Investing In Mexico

Takeaways

- NAFTA created a special monetary relationship between Mexico and US

- Mexican and US monetary policy have looked very similar since 2016

- Gold has increased 50% in MXN terms in the last year

- MXN/USD exchange rate was stable until COVID Crisis

- Bitcoin is more near All-time-highs in MXN terms than USD terms

- Mexico's economy is both fragile and stable because proximity to US

Introduction

Welcome to our fifth installment of the Emerging Market Series. In this series we compare the performance of Gold, the US Dollar, and Bitcoin against various emerging market fiat currencies. This week we will be covering the Mexican Peso (MXN). Before moving to the analysis of the Peso itself, let's first cover some background on the trade agreement which has significantly impacted Mexican exports for the last three decades, a trade agreement which has recently been replaced, NAFTA.

The North American Free Trade Agreement (NAFTA) was a trade agreement among Canada, the United States, and Mexico reducing trade barriers between these three nations. NAFTA went into effect in 1994 and has been, on net, a big positive for Mexico, although some small, rural farmers were were hurt by mass importation of subsidized corn from the US. Prior to NAFTA, Mexico had a trade deficit with the US, which quickly turned into a trade surplus. In 1993, the year before NAFTA was implemented, total exports accounted for 8.56% of Mexico's GDP with manufacturing accounting for 79.22% of those total exports. By 2013, manufacturing accounted for 82.78% of all exports, and more importantly, total exports as a percentage of GDP had quadrupled to 36.95% (source). The US is Mexico's largest trading partner with exports to the US accounting for 88.66% of Mexico’s total exports.

Bank of Mexico Benchmark Interest Rate & Fed Funds Rate

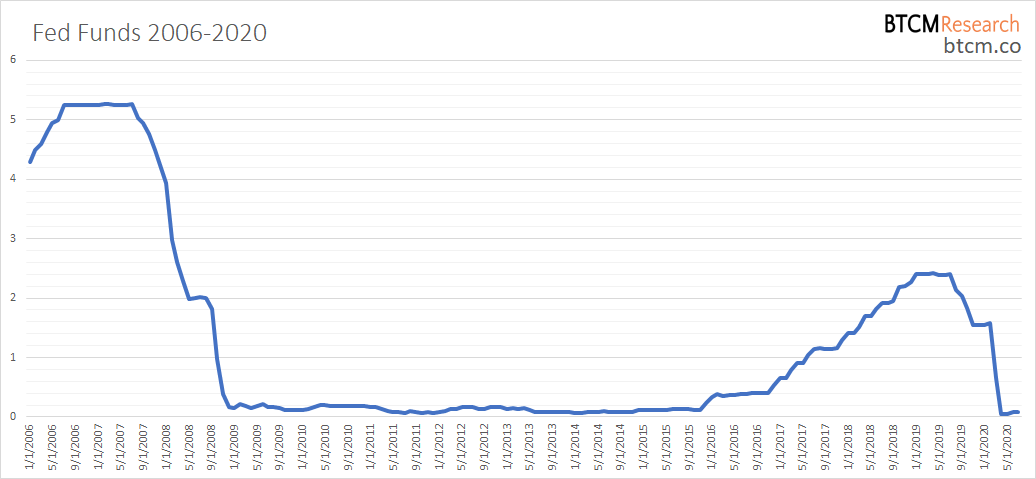

Before we move to our analysis of the Peso, please note the Mexican Central Bank’s (MCB) benchmark interest rate as well as the Federal Reserve fed funds rate in Fig 1 & 2 below. They both represent the interest rate movements over the last decade.

Going into 2016, the Peso had been the target of bearish speculation and had weak Forex market performance going back years. In order to tame speculation and inflation in the Peso the MCB began hiking the benchmark interest rate in early 2016. Additional hikes occurred later that year in response to the election of Donald Trump because of his attacks on NAFTA. The Mexican government wanted to discourage capital outflows by strengthening the peso in preparation of the possibility of trade disruptions with the US. Finally, in 2019, the MCB quickly reversed course, slashing rates due to the onset of recession, and the benchmark interest rate has continued lower since that point in time.

The Mexican Central Bank took rates on a roller-coaster ride from 3% in 2016 to a peak just above 8% in 2019, then back to 5% at the time of writing.

Gold

In the initial phase of aggressive rate hikes starting in 2016, the price of gold remained stable despite the logical expectation of an increased demand for pesos at the expense of gold.

For the three months of February through April 2020, during the Covid-19 Crisis, the price of gold increased nearly 50% in terms of MXN. The velocity of the interest rate cuts over the last year has led to a reflexive reaction by the gold price in the opposite direction. Gold investors should be watching for shifts in monetary policy. Further downward movement in the benchmark interest rate can be seen as an opportunity to accumulate the yellow metal and, conversely, when the MCB shifts course and begins raising interest rates it may be wise to reallocate a portion of gold holdings back into pesos.

US Dollar

We now turn to the US Dollar/Mexican Peso (USD/MXN). The relative strength or weakness of the MXN has been largely tied to the combined monetary policy of the US and Mexico, shown above. Both countries have had an almost identical interest rate policy over the last 5 years or so, increasing rates from 2016 to 2019 and then decreasing them aggressively from 2019 to the present. In the charts below we can see the exchange rate remained in a relatively tight range for the duration of this period until March of 2020 when the global dollar shortage hit in earnest. Since March of 2020, the dollar has remained elevated against the Peso.

One explanation for the exchange rate stability witnessed from 2016 through the 1st quarter of 2020 is the Mexican banking system and economy were relatively stable going into March 2020. This stability was in contrast to the other Latin American countries we've covered in this series who had already shown signs of stress at an earlier point in time.

Bitcoin

Bitcoin has been a better store of value in MXN terms than in USD terms. The current BTC/MXN price at the time of writing is roughly 40% off its all-time high while the USD price is still 60% off its 2017 high.

A pattern among emerging market economies is forming. We are seeing repeatedly that gold has outperformed bitcoin over the last two years in these markets. The gold price accelerated throughout 2019, recording record prices in almost every fiat currency, while bitcoin peaked last summer and has since been declining or flat until recently.

Despite Bitcoin's mantra of serving the underserved, it is obvious that emerging markets including Mexico still suffer from a relative lack of Bitcoin education and Bitcoin infrastructure. Countries like the US, Canada, Japan, Germany, etc. have a robust bitcoin ecosystem complete with access to liquid exchanges. Developed markets are also often interconnected; for example, Coinbase offers services to the whole of Europe, the US, and Canada, services which provide deep pools of liquidity and more efficient price discovery for said countries. However, Coinbase limits its services to residents of Mexico. They are only permitted to covert bitcoin to another cryptocurrency and/or make purchases, but they are prohibited from selling. This is a simple example of the lack of infrastructure residents in emerging markets have to cope with. This isn't to say they are buying gold instead, it's simply that the retail class does not have same type of access to bitcoin markets that you find in more developed countries. While the investment class in these emerging markets is turning to gold, whether as a safe haven or as pristine collateral for trade, it remains difficult for the average person in an emerging market economy to participate in the bitcoin space. The bitcoin space allows for smaller denominated purchases, via sats, that better fit the budget of low to medium earning individuals.

Another reason gold has outperformed bitcoin in Mexico has to do with history. Precious metal mining is deeply ingrained in Mexico, going back to the arrival of the Spanish in the 16th Century and gold's roots in Mexico likely go back much further to the Aztecs and other Native American cultures. Bitcoin is still in its infancy, especially when compared to gold. It is logical in times of turmoil, due to a lack of Bitcoin education, that Mexicans are likely to prefer what is known. This hurdle is present in all emerging markets we've looked at so far. Bitcoin's under-performance versus gold in the last two years will not necessarily continue as it is only a matter of time before more robust bitcoin infrastructure is put into place to better serve emerging markets. One of our main findings in this series is the evidence of a huge opportunity in emerging markets for bitcoin education and infrastructure.

Summary

The key thing to watch in Mexico is their monetary policy, specifically any large moves downward. Decreases in their benchmark rate have been a very reliable signal of gold strength. "The trend is your friend." Of the three assets we looked at here, gold has the most momentum and will likely continue to outperform.

We find the entire world in a low or even negative interest rate regime. It would not surprise us if Mexico attempts to lower rates further in the event of another dollar supply shock or continued weakness with manufacturing exports due to the pandemic. Since there is no demand for the peso outside of Mexico, inflation is felt more acutely in the domestic economy. The Mexican Central Bank has a tall order to control inflation against the USD in an global economy that is often short dollars. Due the current economic crisis, it is very unlikely the MCB can raise rates anytime soon without causing more damage to exports.

It is somewhat surprising how closely the peso tracks the dollar, not perfectly mind you, but much better than other emerging market currencies. This close relationship is a double-edged sword. While the large amount of exports sent to the US is a ready source of dollar funding, any extreme movements in the MXN/USD exchange rate will have large effects on the economy. Additionally, the post-NAFTA relationship between the US and Mexico can be viewed as more fragile. Mexico's manufacturing industry is heavily reliant on the American consumer. If the US finds it politically expedient to raise tariffs against Mexico it could devastate the Mexican economy.

In the chart above, we can clearly see that Mexico has far more dollar denominated debt than they do reserves to cover those debts. Mexico needs seamless trade with the Americans to have any hope of correcting their dollar liquidity problems. To a lesser extent, there is also the ongoing construction of the border wall between the US and Mexico which could portend a poorer relationship between the two countries moving forward.

Mexico is kind of a mixed bag. On one hand, the peso has performed much better than the currencies in other emerging markets, especially against other Latin American economies. On the other hand, Mexico’s over-reliance on the American consumer could lead to big challenges moving forward. Overall, we remain neutral but will continue to watch for any sources of imbalance.

Kent Polkinghorne

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in