Dollar Index Update - Is the Dollar Shortage Over?

In a previous post we discussed what the DXY (dollar index) is and some alternatives like the trade weighted dollar index. This year we've seen astronomical QE and, what pundits call, "money printing." So, how is the dollar doing? Is the end of the dollar nigh?

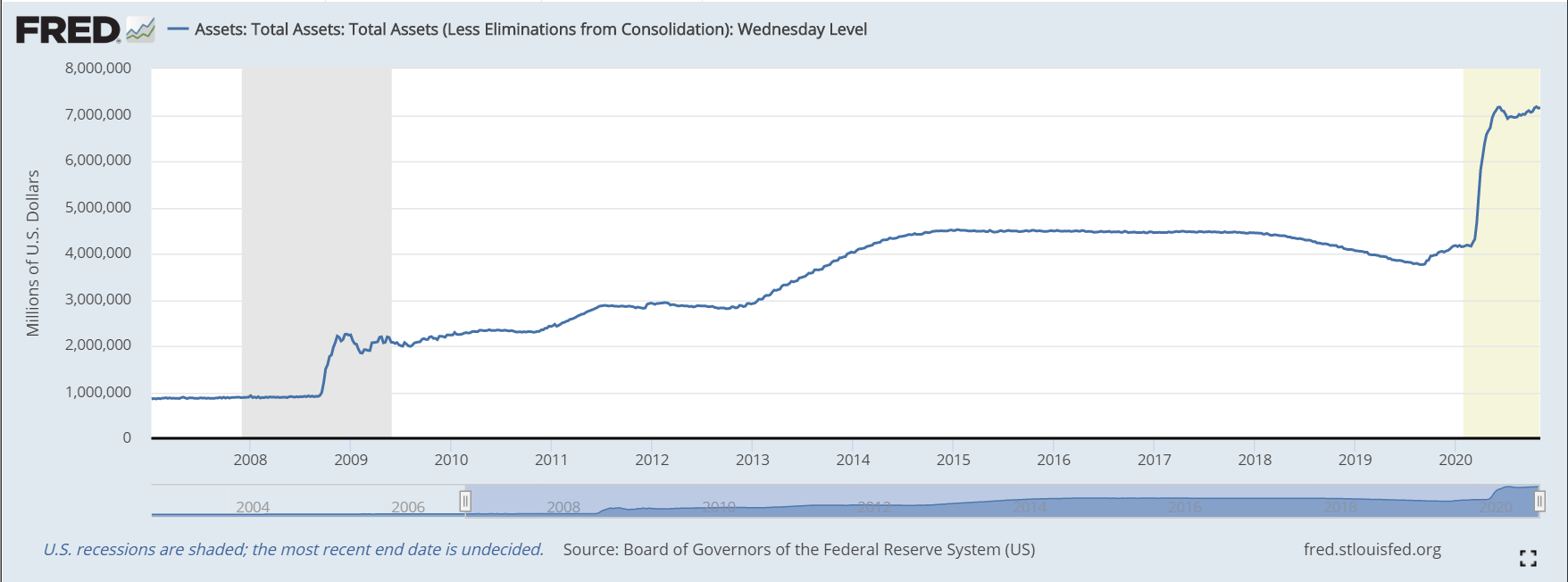

Fed Balance Sheet Update

If all we had to look at was the Fed's balance sheet and we only heard the constant drone that what the Fed was doing is printing money, we'd logically assume the dollar was dramatically weakening over the last dozen years. However, we see the opposite.

Short-term Dollar Goggles

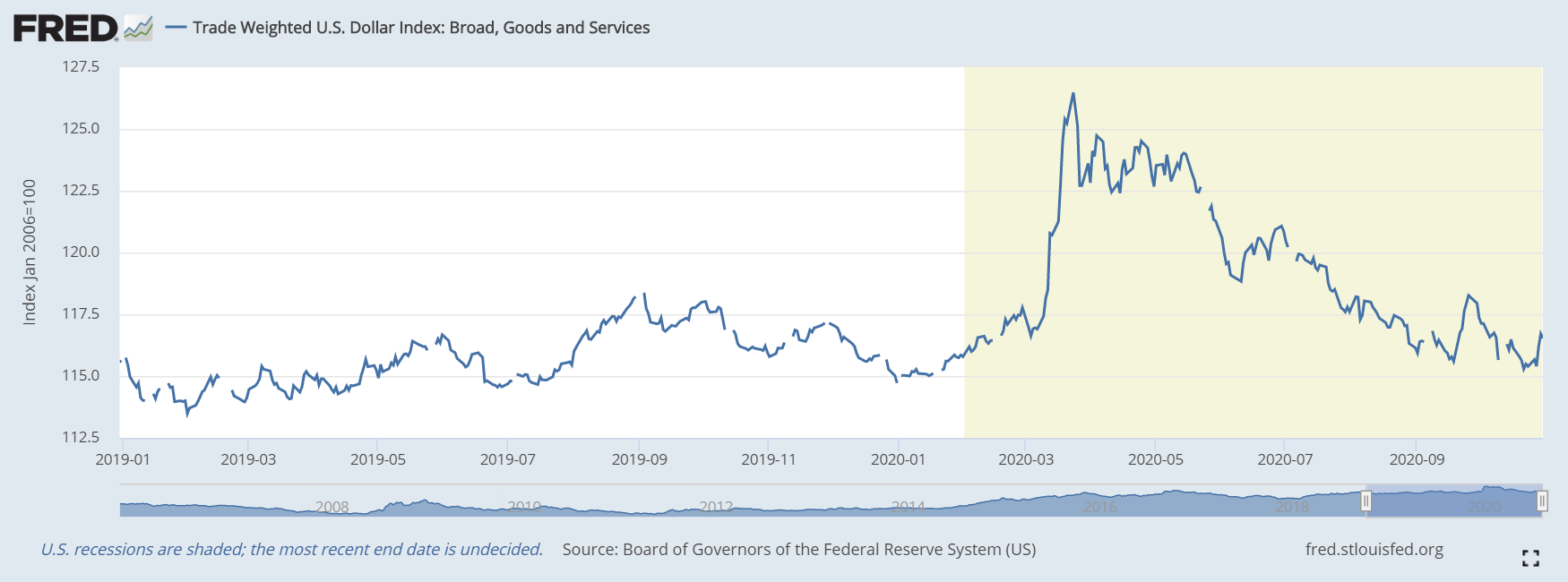

Oh my, the DXY is falling. The dollar must be weakening! Inflation is destroying the dollar!

Most pundits will look at how the dollar has acted since the March QE Bonanza (consistent downward movement) and use it as evidence to support their inflationary bias. Indeed, if we look at the DXY since the start of 2019, it seems to be struggling to hold on and could crash any minute.

The trade weighted dollar, during the same time frame, is similar. A sharp increase at the beginning of the crisis and down ever since. Doesn't this all spell doom for the dollar?

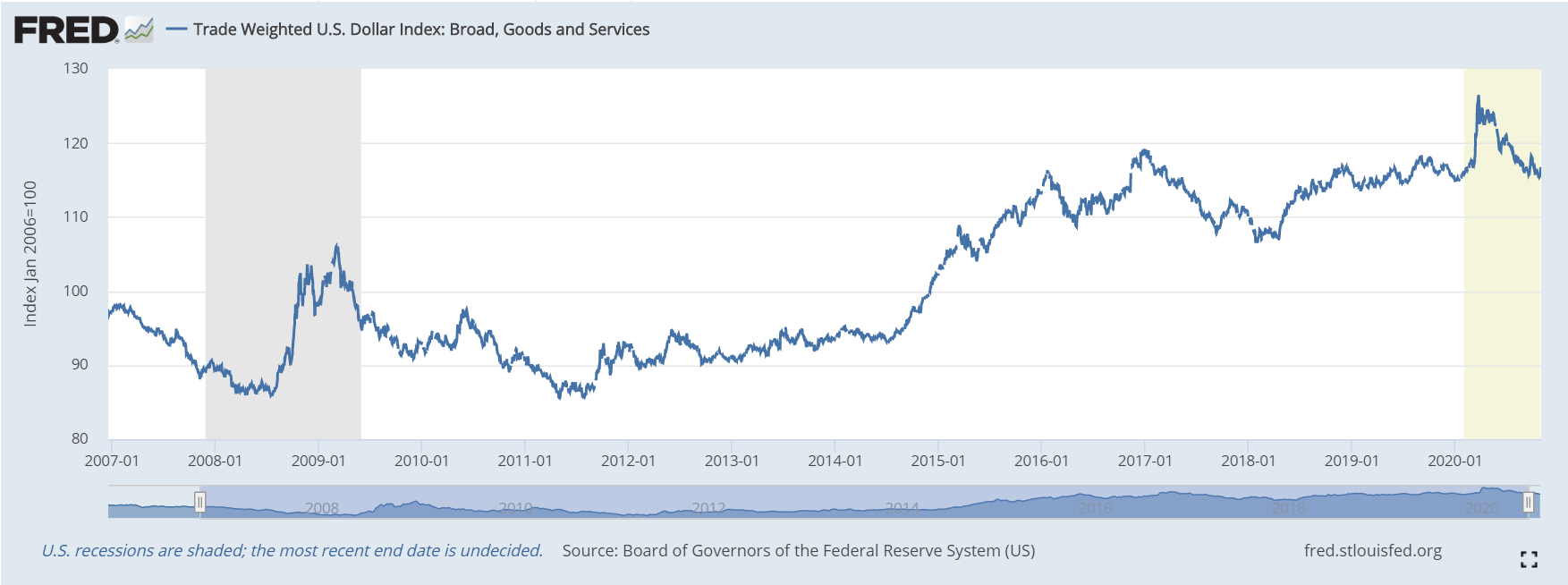

Taking a Long View of the Dollar

Zoom out. All this QE madness started in 2009 in the US (2003 in Japan), what happens if we zoom out to see the last 12 years since the Global Financial Crisis (GFC)? If QE was "money printing" and causes inflation, we should expect the US dollar to be falling dramatically over this 12 year experimentation period, right?

Wrong. The dollar is significantly higher than 2008, and this recent dip is even higher than the 2018 dip. It looks as though the dollar is staying stubbornly high, with a "higher low," despite the massive accommodative measures from the Fed.

It's even worse for the trade weighted dollar as we zoom out. Putting the current lows in context, the dollar has simply returned to the strong condition it was in prior to any crisis from earlier this year, and much higher than almost the entire period since the GFC.

If you have inflationist goggles on, everything to see will be confirming your bias. The fact is the dollar is fairly strong on the DXY and very strong on more broad measures like the trade weighted dollar. All this QE and stimulus has not alleviated the dollar shortages around the world. Trade and credit are still contracting, and when, not if, the next leg of the economic crisis hits, the dollar will once again spike.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in