Investing In India

The next emerging market we will be analyzing is the world’s second most populous country: India. India is one of the most multilingual and multi-ethnic nations in the world. Its religious diversity is also very high and poses unique challenges. Although the country has a majority of the world's Hindus, who are the dominate political group, the religious diversity can cause internal conflict among competing ideologies.

Nevertheless, India is also one of the few nuclear powers in its region and likely one of the few countries that is more or less impervious to invasions from foreign powers. Recent skirmishes along the border between China and India were met by a capable Indian military response and seemingly aligned India with other regional powers, such as Australia, and the United States. In other words, any continued aggression on the border between China and India would tend to tip in India's favor due to this alignment of powers as this decades old powder keg finds a spark. While BTCM analysis mostly focuses on economic factors, specifically around the topic of money, it’s important to consider the geopolitical landscape as well in the case of India.

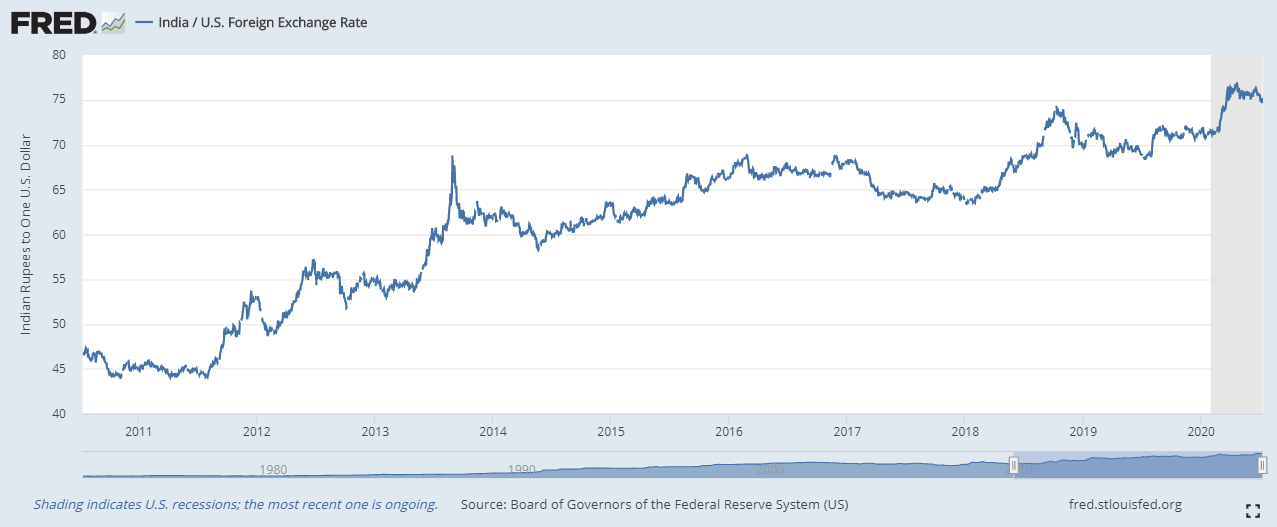

One of the more remarkable monetary events of the past five years occurred in India when Prime Minister Narendra Modi had the 500- and 1000-Rupee notes removed from circulation. Modi claimed that the measure would flush out untaxed wealth being hoarded by wealthier citizens and would also serve to defund criminals and terrorists. Citizens were given several weeks to exchange the older banknotes for the replacement issues; however, the new banknotes weren’t printed quickly enough and a Rupee shortage developed. There was a noticeable strengthening of the Rupee against the Dollar from the end of 2016 and into 2018 that was out of character (as you can observe in a chart below). As with most government policies the effects were disastrous. GDP severely contracted and unemployment quickly rose.

Gold

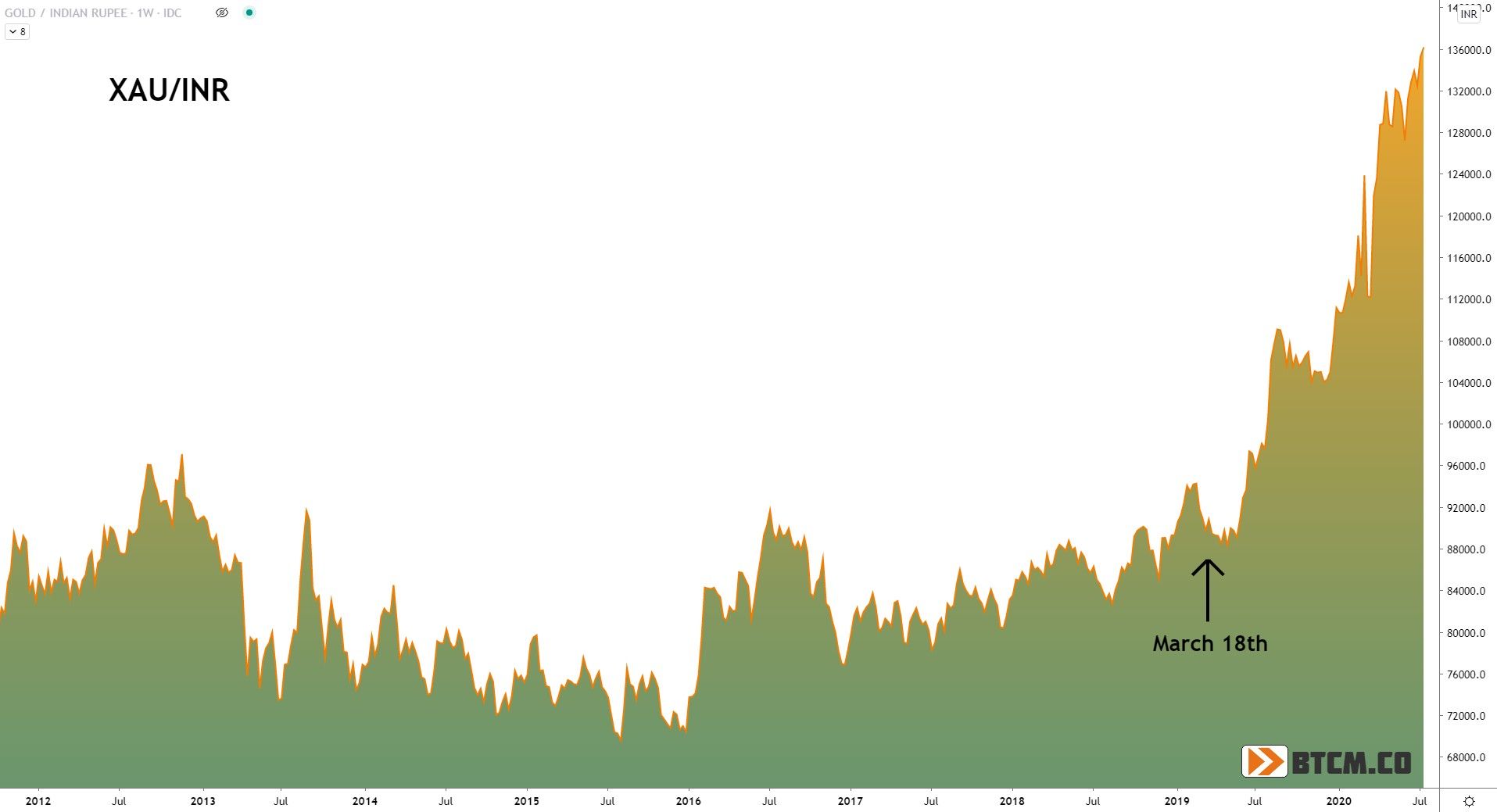

In last week’s Chile article we noted the parabolic price movement of gold against the Peso. Likewise, gold priced in Indian Rupees went parabolic during the beginning of 2019. The similarities between most emerging markets we’ve looked at so far are uncanny (gold is at record high prices against most of the world’s emerging market currencies). Specifically, both India and Chile broke their previous All Time Highs (ATH) sometime around the end of Q1, either March or April 2019, and continued on a parabolic move higher. Also important to note, this broad spectrum move in gold was in place prior to the virus pandemic, pointing to fundamental stress in the monetary system. This global rise in the price of gold occurred as a consequence of Federal Reserve's Quantitative Tightening monetary policy at the time.

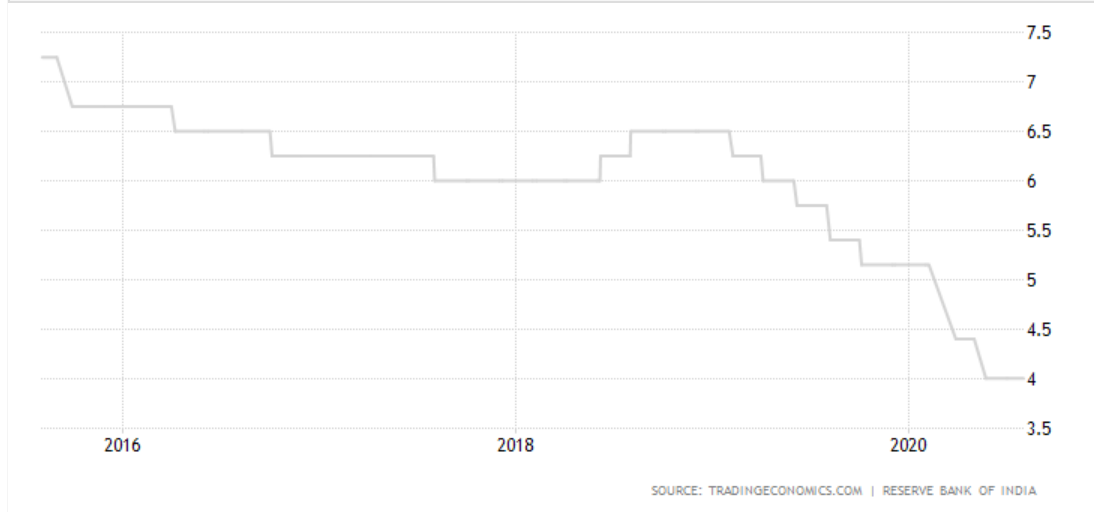

As shown in the chart below the Reserve Bank of India (RBI) aggressively cut rates in the same fashion, and at the same time, as the Central Bank of Chile. From the beginning of 2019 to the present the benchmark interest rate in India has been cut by a total of 250 basis points.

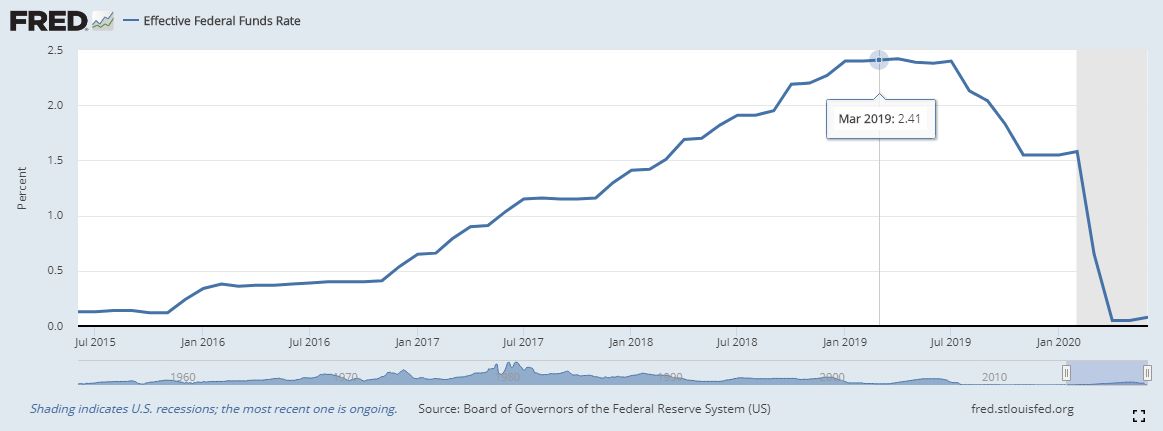

If we go back to the last quarter of 2018, the Federal Reserve was on "auto-pilot" in the midst of the first series of rate hikes in 12 years. As shown in the chart below you can observe the abrupt halt of rate increases which Chairman Powell called a "pause" to the rate hikes at the time. However, when applied to India and other emerging markets, this abrupt halt by the Fed coincides with gold beginning its parabolic move as cracks in the monetary system were appearing.

The Fed reversed course quickly and by July were cutting rates again. However, the contagion had already begun to spread throughout the global monetary system. When the Fed began selling US Treasuries to reduce the size of its balance sheet, it inadvertently created a global dollar shortage. In order to procure US Dollars countries, banks, and businesses in India, had to sell Rupees on the foreign exchange market, quickly devaluing their currency. The debasement of the Rupee led to a general price increase having the secondary effect of driving the price of gold higher. Though gold is an integral part of Indian culture, the spike in gold was not primarily a cultural event, but a response to the debasement of the Rupee in general.

US Dollar

The Rupee has weakened against the Dollar for decades. However, it is important to note Indians prefer gold to dollars when the Rupee loses purchasing power. Other than an ever-present depreciation of the Rupee versus the Dollar, there is not much more to be gleaned from the dollar chart so we will shift our focus to bitcoin.

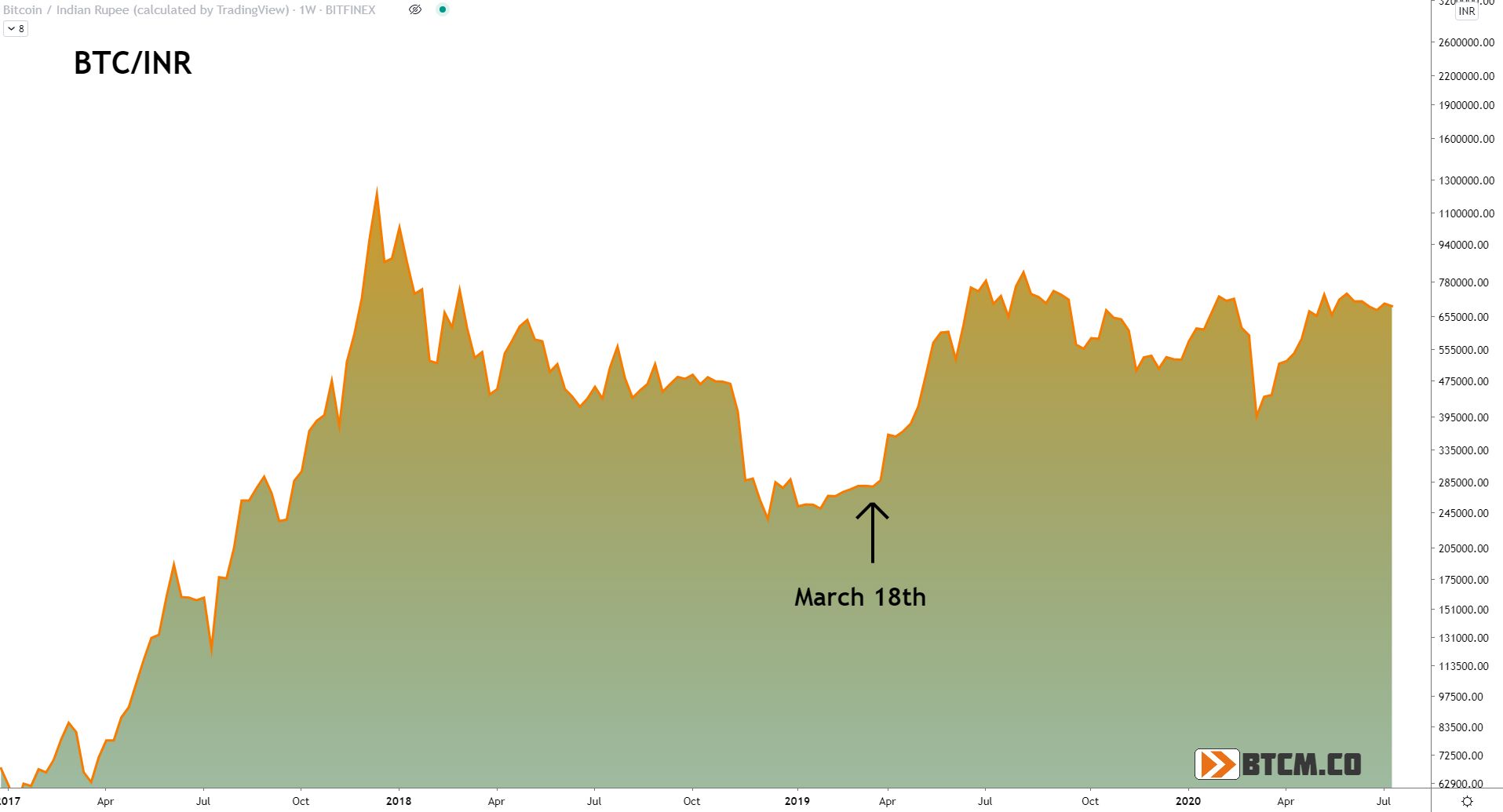

Bitcoin

The bitcoin price is performing very well against the Rupee, but has yet to break the previous highs of 2017. Bitcoin's bear market ended at the same time as the beginning of gold's parabolic move, between March and April 2019. Bitcoin's rise, however, was stalled shy of its ATH. Nonetheless, Bitcoin is less than 25% off its record high.

Bitcoin should perform much better against emerging market currencies, like the Rupee, over the next couple of years than it will against the US dollar. Technical analysis of the emerging market bitcoin charts is more bullish because many markets are on the verge of ATHs. Another bullish development for bitcoin in India is the recent Supreme Court ruling overturning the ban on banks doing business with bitcoin exchanges and other companies.

Summary

India has exhibited better currency stability than many emerging market economies but is definitely not free from the pattern of debasing its currency against harder forms of money.

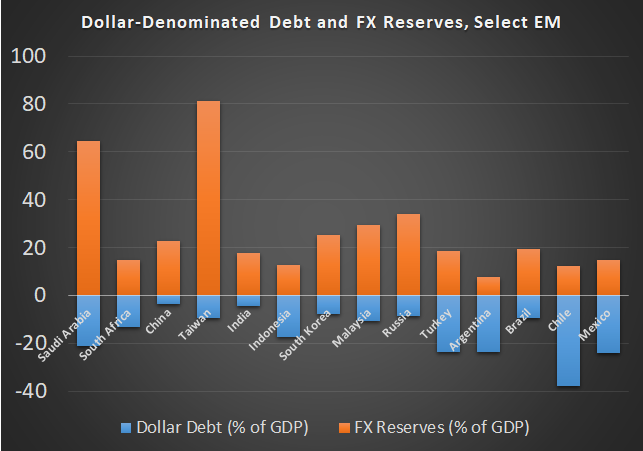

In the chart above, depicting dollar-denominated debt versus Forex reserves, India is in pretty good shape relative to other emerging markets. Therefore, it will likely weather a dollar funding storm better than most of the other emerging market countries going forward.

Despite recent events we've highlighted above, we still believe the Rupee is one of the strongest currencies among the emerging market countries for the next couple of years. Having said that, it will still ultimately face the same fate as other currencies, like the Argentine Peso.

Investment wise, India is more in a consolidation phase whereas other emerging markets are in a more precarious phase. We are currently neutral on India and do not intend to take a position at this time. Overall, pressure is more to the downside, so if there is a big move up in the near term, we would look to add puts to our portfolio.

Kent Polkinghorne

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in