Central Bankers and Anti-Central-Bankers are on the Same Side

It is lonely as a dollar bull. Today, both the central bankers and the anti-central-bankers tell us, "inflation is coming!" For years these two sides were far apart in their diagnosis of the monetary system, but in the last year, they are saying nearly the same things. If inflation picks up, both Jerome Powell and Peter Schiff will be right.

Sure, there are some nuanced differences in these two sides of the economic aisle, but those differences have become blurred. The only issue they definitely differ on is central bankers think they can control inflation they are desperately trying to get, while most anti-central-bankers expect uncontrollable inflation. A glaring, and even troubling fact is the two sides both reject the objective reality, that we are stuck in a debt trap and are mired in a deflationary environment.

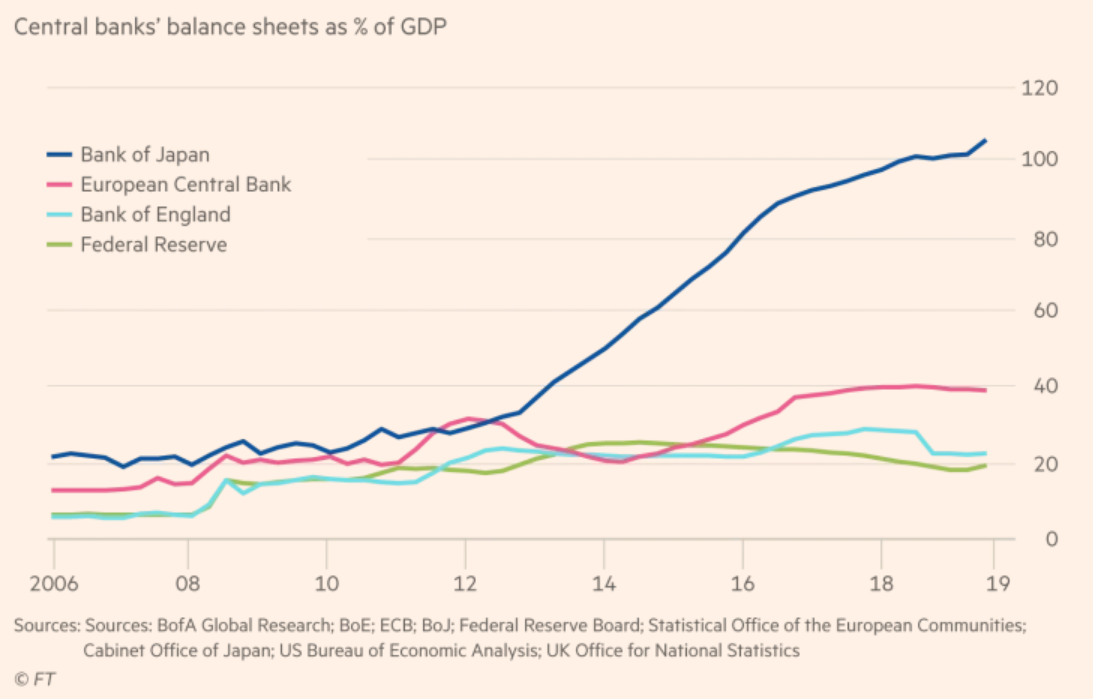

Deflation gets no more than a passing acknowledgement from most market pundits. We only hear things like, 'there are deflationary pressures in the economy, but $4 trillion in central bank liquidity cannot be anything but inflationary,' are very common. This is despite the fact that the Fed has been the least profligate of the major central banks, and the other currencies aren't suffering from inflation.

Japan has been trying to produce inflation for a decade longer than the Fed. How is that working for them? Japan has negative rates and inflation hovering around zero. Europe is mired in the worst deflation they have experienced since the Euro was created despite more easing relative to GDP in 2020 than the Fed.

I have been waiting 12 years for high inflation that was so certain after the first Great Financial Crisis (GFC). I had been waiting for 8 years when the Fed began raising rates and no inflation. Then when they had to do the mid-cycle adjustment reversing course in 2019 and no inflation. Then when the Repo market snapped in September of that year, still no inflation. In March 23, 2020, when the Fed Funds rate was cut by 100 bps and QE infinity resumed, forget inflation, we were back in full blown deflation. This whole period can be seen as a deflationary environment. Even now, in February 2021 after trillions of dollars more in QE and government stimulus, guess what. We're still waiting for inflation to pick up.

Central Bankers

Central bankers desperately want us to think what they are doing is inflationary. We saw this on public display when Jerome Powell went on 60 Minutes to instill confidence in the Fed's ability to do just that. "We print it digitally. So as a central bank, we have the ability to create money digitally."

The rationale here is that if people think there is inflation, they will act as if there is inflation and get out there and spend. That marginal increase in economic activity will be enough to pull us out of the financial depression we are in. The central bankers need to appear extremely dovish (meaning they welcome inflationary activity) to the point that people are convinced they will ruin the economy with inflation. The famous economist Paul Krugman calls this, "credibly irresponsible."

The important thing here is that must appear irresponsible, because they don't know how to actually be irresponsible. In fact, the system is set up so the Fed cannot irresponsibly print money. All the Fed can do is increase bank reserves through QE, they can't print money.

Anti-Central-Bankers

This is an odd phrase, I'll give you that. What I mean is simply adherents to the Austrian School of Economics, those who oppose central banking for economic and ethical reasons. Their framework considers QE and deficit spending as printing money. They have been hollering from the roof tops for decades that central banking creates inflation. Since 2008, as the Fed's balance sheet expanded and the Federal debt surpassed 100% of GDP, they are very vocal about impending inflation.

Today, when the Fed does a new round of QE, the biggest promoters of the Fed's inflation narrative are these people who have been arguing against central banks for ever. This is exactly what the Fed wants us to do. So in a twist of fate, the most vocal enemies of the Fed have become its biggest cheerleaders.

What about Asset Price Inflation?

The best measure we have is the CPI (consumer price index). That might trigger some people, but measuring an overall price level is a very complicated task and the CPI is the best we have. It is also open source, meaning we can see what goes into its calculation. All the alternatives either do not try to adjust to modern developments or outright close source their methods. The CPI is not perfect, but it is the best we have. And what does it tell us? There is very little measurable inflation out there.

The anti-central-bankers will instantly jump to asset price inflation. This is where inflation is only seen in some specific assets, usually those assets which are claimed to be closest to the source of printing. The prices of those assets will be affected by inflation first in what's known as the Cantillon Effect.

In 2008-2012 it was common to hear inflationists say, "wait, inflation is coming. It takes some to work its way through the economy." But, it never showed up. Now, inflationists have resorted to pointing out the price of only a few assets have increased wildly, namely real estate, stocks and bonds. How quickly do these Austrians abandon their economic roots, the principle that prices are not inflation, and inflation is not prices. We must define inflation as an increase in the money supply. That is the cause, with one of its deleterious effects being a broad spectrum increase in prices.

Financial Hurricane

I have recently coined the term "financial hurricane" to describe the same observable prices in the context of deflation. Perhaps I'll write a separate post about that topic alone, but suffice it to say here, a financial hurricane is a period of economic disaster which distorts prices throughout the economy toward safe haven and liquid assets. A hurricane doesn't hit all at once and it is over, meteorologists track it for a week prior to it hitting. There is always a "cone of uncertainty" about the track it will take. This is part of the analogy of the financial hurricane, it happens in slow motion over years, but the exact course of the disaster is uncertain. We can be stuck in a wealth destruction phase for decades and specific prices can actually go up.

Conclusion

Inflationists are as desperate to confirm their bias as central bankers are to make you believe in inflation. If you start convinced of inflation, everywhere you look any increase in price will be blamed on inflation.

Most people don't question their assumptions on what money is, and now we find ourselves in the messed up world where those people who have been fighting against central banks for decades are parroting exactly the inflationist mantra central bankers want.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in