jews who had operated as the primary pawnbrokers in Europe but during the 13th century they were replaced by the Men of Cahors (a Roman Catholic diocese) and the Lombards (Italians descended from Dark Age Germanic tribes). Likewise, while the Roman Catholic Church had served as the primary lender during the Dark Ages, they now rarely engaged in lending. The Order of the Knights Templar, former crusaders returned from the holy land, became a powerful banking organization and began to lend money in place of the church.

Bruges, referred to as “the Venice of the North” during this period, replaced the Fairs of Champagne as the primary market for connecting the north and south of Europe due to its importance as the first point of entry for English wool. An additional bonus was that Bruges was operational at all times whereas the Fairs of Champagne only occurred a few times per year.

Despite the economic expansion that occurred during the 13th century, coinage in much of Europe was still heavily debased. In order to remedy this, the Florentines minted the florin in 1252 while the Venetians minted the ducat in 1284 (both coins are pictured below). These gold coins were of such quality that they managed to last for centuries hence.

The 13th century is largely responsible for the development and growth of extending credit to cities and towns in return for interest payments, similar to municipal debt today. Cities would issue debt in the form of an instrument called the rente and the duration of this instrument could almost be indefinite. Shortly after the creation of the rente, these financial instruments could themselves be bought and sold on a secondary market. The term “rentier class” is derived from this time period and an interesting aside is that the monasteries and nobles of the time were often in debt to this new class of people.

Types of Loans

There were roughly six types, or categories, of loans during this time, at least in terms of mainstream credit. Those were: loans to kings and personal loans, commercial loans, deposits, annuities and mortgages, and loans to states. We will cover each in detail.

Loans to Kings and Personal Loans

The credit of merchants and free towns, such as the cities and towns that comprised the German Hanseatic League mentioned earlier, were generally far superior to that of kings. Towns were able to use the wealth of their citizens as collateral in order to secure credit. This security is somewhat similar to what goes on today with municipal or sovereign credit whereby loans to these government entities are essentially secured by the taxing power of said entities, however, in the case of free towns there were no taxes, just the ability to call on the wealth of citizens in the event of liquidity problems. Contrary to what you might think, citizens of these free towns were willing participants in this arrangement because maintaining good credit allowed free towns to remain sovereign and independent. Free towns also had reliable and consistent sources of revenue which made these sources easy to use as collateral. Furthermore, merchants had to maintain good credit in order to secure business so the incentive to remain creditworthy was omnipresent.

In contrast, kings could not use the wealth of their subjects as collateral in order to obtain credit and thus a potential creditor ran the risk of ruin by extending credit to a king without some type of security in place. Good credit for kings largely depended on things like the long term stability of the state and military success, absent those the credit of kings would suffer. Creditors could, and often did, lose their investments such as in the event of a military defeat or when the king being lent to was prone to profligacy. There was also no legal recourse for creditors when kings defaulted. The only real tool available to set the royals straight was to deny them any future credit.

Interest rates charged to kings were typically much higher than those for prime commercial borrowers or free towns unless the king was able to put up collateral under an enforceable contract. As an example, Emperor Frederick II (December 26, 1194 - December 13, 1250) typically paid his creditors between 30-40% for loans. Within the context of lending to kings, the text cites some timeless wisdom from the Book of Ecclesiastes:

“Lend not to him who is mightier than thou.”

The high rates of interest for loans to kings, as well as for personal loans, in the 13thcentury caused widespread complaint from all walks of life. In response, states tried to fix rates and defined any charging of interest above these fixed rates as usury. As we recall from the 12thcentury, being labeled a usurer carried a heavy stigma during this period and served as a deterrent against the charging of excessive interest, at least in most cases. The text provides some examples of attempts to place a ceiling on rates during the 13th century. Milan capped rates at 15%, Sicily at 10%, Verona at 12 1/2% in 1228, Modena at 20% in 1270, and Genoa at 15% throughout the whole of the 13th century. While pawnshop rates were capped at 43 1/3% in England, Provence (France) set much higher limit of 300% as did Germany at 173%.

Commercial Loans

In 13th century Italy, rates of 20-25% were reported for borrowers with good credit, rates which were similar to those that had existed in the preceding century. By the end of the 13th century these rates would decline. In the year 1260, rates of 12 ½ to 15% in Siena were reported to be “high.” It was also indicated that borrowers who were not merchants were charged between 25-30% for extensions of credit. During this time rates of 6 5/8 to 8 3/8% were being paid on long term government debt, 8-12% on short term debt government debt, and commercial loans for sea voyages were being issued at 20%

By the year 1270, rates at the Champagne Fairs in northern Europe were quoted between 15-20%. In the Netherlands between 1200 and 1350 commercial loans on good credit were issued at rates between 10 and 16%. The overall range of interest rates in the Netherlands, however, vacillated between 5 and 24% depending on the creditworthiness of the borrower.

Deposits

The Florentine Peruzzi, whose banking dynasty collapsed in the middle of the 14th century ostensibly due to their numerous unsecured loans to kings such as Edward III of England, paid as a high as 20% for a four-month time deposit during the 13th century. This high figure implies that they were capable of lending out at significantly higher rates. Generally speaking, bankers would pay 10% for demand deposits but by the time of the 14th century the interest on demand deposits had decreased a bit. Deposits with the Florentine bankers during this period would earn you 5-10% while the Peruzzi charged 8%.

Annuities and Mortgages

During the 13th century, as well as the beginning of the 14th century , interest rates charged on real estate loans in the Netherlands were reported to be between 8-10%. Toward the end of the 13th century, the rentier class of Arras, France issued loans for land and property at rates as high as 14%.

Loans to States

Interest rates on Florence’s public debt dropped from 15% to 10% during the 13th century and eventually declined all the way to 5% by the year 1390. It is unclear whether these rates were a product of the market or set by edict.

In Venice, long term debt instruments called “prestiti” were being used to fund the public debt. These instruments were not voluntary, however, but forced upon the wealthy citizens of the city with the amount required for purchase being commensurate to the amount of wealth they possessed. One might refer to this as a sort of “progressive” loan based on the fact that the higher your wealth, the more debt you were obligated to purchase. These prestiti were originally designed to be temporary, however, due to the ongoing instability in nearby Constantinople, a city where Venetian interests lied, they were consolidated into a permanent fund called the “monte Vecchio.”

Prestiti paid a nominal interest rate of 5% but the principal itself was not paid back with any regularity and, when it was, it usually coincided with a new issuance of forced loans whose principal amounts exceeded the amounts being paid back. Towards the end of the 13thcentury, debt burdens increased due to an ongoing conflict with Genoa. Interest payments of 2 ½% were paid to creditors twice per year and this arrangement lasted for more than a century hence.

The owners of prestiti were not issued certificates, instead, these claims were recorded at the loan office. Through the ink of the bookkeeper’s pen these claims could also be sold, transferring the ownership rights to others.

Since a securities market for prestiti existed at the time, it is possible to ascertain market interest rates as well. We can get an idea what these rates were by taking the 5% rate and dividing it by the sale price of the debt instrument itself, keeping in mind a par value of 100. For example, if the sale price of a prestiti was for 90 ducats then it's yield was 5/90 or 5.56%. Venetian aristocrats would voluntarily purchase these prestiti in the secondary market and use the proceeds for the endowments of charities or for paying dowries.

Forced loans were typically issued on account of war. The creditors for these loans had first priority for repayment after state revenues were first applied to meet any outstanding expenses. Despite there being no promise to repay, when repayment did occur it was done in chronological order. The relationship between the quantity of repayments against the quantity of emissions played a large role in determining the market price of prestiti. Once a citizen possessed a prestiti, assuming they were the original owner, they were exempt from being issued forced loans going forward. Assessments were determined by calculating the productive output of an estate and multiplying that amount by ten.

Due to a series of wars in the latter stages of the 13th century, the price of the prestiti sank, reaching a low of 60. However, when the 14th century brought a return to stability, prices above 100 were even quoted at points. Due to the regularity of payments and overall prosperity of Venice, the popularity of the prestiti would continue to increase from this point forward.

In addition to the prestiti, voluntary loans were also issued but sadly no rates were reported in the text. Borrowers of these types of loans included: the city itself, butchers, and the town granary. The loans themselves were stored in the town granary, called the Camera del Frumento, and the granary eventually began to function like a bank whereby lending services were offered in addition to borrowing.

Examples of Loans

A history of interest rates would not be complete without some documentation of actual loans that occurred during the 13th century. Luckily, the text provides us with a few:

Emperor Baldwin II (late 1217 – October 1273) borrowed 13,000 perperi on short duration from a Venetian merchant named Morosini in 1237. This loan was secured by the Crown of Thorns, a relic believed at the time to be the actual crown of thorns worn by Jesus. The interest rate was not recorded. Baldwin did indeed default and the Crown of Thorns ended up in the hands of King Louis IX of France.

Joan of Flanders (c. 1199 – 5 December 1244) borrowed at a rate of 18% payable in one year in 1221 in order to ransom her husband, Ferdinand of Portugal. The text indicates that the low rate she paid implies that she posted good collateral.

In 1285, Venetian prestiti were quoted in the secondary market at 75% of their face value. Remembering how bond yields are calculated from above that means we divide 5 by 75 for a yield of 6 5/8%. During this time, repayments were larger than new assessments.

In 1288, new assessments increased significantly due to war. The market price of the prestiti was 70 while it's yield rose to 7 1/8%.

In 1299, war with Genoa took a heavy toll and the price of the prestiti sunk to 60, yielding 8 3/8%.

The Camera del Frumento borrowed at 8% in 1285, 10% in 1287, and 12% in 1288 prior to a 1289 regulation that capped their rate of borrowing at 10%

Interest Rate Comparison Chart

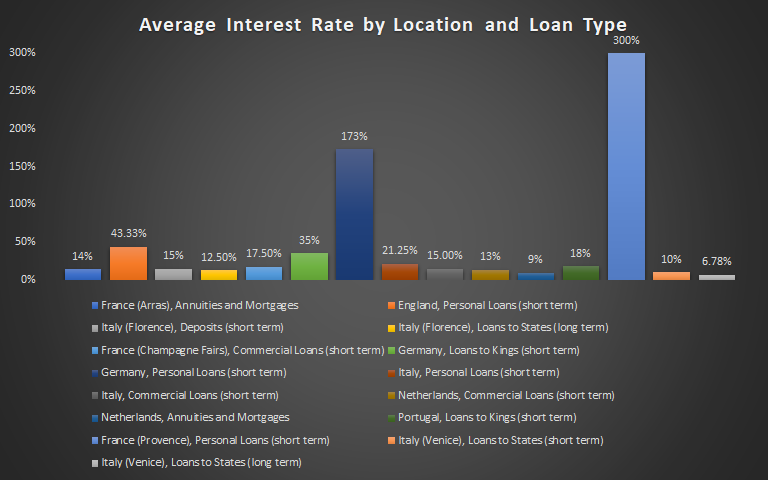

The average interest rates during the 13th century are illustrated in the chart below. The data is organized by location and loan type. For example, in Arras, France the average interest rate for an annuity or mortgage was 14%. Each location with it's corresponding loan type is denoted by color and the list below the chart reads from left to right.

The text typically provides the interest rates in a range so the high and low percentage of that range were averaged together to create the chart. However, the following loans only provided one data point: the personal loan in England for 43.33%, the personal loan in Germany for 173%, the loan to kings in Portugal for 18% and the personal loan in Provence for 300%. In three of the four cases, the exception being Portugal, these figures merely represent limits on interest rates and not an average.

Due to the scarcity of data, no discernible patterns are easily recognizable. However, loans that are personal in nature are clearly shown to be the most risky as evidenced by their high interest rates.

Conclusion

Rates of interest varied quite a bit depending on a number of factors. Any combination of location, time period, loan type, or borrower could drastically affect the rate of interest being charged. It also appears that the power of the church over financial matters had begun to wane at this time which may have emboldened society to be more open about their lending activites.

The 13th century had a profound impact on posterity by way of philosophy, the arts, economics, exploration, etc. With the minting of the florin and ducat, this century also provided a wonderful example of what could be achieved under a sound monetary system.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in