Are High CPI Prints an Accurate Predictor of Recessions?

While the year over year CPI prints capture the headlines I thought it might be educational to instead observe the month over month prints and see if we can derive any valuable information from them. We will first analyze the June CPI print, which almost hit a two decade high, and place it into it's historical context.

Consumer Price Index for June 2022

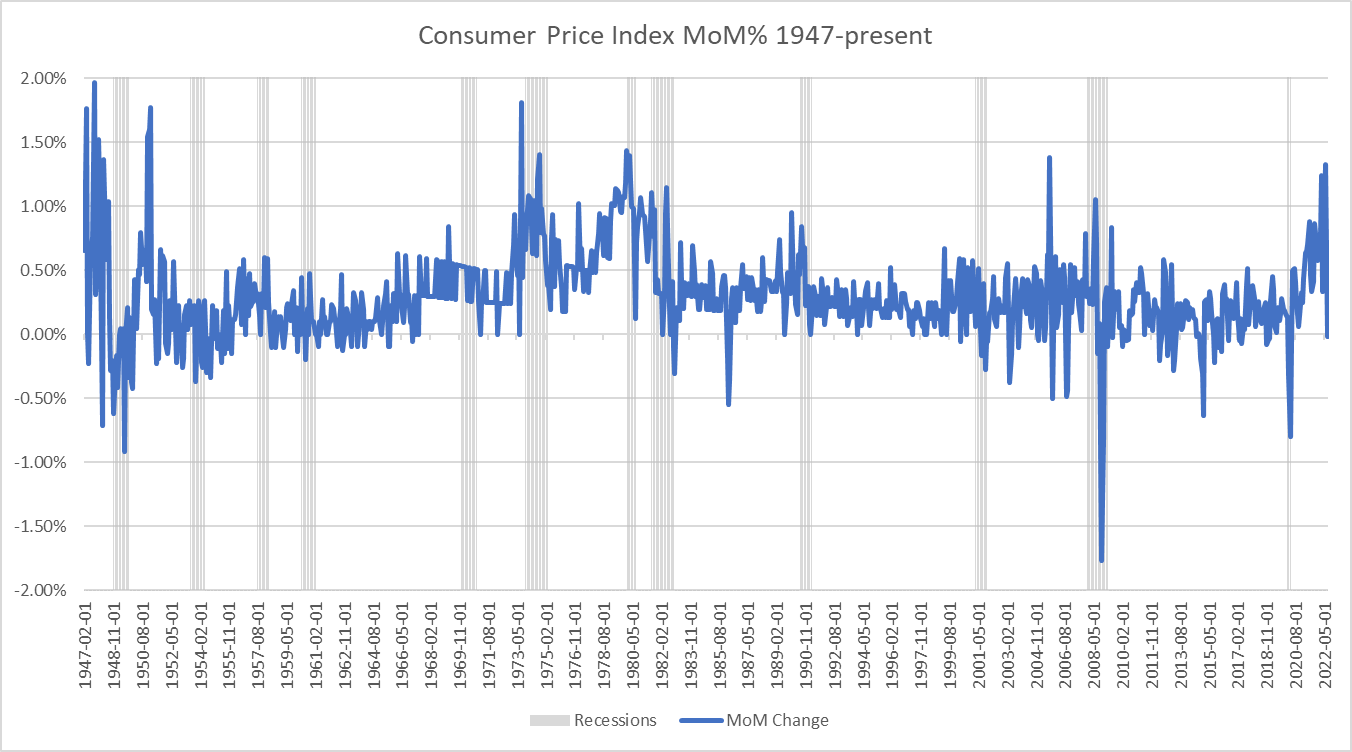

The chart provided below covers the last 75 years of CPI data on a month over month basis. It should be easy for the reader to see how rare a 1.32% print is just be scanning the chart. Nevertheless, let's take a deeper dive into the data to better understand how unusual a month to month increase of this magnitude truly is.

The 1.32% increase from May to June of 2022 was likely to be the highest CPI print we will see this side of the current business cycle. It was also the highest print we have seen since 2005. In fact, a CPI print of 1.32% or higher has only occured 13 times in the last 75 years (out of 906 instances), a 1951 print of 1.96% being the highest over the span. In terms of standard deviation the June print was only about 3 basis points shy of a 4-sigma event. In other words, it doesn't happen very often.

Additionally, the recent month over month decrease from June to July 2022 brought forth something even more unusual...a historically high print followed by a negative print. The 134 basis points decline from June to July (1.32% to -0.02%) was the second largest monthly decrease in our series, second only to the 158 basis point decrease from February to March 1951 (1.77% to 0.19%), and the only time a historically high print was followed by a negative print within the context of our data series.

Time to Recession

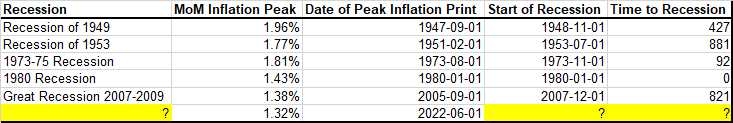

The last thing we will look at is the relationship between historically high CPI prints, registering 1.32% or higher, and recessions. Not only have all prints of 1.32% or higher led to a recession but all prints of 1% or greater have as well. It should be noted that in addition to the June CPI print of 1.32% the March 2022 print was also historically high, coming in at 1.24%.

The chart above identifies the five recessions of the last 75 years that followed historically high rates of inflation. The peak CPI print for each preceding business cycle, along with the number of days it took to get from peak CPI print to recession, is provided as well. On average, it has taken 442 days to get from peak CPI print to recession. The longest time to recession was 881 days while the shortest was 0.

I also included the June CPI print in the data because it is my belief that said print will likely be the highest for this current business cycle. Despite indicators such as negative back to back GDP prints the NBER still has not signaled a recession.

Final Thoughts

While CPI prints of this magnitude have been reliable recession indicators we are still missing the last piece of our puzzle which is in an inversion of the 3 month and 10 year treasuries. Based on the fact that we have yet to witness the 3 month/10 year inversion we still may have some time yet before we are officially in recession. This lack of inversion may also explain the recent rally in the stock market.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in