Investing in Turkey

Welcome to the final installment of the Emerging Market Series. This week we will be covering Turkey.

The Turkish Lira is once again making headlines. A repeat of the 2018 currency and debt crisis is becoming more and more likely with each passing day. In an effort to stabilize the lira, the government has been burning through its FX reserves by selling dollars to purchase lira. The Turkish government has borrowed heavily from domestic banks, and even foreign sovereigns such as Qatar, in an effort to stabilize their currency. This is all occurring against a backdrop of dwindling FX reserves, as mentioned above, which is causing foreign investors to pull their money out of the Turkish markets. Suffice it to say, the government’s bold attempts to defend the lira have so far failed.

In this article we will be analyzing a number of economic indicators to try and make sense of the current situation and where things are headed in regard to the Turkish economy.

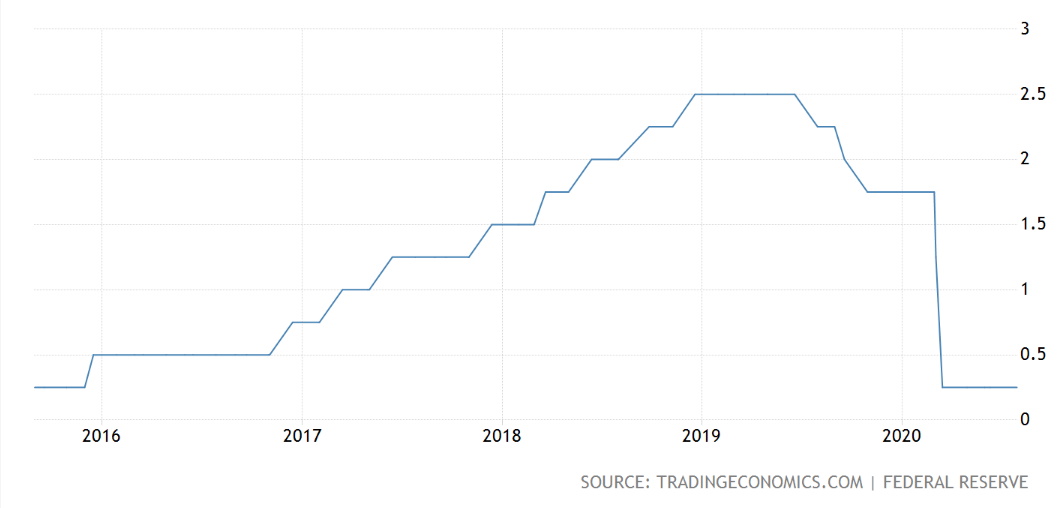

Central Bank of Turkey Interest Rate and Fed Funds Rate

After the election of Recep Tayyip Erdogan in 2002, interest rates were coming down and the lira was strengthening. This encouraged entrepreneurs to take out loans denominated in other currencies such as the dollar and euro thinking repayment would be easier with the combination of a stronger lira and lower interest rates coming from Europe and the US. In doing so these Turkish entrepreneurs assumed exchange rate risk. Easy credit had increased the standard of living in Turkey...but this could only continue as long as interest rates continued to fall. Interest rates could only fall so far, due to the weakness of the lira in international commerce, despite Erdogan's best efforts to keep them low.

A slew of events since 2015 weakened the purchasing power of the lira: civil war in neighboring Syria, the shooting down of a Russian fighter jet, tensions with the US, and an assassination attempt on Erdogan in 2016. While public debt under Erdogan has decreased, private debt has moved strongly in the other direction. As stated above much of the private debt accumulation was denominated in dollars or euros, the repayment of which put economic strain on domestic businesses culminating in a currency and debt crisis. Interest rates eventually rose to 24% (!) in 2018 to stem the inflation.

The US Fed Funds Rate was increasing at the same time that the Lira was losing purchasing power putting additional pressure on Turkish borrowers. Significant dollar denominated debt became extremely difficult to service as the currency crisis in Turkey worsened. This formed what is now a familiar feedback loop: emerging market economies borrow in dollars because they believe the deluge of liquidity emanating from the Fed, in the form of QE, would weaken the dollar, they then begin having issues servicing the debt as the dollar strengthens relative to their currency, and finally, in order to fight inflation, they jack up their interest rates.

Turkish Lira versus US Dollar

The exchange rate between the lira and the dollar is provided below. The chart shows the exchange rate over the past 10 years.

The lira reached a record low against the dollar of 7.3 liras per dollar this past week. The government’s policy of trying to defend the lira, a currency with no external demand, by selling dollars clearly played a role. In fact, Turkey actually borrowed dollars specifically for the purpose of purchasing liras thus putting further stress on their external debt situation. Selling dollars to try and support the lira is ultimately a failing policy as evidenced by the chart above and lira weakness continues to accelerate. A fresh currency crisis could be unfolding only two years after the previous debacle.

Turkish Central Bank Balance Sheet

Central banks use balance sheet expansion as their main tool to control interest rates and, hopefully, the money supply. Increasing the balance sheet is supposed to increase the supply of money commercial banks have at their disposal to lend. The thinking goes that with more money circulating in the domestic economy interest rates should go down which will stimulate borrowing. In the past decade the central bank of Turkey’s balance sheet has increased by 5x, an enormous figure.

This type of policy encourages excessive lending, often to borrowers who are not creditworthy and more likely to default, thus sowing the seeds for the popping of a credit bubble down the road. When interest rates rise due to inflation less than creditworthy borrowers, who are reliant on using new and cheaper debt to service their old debt, begin defaulting and threaten the tightly interconnected financial system as a whole.

Turkish Central Bank Gold Reserves

In 2011 the Turkish government began allowing banks to maintain their reserves with the central bank in physical gold and, since 2017, the Turkish government has been rapidly accumulating gold in an effort to stabilize its currency. The good news is their gold purchases were timely as the current global bull market in gold began in 2018.

Gold in Turkish Lira

The gold price in Lira terms has increased 7x in the last 10 years. The last two years has gone absolutely parabolic. In the last few years Turkey has repatriated 220 tons of their gold from abroad. As noted above the central bank has also been aggressively increasing its gold reserves in recent years.

Turkish Dollar Denominated Debt and FX Reserves

Global central banks tend to hold the most liquid foreign currencies such as the dollar, British pound, euro, and yen in their FX reserves. In the chart below we can observe that a country such as Argentina, Chile, or Mexico, in the event of a dollar shortage, would be unable to cover their dollar denominated debts with their current level of foreign exchange reserves. Turkey also rests in a precarious position that is only getting worse as its central bank attempts to defend the lira by selling its forex reserves. It is a policy doomed to failure because, as stated above, there is no demand for Liras outside of Turkey. The chart below illustrates this concept.

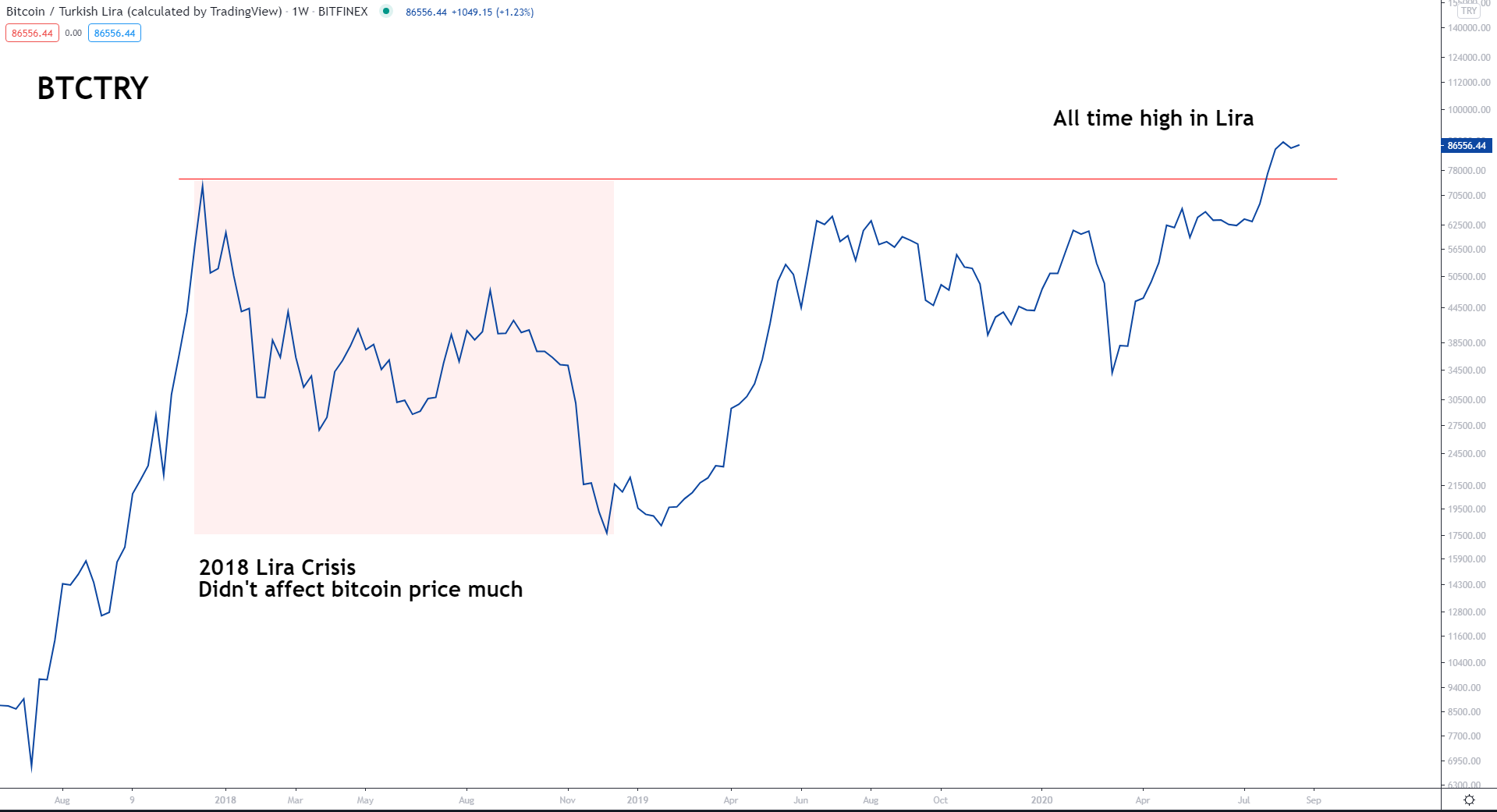

Turkish Lira versus Bitcoin

Bitcoin has recently hit an all time high against the Lira. Turkey joins Argentina, as the other country in our emerging market series to claim that honor. Bitcoin adoption has been on the rise in Turkey for the last few years and recent reports claim volume over the last 12 months has quadrupled.

Here are a couple key points about this topic from a recent Forbes article:

- More than 30% of the country is unbanked but the use of debit cards has allowed easier access to cryptocurrencies

- Turkey is a young country with a median age of 31.5, younger folks are more open to adoption of nascent technologies

- More than 90 percent of adults have a smartphone and mobile internet users are north of 50 million (out of a population of roughly 82 million)

- A 2018 survey showed that 18% of the population owned cryptocurrency and an additional 25% were interested in purchasing some

- 2/3 of the Turkish population support crypto adoption

- The Turkish government has been providing support for crypto research

Summary and Takeaways on Turkey

The Good

- Banks are allowed to maintain their reserves in physical gold

- The Turkish central bank has significantly increased gold exposure in recent years

- Bitcoin adoption is strong and being used as a store of value

- The Turkish government is supportive of innovation in the bitcoin space

The Bad

- Entrepreneurs have taken out significant amounts of debt denominated in foreign currencies, specifically the euro and dollar, and the continued weakness in the lira has made debt service untenable

- In an effort to prop up the lira the government has not only burned through forex reserves but is also borrowing from foreign entities to try and maintain a failed policy

- Despite interest rates that are already too low, President Erdogan continues pressuring the central bank to lower interest rates further in the hope of stimulating the economy

Final Thoughts

Turkey is an enigma. We are bearish on the lira but are less bearish than we originally thought we'd be on the Turkish economy over the long run. The government appears to have a mild form of cognitive dissonance. On one hand, they are encouraging easy money policies and on the other hand they are buying gold and supporting research in the bitcoin space.

I have an idea I like to call “the domino theory.” Essentially, the countries with the weakest domestic currencies will be the first to have large numbers of their populace transition to gold and bitcoin out of necessity due to Gresham’s Law. The demand and subsequent rise in the price of gold and bitcoin, created by the countries with the weakest currencies, will stimulate demand in the countries with relatively stronger currencies causing them to follow suit, and this demand will eventually make its way to the strongest currencies such as the dollar, euro, and pound. This dynamic ensures the price of gold and bitcoin will continue to rise in the long run.

As for Turkey in the immediate short run, shorting the lira through emerging market indexes such as the TUR ETF is likely to be a winning strategy until the government and central bank can develop some monetary restraint.

Kent Polkinghorne

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in