Investing In Russia

Welcome to installment #6 of the Emerging Market Series. This week we will be covering Russia. I have personally been looking forward to working on this week’s piece because I view Russia as a bit of an enigma.

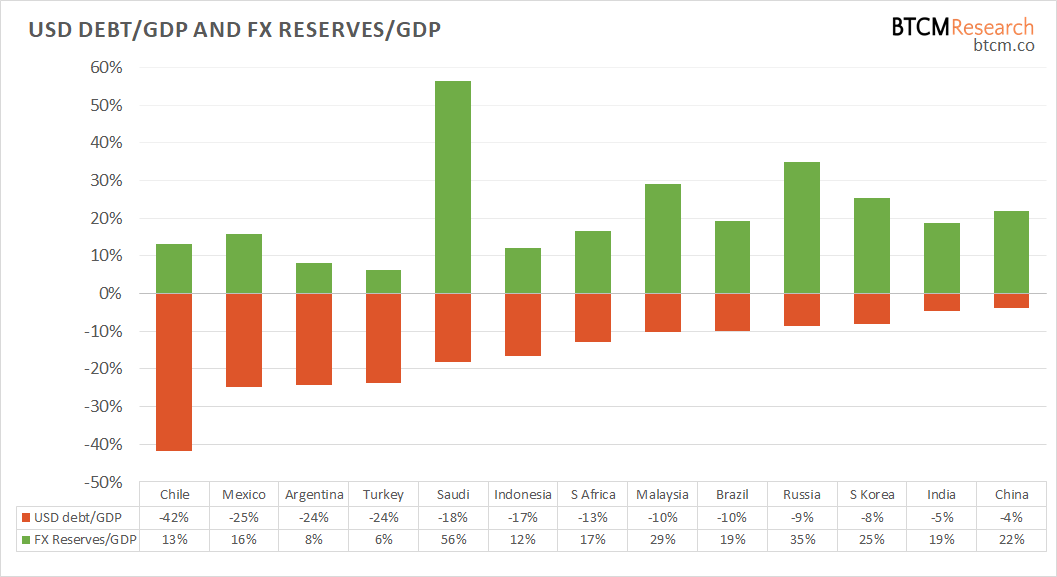

Most of the media coverage on Russia in the US is negative, despite the Cold War ending nearly 30 years ago. The Russian Federation is a favorite target of US led sanctions, and Russian banks are constantly harassed with threats of removal from the SWIFT payment system. Between 2014 and 2017 Russia suffered a sharp financial crisis from: falling crude oil prices, tensions in Ukraine, and high dollar denominated debts. The Ruble crashed and any tenuous gains in its role in international trade were crushed. This year (2020), financial sanctions have become more apparent with Russia being denied eligibility for currency swaps with the Federal Reserve during the dollar squeeze.

Despite the constant negativity and harassment by the US lead coalition, Russia still might present a bullish case for long-term investment, because of its stable social cohesion. While the West is fragmenting from internal clashes of different cultures and ideologies, Russia has been attempting to unify its inhabitants around a set of Russian cultural ideals. Countries which typically have more homogeneous populations such as Norway, Japan, China, South Korea, and even Botswana typically provide more long-term stability for their citizens. Russia appears to recognize that a strong cultural identity will be necessary if it wants to raise its status and importance on the global stage.

Russia is consciously trying to limit its vulnerability to the dollar while building unity within. Whatever happens, Russia's vast resources and geopolitical positioning between East and West guarantee at least ongoing regional significance. For investors, it is important to consider more than just the financial situation when analyzing a country. Social dynamics are critical to understand prior to investing in a given country. If Russia can successfully navigate many of these challenges it could rise above regional significance to international heavyweight once again.

Russia's Monetary Policy

Very few people take the time to look at Russian monetary policy when evaluating the economic outlook of the country which is a huge mistake One look at the last 10 years of their benchmark interest rate (Fig 1.) tells you something exciting has been happening there. A crash in oil prices in 2014 caused significant pain to the heavily oil dependent Russian economy. Oil makes up 70% of the nation’s exports. When oil prices go down economic pressures increase and, vice versa, when oil prices rise budgetary pressures ease. The 2014 oil crisis can be seen clearly in Russia's monetary policy. The Central Bank of Russia's benchmark interest rate began to spike as oil prices crashed. Not easily seen on a long term chart, rates briefly went as high as 17% to prevent inflation and capital flight reminiscent of the early 1980's Volcker era in the US.

Comparing the benchmark interest rate between Russia and the US, we see "normalization" from two different directions. Beginning in 2016, Russia was trying to decrease their benchmark interest rate while the US was trying to increase theirs after being stuck on zero for many years. This observation will come into play when we analyze the relationship between the Ruble and the Dollar later on. In 2019, interest rates between Russia and the US began moving in tandem providing supporting evidence that the current global, economic crisis has its roots at least as early 2019, a time when the monetary policy of almost every central bank became aligned in cutting rates.

Ruble Money Supply

The M2 money supply for the Ruble has more than doubled over the last 10 years, a point to consider as we move forward.

Gold and the Ruble

Something big is happening in the gold market on a worldwide scale and it appears that the US markets are reacting very slowly by comparison. Gold has performed extremely well in every country we have examined thus far with no signs of abating. There appears to be clear positive correlation between increases in the money supply and increases in the price of gold over the long term. The only currency not showing as close of a relationship between money supply and gold price is the dollar, which happens to function as the global reserve currency.

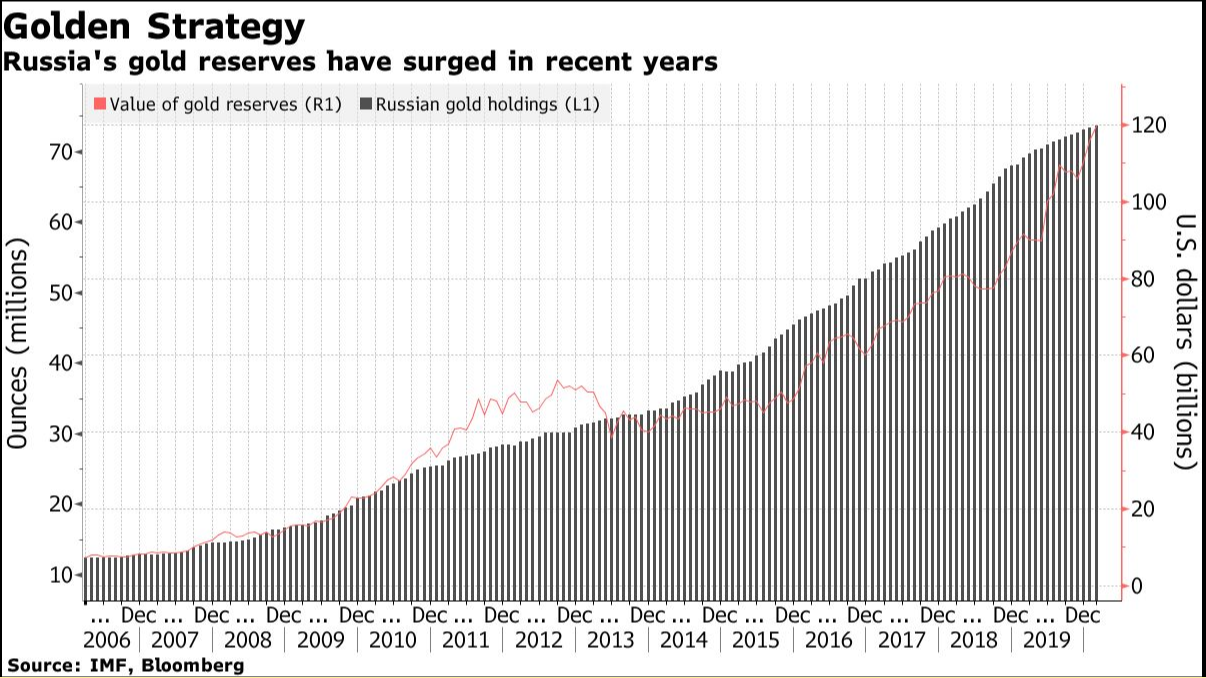

While the M2 money supply of Rubles has more than doubled in 10 years, the price of gold in Rubles has more than tripled. The catalyst may be associated with the purchases of gold by the Russian central bank. We can clearly see, over the same 10 year time frame, that the amount of gold being accumulated by the Russian central bank has also tripled.

US Dollar versus the Ruble

As expected, the Ruble lost half of its value against the dollar during the 2014-2016 financial crisis. However, somewhat unexpectedly, the exchange rate between the Ruble and the dollar remained quite stable from 2016 until the 2020 crisis. This is fascinating because during that period the US was increasing the Fed Funds Rate while Russia was decreasing their benchmark interest rate. Considering monetary policy alone, we would expect the Ruble to weaken against the dollar throughout that period but that was not the case.

Since 2013, Russia has pursued a policy of limiting its use of dollars where possible, in both domestic and international transactions, as a means to avoid sanctions. To understand this better, imagine a scenario where Russia sells oil to China. Instead of purchasing dollars in the Forex markets to buy Russian oil, China could settle the bill in renminbi or could purchase rubles in the Forex market to settle the bill. The dollar would be circumvented using either method. This hypothetical example is supported by the fact that Russia has not only been decreasing its dollar exposure but increasing its renminbi exposure in replacement. The dollar was once the largest component of Russia’s FX reserves but that position has been abdicated in favor of a larger weighting in euro, yen, and renminbi. The continued sale of dollar assets acted as a counterweight against the decrease in the Russian benchmark interest rate, stabilizing the exchange rate between the ruble and dollar. This policy has supported the ruble against the dollar since 2016.

Bitcoin and the Ruble

The historic exchange rates between bitcoin and the ruble are provided below. The top chart spans 10 years of price history while the bottom chart covers the last year.

An interesting trend among emerging market currencies is developing with respect to bitcoin. If you create a fiat currency spectrum ranking currencies from weakest to strongest, we see a pattern where bitcoin performs better and better the closer it moves toward the weak end of the spectrum, providing for record high prices in some currencies. In other words, bitcoin is performing its function as a store of value where it’s needed most. The more profligate or weak a given fiat currency is the better bitcoin performs for those who possess it against said fiat currency. With that said Russia has been relatively stable as a currency since their financial crisis. The current bitcoin price currently rests just within 60% of its all time high.

When it comes to Bitcoin policy, however, Russia needs to get out of its own way. Recent proposals seek to legislate a ban on crypto activity within Russia:

“Buying crypto for cash or via a bank transfer from a Russian bank would be subject to a fine of up to one million Russian rubles ($14,000) or up to seven years in prison, depending on the scale of the deal. Similar punishment would be in store for those who accept crypto for goods and services.”

The proposed legislation would include Russia on a list of countries such as: Morocco, Algeria, Bolivia, Nepal, and Pakistan which languish in respect to international trade and have high rates of poverty. This is why Russia is such an enigma. It pursues high growth strategies in some cases but also eschews opportunities in others. Banning Bitcoin (or crypto more broadly) in this case will only push them further behind in the monetary arms race.

Summary and Current Developments

The big story in Russia has been the price of gold. Considering that the Russian money supply has been rapidly increasing over the past decade, even during the best of times, it is safe to assume we will see more of the same, especially within the context of the Chinese virus debacle. As rapidly as the gold price has increased, there is no top in sight in terms of the ruble due to continued inflationary monetary policy.

Russia’s forced policy of de-dollarization due to sanctions has the effect of insulating it somewhat from a dollar shortage. If such a scenario occurs, a dollar shortage, there would be no need to sell rubles in order to acquire dollars. The ruble won't be able to totally escape a dollar shortage because all of its other trading partners would be affected but it would be relatively insulated by comparison.

Russia has a habit of taking two steps forward and one step back. It has pursued two encouraging policies, purchasing gold and de-dollarizing, but hurt itself by making Bitcoin commerce difficult. Due to US sanctions, Russia has fallen into the role of geopolitical and financial leadership among a trading bloc of countries wishing to extricate itself from dollar hegemony, including China and Iran. The ruble's performance during the oil price crash in 2020 was much different than 2014, speaking to a more robust economy in the present than during the former period.

We encourage readers to be open-minded regarding Russia and stay abreast of developments there. If there is another sharp pullback in the global economy it may be worth adding some exposure via the MSCI Russia ETF (ERUS) but I would add this ETF with the intent of holding it for a lengthy period, betting on a Russian resurgence in the long run. I personally think that the index is significantly overbought at the current price and would personally wait for a sharp pullback prior to taking a position. I have found that the MSCI Russia ETF (ERUS) tends to do a decent job of tracking the relative strength or weakness of the ruble against the dollar. During periods of stability or strength the index performs well but be wary that the correlation between the index and the ruble is not perfect and sometimes breaks down. As an example, the ruble has been decreasing against the dollar since the beginning of June and yet the index has moved up. This is not intended to be investment advice but merely food for thought.

Kent Polkinghorne

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in