Investing In Brazil

In our second post on Emerging Markets we cover the most populous country in Latin America, Brazil, and analyze the strength of its domestic currency, the Brazilian Real, against Gold, the US Dollar, and Bitcoin. As always, we will begin by observing the gold chart.

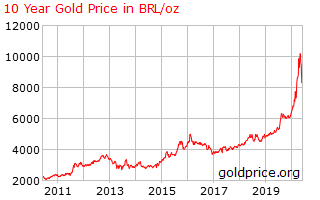

Gold

Gold has been in an incredible bull market versus the Brazilian Real for 10 years. The price of Gold was on a pace to double in terms of the Brazilian Real every five years. However, in the beginning of 2020 it went parabolic doubling in only 1 year, though it had a sharp correction after reaching 10,000 Real/oz. It is likely much of the parabolic rise was due to the sharp US dollar shortage in March leading a sell off in the Real. Nevertheless, despite the aggressive correction toward the mean, the price of Gold still remains elevated versus the previous 5 year doubling trend. What is remarkable about this episode is that the bull market in Gold ended internationally in 2011, yet never ended in terms of the Brazilian Real.

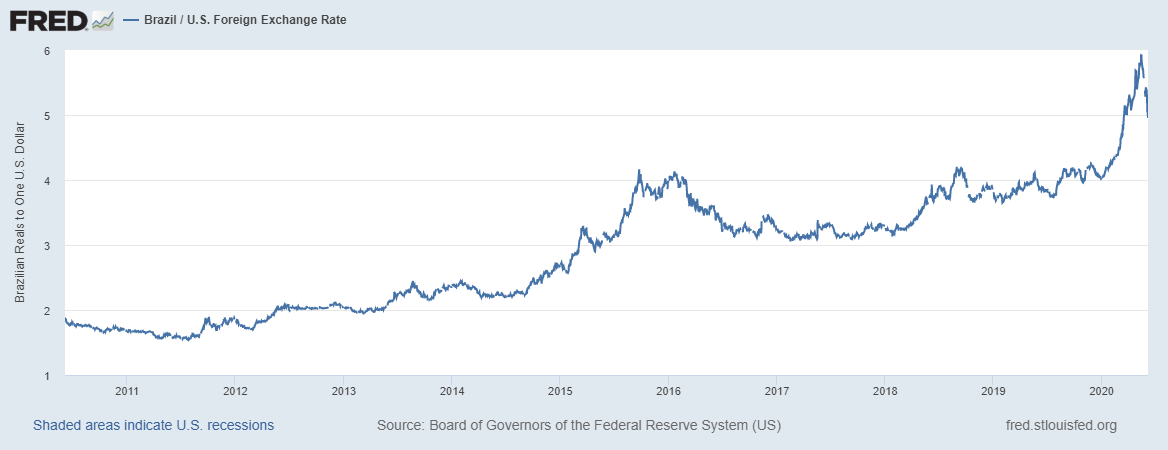

US Dollar

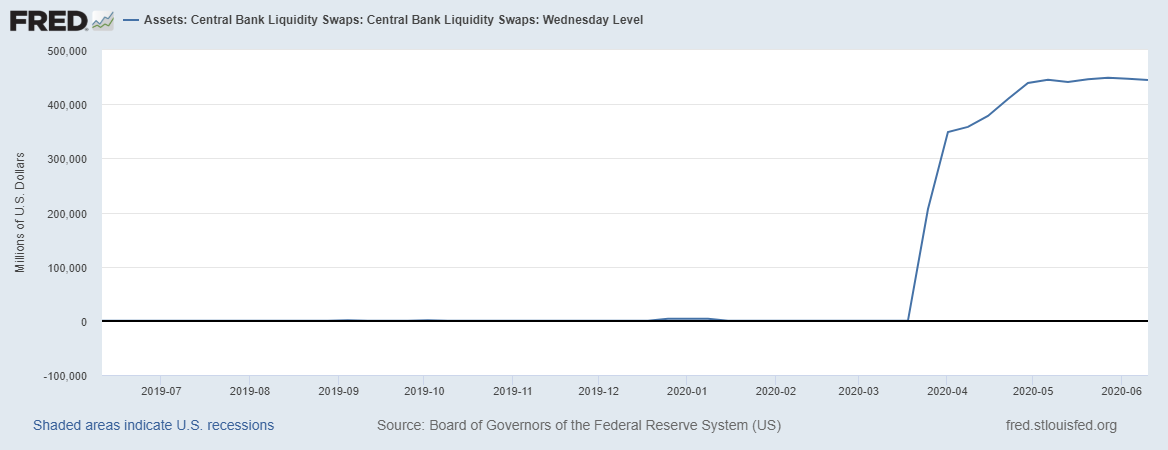

Just a short time ago the US Dollar was moving parabolic against the Brazilian Real. The exchange rate between the Real and the US Dollar was almost 6 to 1 at its weakest in May. However, since that point the Real has corrected markedly against the dollar, just as with gold above, settling in at around 4.82 within the last week. Federal Reserve liquidity swaps with foreign central banks peaked In late May and the total swap amounts outstanding have even declined only slightly.

Bitcoin

The price of Bitcoin, in Brazilian Real terms, climbed to within 20% of its all time high in May. It has, once again, corrected quickly after a huge parabolic move following the onset of the Covid-19 Crisis. Much has happened in the preceding 3 months which likely affected the Bitcoin price. For instance, the initial fire sale of Bitcoin and other assets to cover US Dollar denominated debt, the Brazilian central bank entering into swap agreements with the Federal Reserve and rapidly devaluing its currency, and then the short term respite and subsequent strengthening of the Brazilian Real versus the US Dollar.

Summary

The Covid-19 Crisis has hit Brazil extremely hard. Brazil is now the country with the 2nd highest number of deaths worldwide and the 4th highest number of infections. As the Northern Hemisphere is beginning summer, winter is just setting in south of the equator. It is not unrealistic to assume that the impact of the coronavirus will continue in Brazil. Articles are circulating with claims that hospitals in Sao Paulo, Brazil’s largest city, are on the brink of collapse. Some cities and towns have eschewed lock down procedures, while many of the larger metropolitan areas have kept lock down measures in place until recently. Unemployment figures remain elevated, with recent months reporting a record-high number of new unemployment claims, and many people either working minimally, or not working at all. Funding and liquidity pressures should continue to persist.

Prior to the onset of the Covid-19 Crisis, Brazil was already embroiled in political unrest under the Bolsonaro regime. Over the last few years Brazil has seen a President impeached and another sent to prison. The largest company in Brazil, Petrobras, is a state-controlled oil producer hit hard by recent oil futures volatility. If demand doesn’t return in the near term, depressed oil prices will have major ramifications for Brazil’s economy.

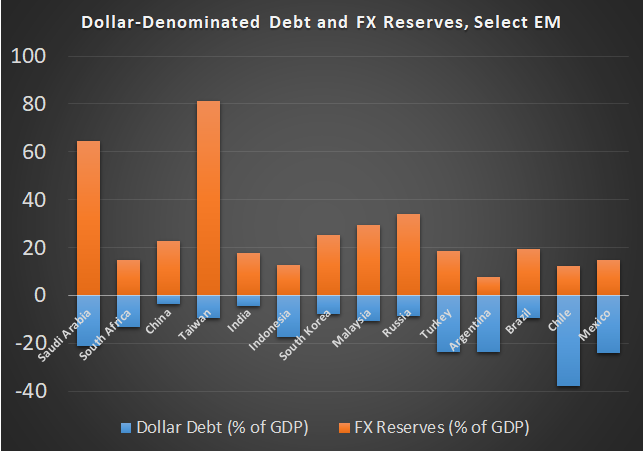

One thing that might be seen as positive is that Brazil has US Dollar denominated reserves in excess of its obligations. However, despite this, the Federal Reserve does not want the Brazilian government (or any government for that matter) to sell US Dollar denominated assets (US Treasuries) to cover current funding shortages. The rationale behind this is that selling US Treasuries, would quickly increase interest rates for the US and create a cascade of debt defaults which the Federal Reserve, and US Government, wants to avoid. Brazil is then forced into currency swaps with the Fed, nevertheless weakening the Brazilian Real.

How long Brazil is willing to go along with this strategy is anyone’s guess. Either way, the long-term trend remains bearish for the Real in terms of Gold, US Dollar, and Bitcoin. This sharp correction in the last month, in favor of the Brazilian Real is likely only temporary. With no positive news in sight and a consistent historical trend moving against the Brazilian Real, we think it should come as no surprise if bottom for the Real is not in. We are watching the currency swaps with the Federal Reserve closely, betting another US Dollar shortage is right around the corner. Rinse and repeat.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in