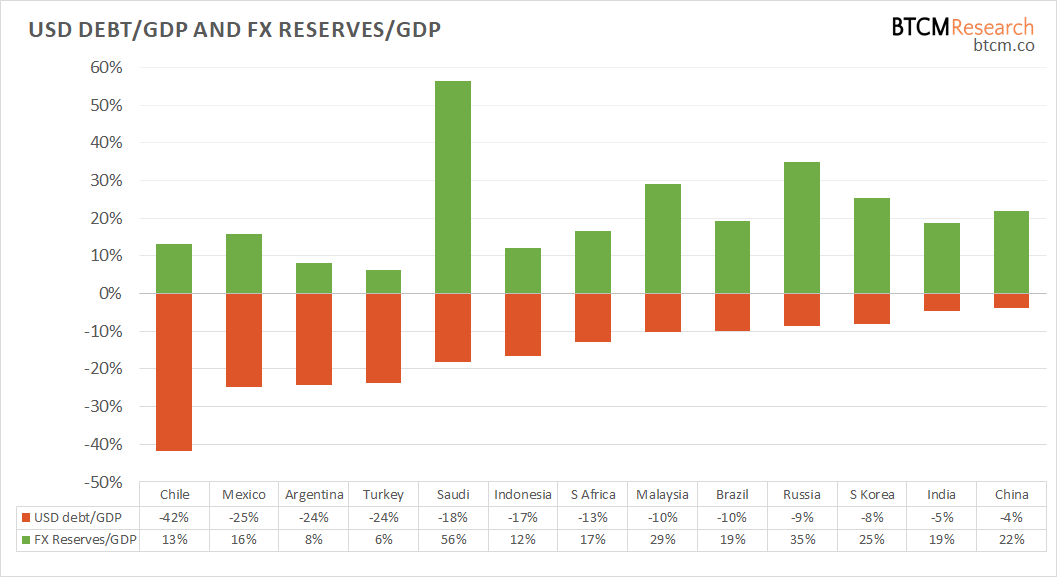

Dollar Debt and FX Reserves

This is one of the important charts we use in our analysis for select emerging markets. In red, is the USD debt levels by non-banks as a percentage of GDP. In green, the country's Forex reserves are represented as a percentage of GDP. The debts are denoted as negative due to being liabilities.

At first glance, the countries on the left side of the chart look to be in worse shape. Their economies have a lot of USD denominated debt and few FX Reserves to match. This is disastrous in a strong dollar environment because they will feel the global dollar shortage acutely and find it extremely difficult to meet their debt burdens. These countries with high debt to FX Reserves typically have to print their own currency and use it to buy dollars, then bailout their domestic corporations through their banking system or directly. That takes a heavy toll on their currency, devaluing it sharply versus the dollar.

However, if the dollar weakens, or if there is a Plaza Accord 2.0 where the international community agrees to systematically weaken the dollar, the countries with high debt to FX Reserves benefit the most, because it will devalue their liabilities relative to their assets.

The countries with larger FX Reserves relative to USD debt have assets more reliant on the Global Dollar Monetary System. If the dollar gets devalued, their assets are depreciated as well. In some cases a dollar devaluation could create solvency issues in the country so they will be resistant to any meaningful monetary changes. Though they might talk tough against the dollar, loudly proclaiming a need to replace it in the international monetary system, they are the most invested in it. They are outspoken because they feel their dependence the most acutely.

Lastly, we did take into consideration gold as a percentage of their FX Reserves. Only Russia showed a significant difference, lowering their FX Reserve/GDP percentage by 9%, to 26% when subtracting their gold reserves. The effect on other countries was negligible, averaging 1%.

Ansel Lindner

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in