14th Century Interest Rates

Primary source material: A History of Interest Rates, Fourth Edition by Sidney Homer and Richard Sylla (1963, 2005). This book covers interest rate history dating back to ancient times and contains very interesting charts, tables, and analysis which I will attempt to modernize and summarize. This data can expand our understanding of different eras of monetary and financial information to help us understand the world of economics and finance better.

The 14th Century

The most well-known event to occur in the 14th century is arguably one of the most well-known events in western history: the Black Death. It is impossible to account for the number of people who died as a result of this pandemic and its origins are still debated today. Nevertheless, historians estimate that somewhere between one third and two thirds of Europe’s population succumbed to the Black Death in a matter of a few short years. Due to the enormous loss of population the cost of labor spiked and the cost of agricultural products fell, a benefit to those who survived the ordeal. The value of both land and rents fell in places like France while other events, such as England’s 1381 Peasant Revolt, nearly toppled a centuries old aristocratic order. These types of events had their roots in the plague.

The Black Death managed to temporarily halt the second most significant event of the 14th century, the Hundred Years' War between England and France. The conflict which began as a succession dispute between the House of Plantagenet (England) and House of Valois (France) over the French crown led to a series of wars which lasted for more than a century, the most famous of which was the Battle of Agincourt in 1415. The House of Plantagenet descended from the Norman French who had conquered England in the 11th century and still had large land holdings in parts of France. In fact, French was the language of the aristocracy in England from the time of the Battle of Hastings (1066) on through the 14th century. The bad blood between the two countries eventually prompted Edward III of England to begin the process of transitioning from the use of French to the use of English and, by the end of the century, one of the most classic pieces of English literature, The Canterbury Tales, was produced. In order to fund the wars Edward borrowed heavily from the Bardi and Peruzzi banking houses of Florence, both precursors to the powerful Medici of the 15th century. Sources differ as to whether Edward defaulted on some or all of his loans but either way it was reported that both banks were ruined, at least in part, to having lent to him.

While the Florentines were financing the wars of northern kings both Genoa and Venice dominated the Mediterranean, controlling virtually all trade on either side of the Italian peninsula. Additionally, as we mentioned in our history of 13th Century Interest Rates, both the Florentines and Venetians dominated the production of European coins during this period thanks to the minting of their superior coins the Florin and the Ducat. Despite the growing prowess of the northern kingdoms, the Italian city states were still at the forefront of trade and finance in late medieval Europe.

Money, Banking, and Credit in 14th Century Europe

In this section, we will focus our attention on some of the primary institutions that were responsible for extending credit during the 14th century. We will also observe some examples of the types of money being used to facilitate commerce during this time as well.

Pawnbroking in Medieval Europe

In medieval times the Jews and Lombards, northern Italians of Germanic descent, were the most prominent pawnbrokers in Europe. By the time of the 14th century however, it appears that the Lombards had supplanted the Jews as the primary pawnbrokers of western, and perhaps all, of Europe due to the expulsion of the Jews in England and France.

Pawnbroking is the practice of lending money that is secured by collateral. An example of this practice involved King Edward III pawning his crown jewels to the Lombards in exchange for a war loan in 1338 (note: it appears that Edward III financed his war efforts through multiple sources).

Peruzzi

Prior to the rise of the Medici in Florence, the Peruzzi were the premier bankers in the city. The family allegedly acquired the banks' initial capital by acting as a wholesaler of both English wool and French grain. By the 1330s the Peruzzi bank was the second largest in all of Europe with branches stretching from the Middle East to London and everywhere in between. At their peak the Peruzzi were the primary lenders of credit to popes, kings, nobles and other individuals of high rank but loans to these types of risky borrowers eventually led to their downfall and by 1345 they were bankrupt.

Sroda Treasure

Gold and silver coins were discovered during a demolition in Poland in the 1980s. The discovery of these coins is referred to as the Sroda Treasure. It is widely believed that the Sroda Treasure belonged to Emperor Charles IV, Holy Roman Emperor during the middle of the 14th century. This discovery unearthed a large number of medieval coins and gives us a window into what money was like during the time. 3,000 Prague groschens (pictured below) were discovered and, on account of historical documentation, we know that these coins began being issued in the year 1300 after the discovery of a silver mine in Bohemia. In addition to the groschens, a number of gold florins were discovered which helps substantiate the claim that the florin was one of the primary monies of medieval Europe.

Coinage Under Richard II of England

During the reign of Richard II (1367-1400) the following list of coins were used in England: the gold noble, the gold quarter noble, the silver groat, and the silver penny. The image on the gold noble was that of a king standing on a ship. This coin was introduced into circulation by Richard’s grandfather, Edward III, in 1344 to commemorate the English naval victory at the Battle of Sluys, one of the earliest conflicts in the 100 Years' War. The silver coins included in the list, being of lesser value, were the ones that circulated and would have been used to pay for things like wages or consumer goods toward the end of the 14th century.

Types of Loans

If you have read any of my previous articles on interest rate history then you will notice that the types of loans that were available in the 13th century are virtually indistinguishable from those available in the 14th. One difference, however, involves the detailed record of prices and interest rates for the Venetian Prestiti, unavailable in past centuries.

A chart will accompany each type of loan for visual aid. In the text, the rate of interest is listed in terms of a mixed number but for the construction of each chart the fraction portion was converted to a decimal. Lists are provided when specific examples of loans can be identified.

Loans to Nobility

The interest rates charged to kings, nobles, and others of high rank were high when compared to the rates charged to successful merchants or wealthy towns/cities such as those within the Hanseatic League. Since the nobility had a tendency to rule over their creditors it was possible for said nobility to renege on those debts due to their superior position in the exchange. In contrast, merchants and towns had to make good on their debt or else forfeit future business due to a reputation of bad credit.

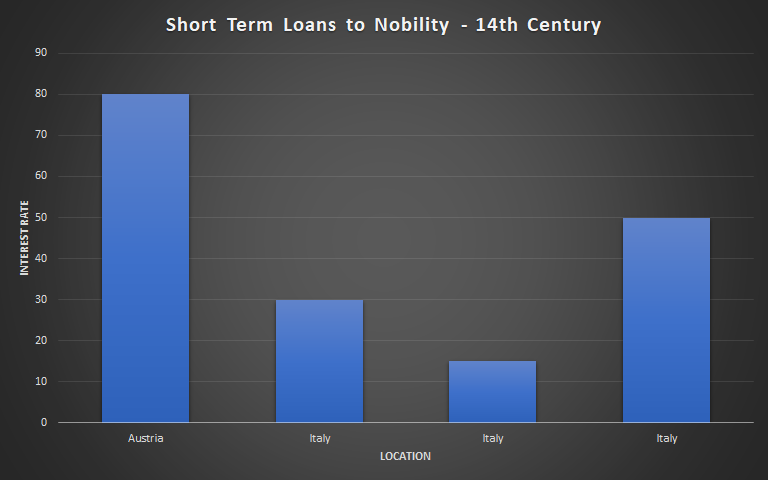

The interest rates charged to the nobility give us some idea of how rates evolved over time due to the fact that said rates were actually recorded for posterity. If a king or noble was able to secure their loan by posting collateral then the rate of interest charged could potentially be lower as well. The following paragraph will provide you some examples of loans to various members of the nobility over the course of the 14thcentury. All terms to the contract, such as if collateral was posted, were not always recorded, nevertheless these are the only examples of specific loans available in this installment.

Frederick the Fair of Austria (1289-1330) borrowed at 80% early in the 14th century, additional details were not provided. Robert of Anjou (1276-1343), King of Naples, borrowed from Florentine bankers at 30% in 1319. In 1328, the Duke of Cambrai borrowed in Florence at 15%. This loan was secured with precious jewels which may explain the lower rate of interest. Marie of France, Duchess of Bar, borrowed at 50% in 1364 using her gold coronet as collateral. Interestingly, this was the same year she was wed.

One of the reasons that loans to rulers involved high rates of interest is best illustrated by the example given by French King Philip the Fair (1268-1314). During the latter stages of his reign, Philip borrowed heavily from bankers but instead of honoring his debt he had it cancelled then had his creditors banished. In the case of the Knights Templar, his largest creditor, he had many of them arrested based on charges likely to have been fabricated. As a result of these charges, many prominent Templars were burned at the stake. The Templars may have had the last laugh as the senior line of the House of Capet, the family line that Philip belonged to, was extinguished a few years later when Philip’s son failed to produce a male heir. The succession crisis that followed plunged France into decades of turmoil and was the main driver for the onset of The Hundred Years War.

France’s opponent in The Hundred Years War, England’s King Edward III, was also no stranger to borrowing heavily, having done so to support England’s war effort against France. As stated already, Edward repudiated his debts and may have been instrumental in ruining the Peruzzi Bank. However, when taking a loan from the Lombards in 1338, he posted his jewels as collateral but the final outcome of those debts remains unknown.

Personal Loans

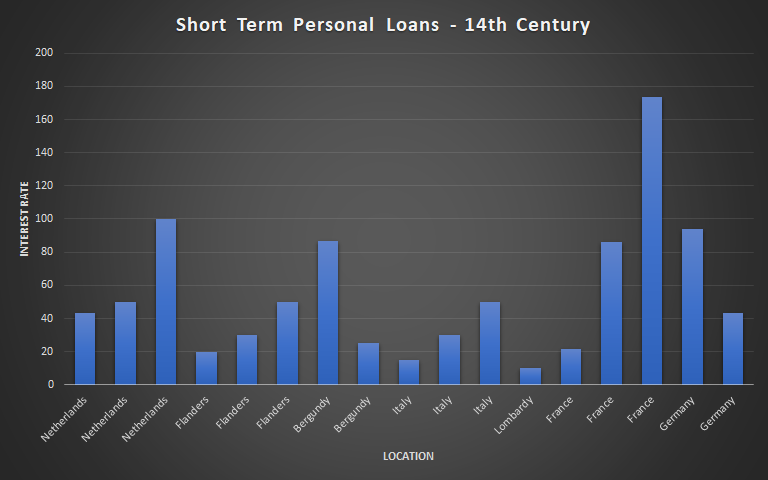

Personal loans were extended by pawnbrokers, usually Jews or Lombards, and were often used for activities like consumption. Some examples of personal loans in 14th century Europe will provide the reader with a better understanding of the nature of credit during this time. Unlike the loans to nobility, these records are of a more general nature.

In the beginning of the 14th century, the Lombards would charge distressed debtors in the Netherlands rates as high as 100%, rates far in excess of the legal limit of 43 1/3%. Decades later, in 1364, these same Lombard pawnbrokers were lending at rates between 20% and 50%. In Nuremburg (Germany) a record indicates that a group of Jews borrowed at rates of 94% and are presumed to have lent that sum out at higher rates despite a limitation on interest which was also capped at 43 1/3%. Medieval lenders seem to have viewed interest rate caps more as suggestions than laws.

The legal pawnshop maximum in France fluctuated wildly in the 14th century. In 1311 it stood at 21 2/3%, rose to its century peak of 173 1/3%, then finally by 1361 it stood at 86%. The first half of the 14th century was a difficult period for France. They struggled through the aforementioned succession crisis which was then followed by military losses at the battles of Sluys, Crecy, and Poitier during the early battles of the Hundred Years War. French fortunes also continued to fade with the advent of the Black Death. By the end of the century, the maximum for usurious loans in Burgundy was 87% but, similar to other parts of Europe, records indicate that this percentage was often exceeded.

In Italy, consumption loans, loans where consumables were loaned out instead of money, were issued at rates as high as 50%. My presumption is that these types of loans must have been repaid in kind as well. In northern Italy, a personal loan of 30% was recorded in Florence while a rate of 10% was given for personal loans issued in the Lombardy region, dates not provided.

Commercial Loans

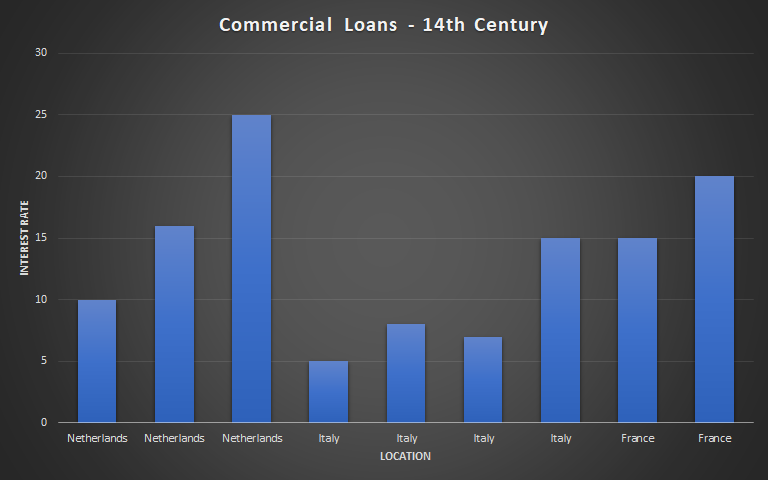

In the Netherlands, rates at beginning of 14th century usually ranged from 10-16% but could be as low as 5% or as high as 24%. Other sources for the same place and time indicate that good commercial credit ranged from 10-25%.

In France, rates at the Champagne fairs ranged from 15-20% with no dates provided. Early in the century, French King Philip the Fair (1268-1314) regulated the rates of interest at the fairs. Rates of 2.5% were permitted per fair of which six occurred each year. This amounts to rates of roughly 15% annualized. Sadly, the relevance of the fairs had begun to diminish by the end of the 13th century. With the relevance of the fairs waning events like military conflicts between Venice and Genoa, which blocked routes into France, as well the Black Death appear to have rendered the fairs obsolete during the 14th century.

In Italy, rates for commercial loans to private business ventures from lenders in Florence and Pisa are ranged from 7-15%. Elsewhere on the Italian peninsula, Venetian loans for commercial activity within the city itself ranged from 5-8% mid-century and then fell to 5% by the century’s end.

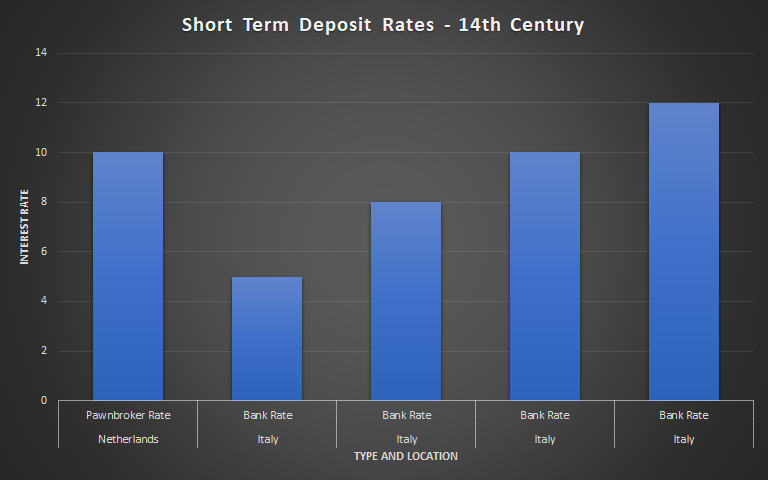

Deposits

While deposit rates on the Italian Peninsula ranged from 10-20% during the 13thcentury, that figure was reduced to 5-10% during the 14th century. Between the years 1300 and 1325 the Florentine Peruzzi, mentioned previously, paid a fixed rate of 8% to their depositors. In addition, pawnbrokers in Brussels were paying depositors 10% by 1369.

Annuities, Mortgages, and Loans to States

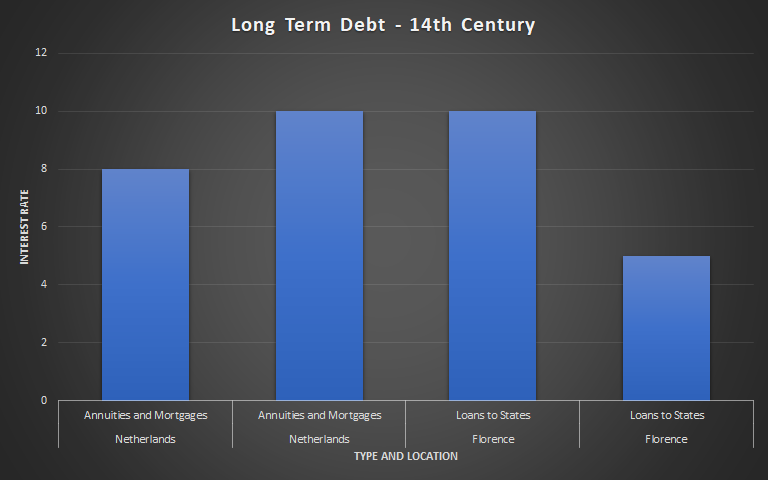

Rates for real estate loans in the Netherlands ranged from 8-10%, unchanged from the 13th century. The city of Bruges financed itself by issuing life annuities and rentes (we will cover rentes in more detail in later installments) which both paid a perpetual income stream to the lender. Documents only indicate that the rates paid on these instruments were below the rates paid on commercial loans, so we can expect that holders of these instruments earned less than 10-16% .

In Florence, forced loans with long durations were yielding 15% during the 13th century but, by the time of the 14th century, that rate had declined to 10%. By the year 1370, interest paid to the holders of forced loans had decreased to just 5%. A special type of forced loan, known as the prestiti, was also being used in Venice during this time. Due to the detailed nature of its price and rate of interest during this time, we will dedicate the next section to it.

Prestiti

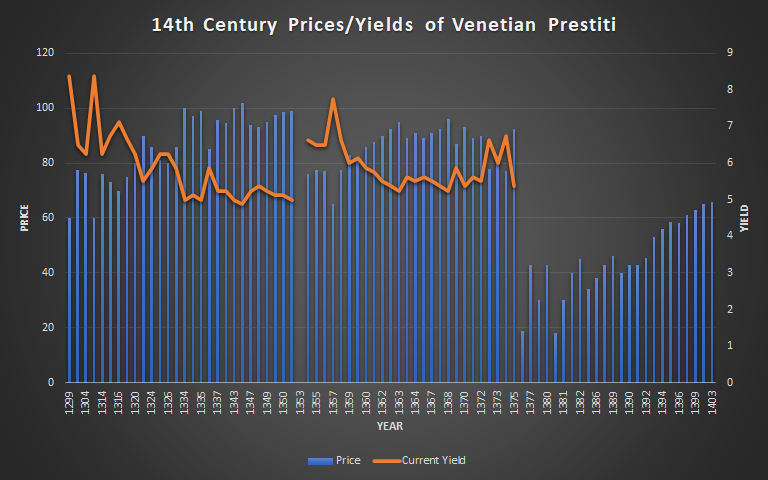

The Venetian Prestiti was another type of forced loan that paid interest to the bearer and could be traded on the open market. These debt instruments were originated via assessments which were typically directed at the wealthier citizens of the republic and had no set duration. The Republic of Venice paid interest at 5% of the face value (a price of 100). This means that if the market price went above 100 (due to higher demand) then the yield would have been less than 5% (example: 5% at a market price of 105 would yield 4.76% by dividing 5 by 105). Likewise, if the price went below 100 then the yield would be greater than 5%. This will make more sense when we get to the chart later.

Prestiti were popular not only within Venice but across all of Europe. Foreign rulers and speculators purchased them as a form of stable investment. However, the right for a foreigner to own one of these financial instruments was a privilege only granted by the Council of Venice and only Venetians themselves could own this financial instrument without first seeking approval. It is unclear why this rule existed but perhaps the idea of powerful foreign creditors having claims on Venetian wealth played a part.

The purpose of the prestiti, and reason for its existence, was to fund charities and to financially assist women should they become widowed; this would have been a serious concern during this time due to all the wars being fought by the Venetians.

For two centuries, between 1200 and 1400, the prestiti functioned as a substitute for direct taxation. New issues were typically created to fund the great number of Venetian wars that arose during the course of the 14th century. Outside of wartime, a tax on Venice's salt monopoly, for example, would have sufficed to pay for the expenses of the republic itself, expenses that would have included paying interest on outstanding prestiti.

A few examples of dates, events, prices, and the current yield of prestiti were recorded and will be provided here to give the reader an idea of how certain events affected the price and yield. In 1299, the cost of the ongoing war with Genoa required very large assessments and the price of the prestiti declined from a base price of 100 all the way down to 60, yielding 8.375%. Between 1332 and 1334 there was a period of large repayments and the price of the prestiti rose from 86 to 100, yielding between 5.875% and 5%. In 1344, during a period of large repayments, the price of the prestiti actually rose to 102, yielding 4.875%. This wasn’t too last long however. During a war with Genoa in 1350, large assessments were again issued. Despite the war the price of the prestiti remained strong trading between 98.5 and 100, for a yield that vacillated between 5.125% and 5%. In 1377, the War of Chioggia exacted an enormous toll despite ultimately ending in a Venetian victory. Enormous assessments were issued to fund the war and interest payments on any outstanding prestiti were suspended. It is reported that the debt from this war alone was 6-9 times the size of the accrued debt in 1344. As a result, the price of the prestiti cratered, fluctuating in a price range of 19 and 43, yields uncertain.

Conclusion

Although it may amount to nothing, given the dearth of data for this time period, a pattern does seem to be emerging which identifies more stable countries with lower rates of interest, a pattern still with us today. This is especially glaring when we compare the rates in Italy, whose republics were the most influential of the time, to rates in France, which was limping from one calamity to the next.

Compared to centuries past, the stigma associated with usurious lending also appears to have declined significantly. As Europe was transitioning away from the institution of serfdom and toward commercial enterprise deep capital pools were needed in order to facilitate the growth of business. During this time, there is even evidence to suggest that there were religious officials who not only tolerated usury, but actively engaged in usury themselves.

Despite the many difficulties that are often associated with the 14th century, the advancement of its debt markets along with transitions away from serfdom and usury laid the foundation for the 15thcentury, a century that gave rise to the Renaissance, the age of exploration, and the Medici.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in