Bowling for Fiat

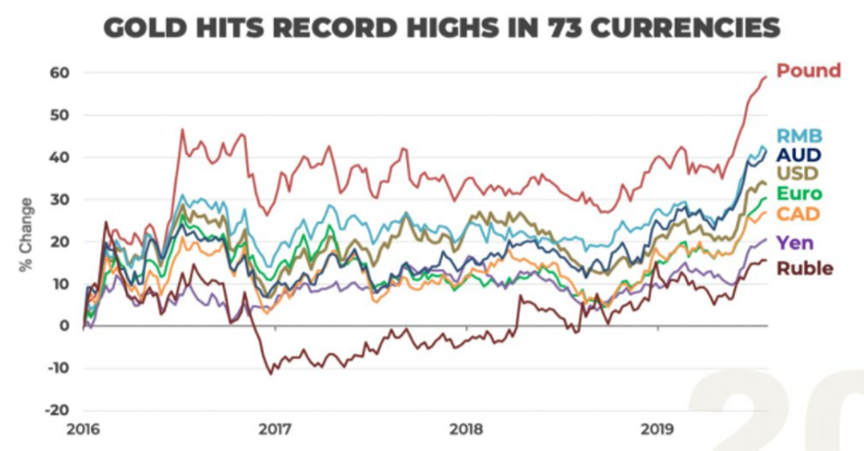

During the summer of 2019, something unusual occurred in the gold market. The gold price was hitting all-time highs against almost every global fiat currency, including the major ones. In fact, by early August of that year, it was being reported that the price of gold had reached a record high in 73 currencies. Major global currencies with external demand outside of their domestic economy such as the British Pound, Canadian Dollar, Euro, etc. all saw record high prices as did emerging market currencies such as the Brazilian Real and South African Rand. Noticeably absent from the group was the US Dollar, but that absence would be short lived. In the chart below, the gold price reached record highs by the beginning of August 2019 for each currency listed, except the RMB (China) and USD.

It was after observing this global spike in gold prices that the idea of “bowling for fiat” was born.

Bowling for Fiat

A strike in bowling usually requires the bowler to knock down the lead pin first which sets off a chain of events that results in all ten pins being knocked down. Bowling for fiat operates in a similar fashion. Under this theory, the first bowling pin represents the weakest global fiat currencies which, when struck, collapse and take down the subsequent set of pins, represented by the next group of fiat currencies, and so on until all the pins, or fiat currencies, have been knocked down.

The price of gold is the bowling ball. When the price reaches a record high against a given fiat currency, that pin, or set of pins, is knocked down. The theory works in a series of steps which I will outline below.

Striking Down Row One (includes a single bowling pin)

This category includes currencies such as the Argentine Peso, Brazilian Real, Indian Rupee, Turkish Lira, etc.; large emerging market currencies with no external, or reserve, demand. The reason one of these currencies is first to fall is due to the aggressive debasement of their monetary unit by their governments. Citizens from these countries have every incentive to escape their domestic currency and store their wealth somewhere safer. Even if the gold price declines, people in these locations know it is temporary and are thus more likely to continue holding gold. Despite having dysfunctional economies, these countries are still large and influential within the international gold market and will thus be a catalyst for further price appreciation. Due to the behaviors of the citizens within these more influential emerging markets, through their buying and holding of gold, the record high price of gold that is induced causes the first pin to collapse onto our second row.

Striking Down Row Two (includes 2 bowling pins)

The next two pins to fall are represented by smaller but developed economies. The domestic currencies within these economies capture little to no market share in international trade and are thus more vulnerable than the larger developed economies. These currencies will succumb to a record high gold price next. The currencies in this category would include the Australian Dollar, Canadian Dollar, Hong Kong Dollar, etc. Many of these smaller but developed countries have been debasing their own currencies too in an effort to make exports more attractive, just not to the extent of the large emerging market currencies that could be in row one.

Furthermore, developed countries have been artificially reducing interest rates to levels not seen since World War II, creating an environment of extremely low yields. This phenomenon leaves investors starved for yield. The combination of the restricted supply caused by the countries in our first row, currency debasement, historically low interest rates, and the chase for yield leads to a record gold price and causes the second row of pins to collapse onto our third row.

Striking Down Row Three (includes 3 bowling pins)

The next three pins to fall represent the upper echelon of fiat currencies. These are the fiat currencies of the major, developed economies. This is a rather exclusive group that includes the British Pound, Euro, and Japanese Yen. These particular currencies are found on the balance sheets of numerous central banks around the world and are actively used in international markets. Despite their strength, they too fall prey to the same types of predations that plague the fiat currencies previously mentioned, namely: currency debasement, high levels of debt, and artificially low (or even negative) interest rates. Once the price of gold attains a record high against this group, all three pins collapse onto our final row.

Striking Down Row Four (includes 4 bowling pins)

The last four pins are represented by the US Dollar. The US dollar is the world reserve currency, having been awarded that privilege during the Bretton Woods agreement all the way back in 1944. This privileged position allows the dollar to export inflation, thereby insulating it against the rapid loss of value seen in emerging market currencies, due to its ever present demand. In fact, the United States is able to run large trade deficits because trading partners will only accept the dollar alone in exchange for goods and services because said trading partners need dollars in order to conduct foreign trade.

The global status of the dollar typically allows it to maintain relative strength against all other fiat currencies and, thus, is usually the last pin to fall. This is evidenced by the fact that it took almost an additional year for the dollar to finally succumb to a record gold price, during the summer of 2020, and become the last set of pins to fall producing a strike.

Bitcoin as a Corollary

Bowling for fiat may seem simplistic or predictable in hindsight, however, would it have been so predictable from the perspective of someone in 2015? This was the year when the Brazilian Real recorded the first of numerous all-time high prices in gold, however, we were still a few years away from 2019 when the pins would really began to fall.

In order to profit, an investor needs to be somewhat prescient. This requires a thorough understanding of the point in time in which they are living. It is my belief that bitcoin, despite being volatile, behaves in a similar fashion as gold. As the bitcoin price begins to accelerate the important question that needs to be answered is: where are we now in the process? The evidence suggests that bitcoin has only struck the first pin:

Fresh BTC all-time highs vs.

— Ryan Selkis (@twobitidiot) November 5, 2020

+ Brazilian Real (#11)

+ Turkish Lira (#25)

+ Iranian Rial (#26)

<10% from BTC all-time highs vs.

+ Indian Rupee (#9)

+ Russian Ruble (#20)

+ South African Rand (#45) pic.twitter.com/iwdO2Eqa0Q

As one can see above, large emerging market currencies such as the Brazilian Real and Turkish Lira have now fallen...with the Indian Rupee, Russian Ruble, and South African Rand in sight.

What Will It Take For Bitcoin to Strike Down The Remainder of The Pins?

There are a number of ways our bowling ball, now represented by bitcoin, can successfully strike down all of the world’s fiat currencies in the near term and attain a record high price in each. We will cover a few of these ways below.

Continued Buy In From Large Companies

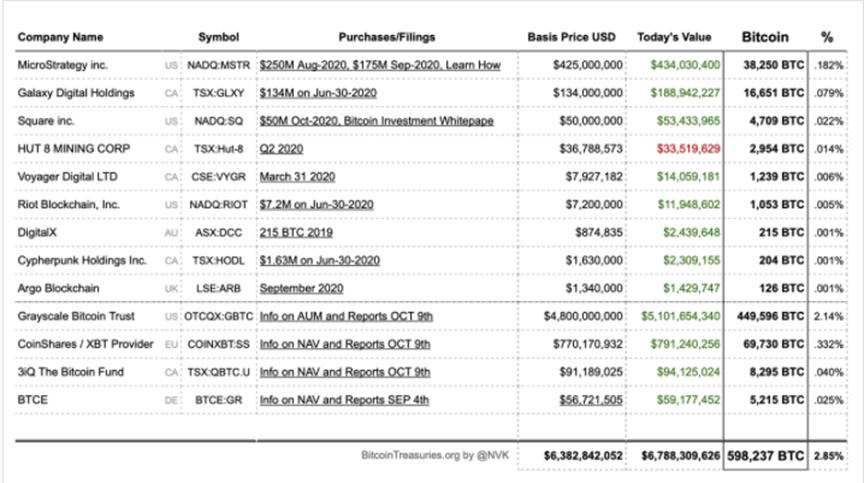

Companies such as MicroStrategy and Square have been making headlines lately as a consequence of their large bitcoin purchases. Fidelity, which manages $8 trillion on behalf of its customers, has been active in bitcoin mining for six years already. As companies continue to allocate significant capital into bitcoin, demand for the asset will only continue to grow. Here is a list of top companies that have adopted bitcoin as a reserve asset along with their allocations:

Nation States

Whether to get around sanctions or avoid use of the US dollar, more and more countries have an incentive to gain at least some exposure to bitcoin. Iran has apparently paved the way for subsidizing mining operations and are using that fresh bitcoin to fund imports into the country. The Bulgarian government confiscated around 200,000 bitcoins from an organized crime crackdown in 2017 and still maintains that amount in their possession as far as we are aware. Continued interest in bitcoin by sovereigns will only further provide support for the digital asset moving forward.

Monetary and Fiscal Policy

Global debt has continued to balloon over the last decade and now sits at 320% of GDP. This figure is even more alarming due to the reductions in productivity caused by the coronavirus. A reduction in debt would be career suicide for the current crop of global politicians so a reversal of debt accumulation is an impossibility. The reductions in global productivity will translate to even higher levels of debt needed to fund government largesse. In order to fund this debt, governments and their central banks will continue on the destructive path that they were already on prior to the coronavirus, namely, currency debasement and the use of artificially low, and even negative, interest rates. These measures will only accelerate bitcoin adoption.

Bitcoin Halving and Stock to Flow

Every four years, the bitcoin block reward is cut in half. Back in May, the block reward was cut from 12.5 bitcoins to the current 6.25 figure. This event has historically had a significant impact on the price of bitcoin in the following 12-16 months which usually concludes with a blow off top and new all-time high against all fiat currencies. The halving also increases bitcoin's stock to flow, a subject popularized by the pseudonymous Plan B. Stock to flow is the ratio between the size of stockpiles of an asset and the quantity of that asset that can be produced in a given period. The higher the stock to flow of an asset the higher its price. Please refer to Plan B's most recent article on the topic for more information. Here is the most recent tweet from Plan B regarding the price path for bitcoin used for illustrative purposes:

💥#bitcoin $15K pic.twitter.com/2EqV7HaNrj

— PlanB (@100trillionUSD) November 5, 2020

Speculators and Bitcoin Maximalists

Bitcoin maximalists are noted by their apparent religious zealotry to accumulating bitcoin. This may turn some people off but ultimately it's only a boon for the bitcoin price. Nassim Taleb illustrates how the intolerant minority ultimately wins through their intransigence.

Intransigence is one of the defining features of the bitcoin maximalist. They will simply continue to accumulate and never sell. Love them or hate them they will always be at the ready to defend the price of bitcoin. While the maximalists' behavior sets the price floor, it is the speculators who come in and push the price up. These speculators are especially noteworthy during times like the present, when the bitcoin price is beginning to accelerate. As a side note, many of these speculators ultimately join the ranks of the bitcoin maximalists over time.

Final Thoughts

In the same way that a bowling ball can hit from a number of directions and still produce a strike, the order in which fiat currencies fall can vary slightly, but it is highly unlikely that the British Pound is taken down before the Argentine Peso for example. It is important to use the information provided above to identify which point of the process we are currently experiencing. One other thing to keep in mind is that the bitcoin market is much younger than that of gold and thus the process of bowling our proverbial strike can happen much more quickly in bitcoin than gold. Act accordingly.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in