Chart Rundown for 4/14/2021

Welcome back to BTCM Research. Please subscribe if you are finding these weekly updates informative.

Bitcoin

The big news for today is the Coinbase direct listing. This is similar to an IPO but a much cheaper and faster process. The interest is extraordinary. It is expected that Coinbase will immediately enter the top 100 most valuable public companies.

Many people are worried that it will be a "sell the news" type event, like CME bitcoin futures were in December 2017. I don't see any sign of that. In fact, other than Bitcoin & Markets' newsletters, I only saw a handful of other plugged in outlets talking about this further back than two weeks ago.

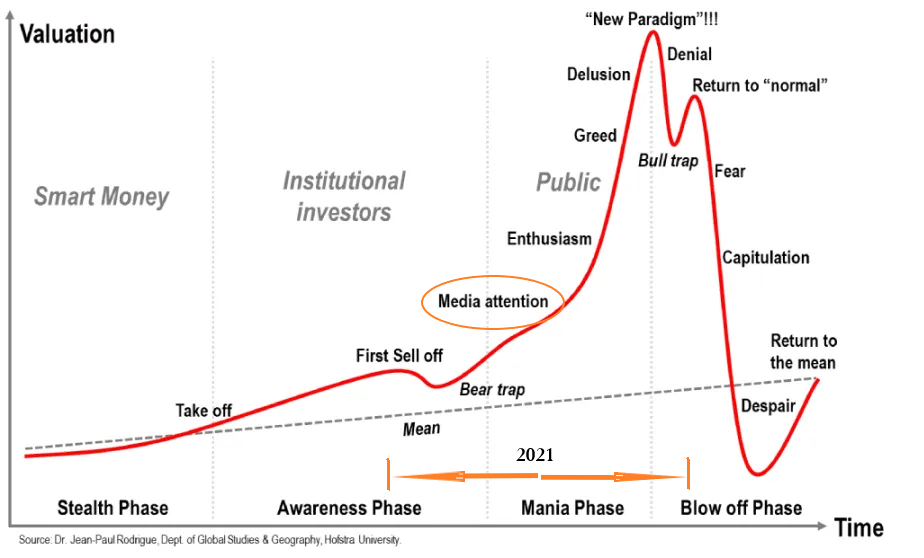

It's likely to be a "buy the news" event, and the start of the media attention part of the cycle.

More bitcoin analysis on my member newsletter over at bitcoinandmarkets.com.

Oil

Crude is still struggling with the $62 resistance. I've said that anything over $60 will be hard to maintain for long. There is some news out of Texas again this morning as they are hit by another crisis. That could pump the price temporarily, but will not change the fundamentals toward lower prices.

Anything that pumps the price of oil from this point in time forward is a positive for the US oil industry and will hasten the US withdrawal from world policeman.

Gold

Gold is still range bound and at a decision point. If it retests the bottom of the range (the 3rd time), it is highly likely to eventually break that level. Bulls need to come in and buy this right now. If they can't hold it, it's going lower.

Dollar

S&P 500 Stocks

I do not have strong conviction on stocks other than US stocks are likely going higher over the next 1-5 year timeframe. Right now, technical analysis wise, I'm seeing a possibility for a near term top and a test of some pattern support.

An interesting fractal in red circles could be fake out followed by a cool off similar to what happened last year in August and September.

That's it for this week. Thanks for reading, subscribe and check out our other posts from this week!

A

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in