A Generation of Grifters: Our Aging Political Class, Their Peers, and the Connection to Wealth Inequality

The article this week will be a little different than the topics normally covered on this platform because a recent series of tweets by Jim Bianco were just too tantalizing to ignore. Jim provided a series of tweets regarding the geriatric nature of our ruling class and I have included those tweets below. In this article we will expand on Jim's tweets by analyzing the relationships between age, interest rates, debt, and wealth inequality. We will also introduce some notable politicians, both past and present, that exemplify the very problem that Jim is trying to point out, namely refusing to give up the reins of power.

In relation to Jim's tweets below, please ignore the duplication of the second tweet as there was no other way to post Jim's entire tweet series without doing so. Also, if you don't follow Jim on Twitter you really should. Now let's get to the those tweets.

Jim's Tweets

Please read through each tweet carefully. A short analysis will be provided at the end of each tweet as well.

If gets worse

— Jim Bianco (@biancoresearch) February 15, 2021

Boomers (57-75) and the Silent Generation (76+) are WAY over-represented compared to their share of the wealth and population (noted on chart).

Generation X (41 to 56) and Millennials (26 to 40) are relatively under-represented.

(2/3) pic.twitter.com/vTV3xSpMPA

Ditto the House

— Jim Bianco (@biancoresearch) February 15, 2021

-

Tech is generational and it is disrupting lives/business, both good/bad. How we use/regulate this tech is THE ISSUE moving forward. It folds into equality, climate and nearly everything else.

Our elderly leaders are not capable of understanding this.

(3/3) pic.twitter.com/VHi2npoZAi

Interesting to note is the fact that the average ages of both the senate and the house share an inverse relationship with interest rates. During the 1970's, when interest rates were increasing (due in large part to high levels of inflation), the average age of the legislative branch was decreasing. Likewise, since the interest rate peak of 1981, and subsequent decline, the average age of legislators has increased. We will cover interest rates in more detail later. It should also be noted that the gold standard was "temporarily (read: permanently)" suspended by Richard Nixon in 1971. From Jim's charts you can see that average age of the house and senate declined sharply over the next decade just after the closing of the gold window, again forming an inverse relationship with interest rates, before making a sharp reversal after 1981, a reversal that has now persisted for 4 decades.

The silent generation, despite being just 5-6% of the population, hold 11% of the seats in the senate making them overrepresented, as a share of their population, by a factor of 2. In regards to the house, they hold about 6% of the seats which is on par with their share of the population. Keep in mind though that senate seats are the most coveted.

Baby boomers make up 21% of the population and yet account for 67% of the senate and 53% of the house, making them over-represented by greater than a factor of 3 in the senate and greater than a factor of 2 in the house. Due to their age bracket, it is fair to assume that they will have a somewhat disproportional representation on capitol hill, however, being over-represented by factors greater than 3 and 2 is simply staggering.

Taken together, the silent generation and baby boomers account for 78% of the seats in the senate and 59% of the seats in house despite accounting for no more than 27% of the total population when combined. Jim not only listed each generation in terms of their share of representation in the house and senate but also with respect to their share of wealth, however, we will include information on wealth distribution later in the article.

We will now shift our focus onto some of the politicians who are responsible for the massive increase in the average age of the senate and house. The first section will cover the longest serving politicians in history followed by another section which will cover some of the more lengthy tenured politicians still active today. Each of the two sections will contain some important notes about each. As you read, you will have to forgive me for any tongue in cheek comments which I let slip along the way.

Longest (Self) Serving Politicians

A list of the longest serving senators can be found here. Additional information on some of the longest serving senators will be provided below along with the generation they belong to, their length of time in office, and some notes about them.

An interesting historic parallel between our time and a lifetime ago is that during America's last crisis, The Great Depression, President Roosevelt attacked the Supreme Court on account of the advanced ages of its justices. While many of Roosevelt's attacks during the 1930's were self serving, he naturally wanted to replace the old judges with his own appointments to the Supreme Court, it is nonetheless interesting to observe the parallels. It is also worth noting none of the politicians listed below spent much, if any, time working in the private sector...the same private sector which is responsible for their salaries and pensions. You would think that lawmakers would be required to spend time working in, and thus understanding, the very sector that they oversee and govern but that is apprently not always the case. Now to our list.

Robert Byrd (G.I. Generation) - 51 years, 5 months, 26 days

Byrd worked as a gas station attendant, a grocery store clerk, as a shipyard welder during World War II, and finally as a butcher prior to being elected to the West Virginia House of Delegates. Byrd would never hold a private sector job again and would spend the rest of his life as a politician, dying in office in 2010 at the age of 92. I can't imagine being a politician would be more rewarding than being a gas station attendant, butcher, etc. but nevertheless, Mr. Byrd must have thought so.

Daniel K. Inouye (G.I. Generation) - 49 years, 11 months, 15 days

Inouye lost his arm due to his service in WWII. Upon being discharged, he went on to obtain his bachelors degree as well as his juris doctorate. He would never go on to practice law, however, and entered politics immediately upon graduation in 1953. Unlike his contemporary Robert Byrd, Inouye never worked a day in the private sector, enjoying the fruits of the taxpayers labor instead. He died in office in 2012 at the age of 88.

Strom Thurmond (G.I. Generation) - 47 years, 5 months, 8 days

Thurmond was a lifetime politician. Prior to WWII he had served as a member of the South Carolina senate, and following his WWII service he was elected governor of South Carolina. After his stint as governor he went almost directly into the US Senate where he would go on to celebrate his 100th birthday decades later. He died less than 6 months after leaving office in 2003.

Ted Kennedy (Silent Generation) - 46 years, 9 months, 19 days

Despite having lackluster grades in high school, Kennedy still managed to get into Harvard due to being a member of the powerful Kennedy political family. In his first year there he cheated on an exam and was kicked out. Prior to regaining admittance to Harvard, he served in the US Army where his father's political connections kept him stationed in Europe and away from the violence of Korea. He would re-enter Harvard in 1953 and graduate in 1956. He then went on to law school where he graduated from the University of Virginia Law school in 1959 with a C average.

Ted Kennedy did a short stint as an assistant district attorney before securing the Massachusetts Senate seat, vacated a couple years earlier by his brother John, in 1962. Ted would die in office in 2009 at the age of 77 with an estimated net worth somewhere between $43 and $162 million. Senators must be making more these days.

Patrick Leahy (Silent Generation) - 46 years

Upon receiving his license to practice law in the state of Vermont in 1964, Leahy became an associate at a firm run by then governor Philip Hoff. Within two years Hoff himself would appoint Leahy to the DA's office where he remained until being elected to the Senate in 1975. At the age of 80, Leahy is still in the Senate and will probably follow in the footsteps of the other notables above and die in office.

Even though Leahy is still active, I thought it made more sense to associate him with the aforementioned individuals due to the fact that he is not well known but is near the top of the list for the longest serving senators. Politicians who are both active and more notable will be discussed next.

Notable Active Politicians by Age, Net worth, Tenure, and Key Facts

In this section I intend to focus on certain notable politicians who receive, or have received, a significant amount of public exposure. In order to qualify for this section the criteria is two-fold: the politician must be both currently active and a career politician. We will also examine the net worth, when possible, of each of the individuals below as well as assign them to their correct generation.

Joe Biden (Silent Generation), Age 78

Biden obtained his Juris Doctorate in 1968 and practiced law for a few short years before being elected to a seat on the county council in 1971. During his two years on the council, young Biden must have realized that working in the private sector was too just too stressful and instead opted to remain in politics. Remain in politics he did, winning a US Senate seat out of the state of Delaware in 1973, a seat that he wouldn't vacate until 2009 when he moved over to the Vice President's office. He was actually the 6th youngest senator in history when he was elected at 30 years of age.

Aside from the 4 year hiatus between his stints as Vice President and now President, Biden has spent all but 3 years of his working life as a politician. Being a politician at his level is indeed lucrative, book deals and speaking fees have earned him a serious sum in recent years and his current net worth is estimated to be around $9 million. It is also rumored that his family businesses are worth much more than this.

Let's also not forget that his crack smoking son somehow managed to get on the board of directors for BHR Partners, a Chinese based private equity firm, in 2013 and then followed that up by joining the board of Burisma Holdings, a natural gas dealer, in 2014. Both appointments occurred while his father was acting Vice President and the Burisma appointment in specific occurred just after the US backed Ukrainian revolution had finally subsided, leaving a destabilized country in it's wake.

Diane Feinstein (Silent Generation), Age 87

Feinstein has been involved in politics for her entire adult life, first being appointed to the California Women's Parole Board in 1960 by former governor Pat Brown (father of two term CA governor Jerry Brown). She was mayor of San Francisco from 1978 to 1988 and finally made her way onto the national scene in 1992 with her election to the US Senate, a position she currently maintains despite being more advanced in years than the average lifespan of a normal human being.

Feinstein is worth $58.5 million implying that a career in "public service" is indeed a career in self service. The list of red flag business dealing between her husband's company, Blum Capital, and the Federal government is too numerous to list here but an example from 2009 (during the financial crisis) is provided below:

"On the day the new Congress convened this year, Sen. Dianne Feinstein introduced legislation to route $25 billion in taxpayer money to a government agency that had just awarded her husband’s real estate firm a lucrative contract to sell foreclosed properties at compensation rates higher than the industry norms."

While people were losing their life savings and homes, the Feinstein's were making a fortune.

Mitch McConnell (Silent Generation), Age 79

McConnell allegedly defends the private sector but has spent little to no time working in it himself, aside from a few short years spent in a law firm between political occupations. Instead, he has chosen to live a life subsidized by the hapless taxpayer.

McConnell was elected judge/executive in his native state of Kentucky before finally landing a seat in the Senate in the 1984 election, a position he has maintained ever since. It should also be noted that McConnell is married to Elaine Chao who has also spent her entire adult life in politics.

McConnell had an estimated net worth around $3 million in 2005 when an inheritance from Chao's wealthy family pushed that figure above $25 million. It should be noted that his father-in-law has extensive connections to Taiwan and China.

Nancy Pelosi (Silent Generation), Age 81

Pelosi has been involved in politics her entire life and comes from a political family as well. Both her parents were active in politics and her father was both a congressman and the Mayor of Baltimore (note: both father and daughter managed to preside over the downfall of two cities that were once great in Baltimore and San Francisco, cities which have now long been plagued by drugs, homelessness, and crime).

Pelosi has served (herself) as a congresswoman since 1987 and is now in her 34th year on capitol hill. She and her husband have a net worth of $114 million. Her husband operates a real estate and venture capital investment and consulting firm which has no doubt benefitted immensely from the never ending bailouts that his wife and her cronies support. Pelosi, much like the Kennedys, Bushes,and Romneys before her, is a product of nepotism.

Chuck Schumer (Baby Boomer Generation), Age 70

Upon earning his juris doctorate in 1974 Schumer went straight into politics. First, as a member of New York's state assembly, then as a member of Congress and finally the US Senate. He has spent his entire adult life siphoning a living off of the hapless taxpayer. I could not locate a reliable estimation of Schumer's net worth but this source has his net worth pegged at $500,000, a figure highly in doubt.

A complete list of the wealthiest people in politics can be found here. I would have liked to include Mitt Romney to my list above, another product of nepotism, but his tenure in politics has been far shorter when compared with others on this list and he did spend a significant amount of time in the private sector. However, the means by which his wealth was acquired is certainly worthy of investigation.

Now that we have a better idea of the fruits afforded to those who spend a lifetime in politics, we will move our attention and focus on the relationships among age, interest rates, and total debt.

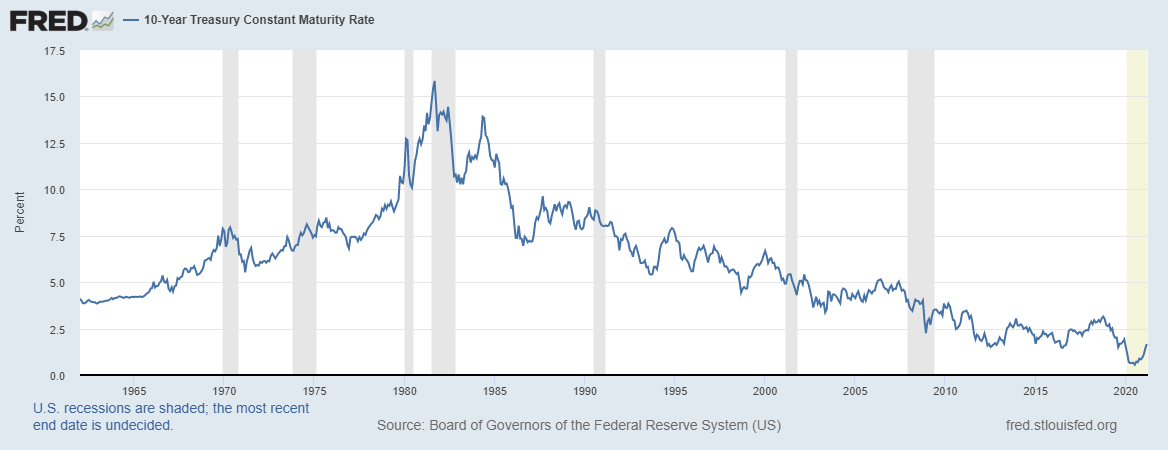

10 Year Government Bond

Ask yourself a couple questions. First, when interest rates go down what types of things go up in value? If your answer involved any of the following: bond prices, stocks, home prices, etc. then you are correct.

Second, who benefits most in a low interest rate environment? If you answered that the current holders of assets do, then you are also correct. Along with this question we must also ask ourselves who owns all the assets already? Answer: the silent and baby boomer generations do. The game is zero sum. As the prices of these assets increase, the younger generations get priced out.

Lastly, due to the enormous expenses involved in funding election campaigns, which age demographic(s) of the population will have a distinct advantage defraying such costs? If you answered the older demographic then you are correct yet again. With lopsided wealth distribution among the four generations listed in Jim's tweets, a distinct advantage is given to the silent and baby boomer generations in terms of political agency.

By supporting a consistent policy of lowering interest rates, current asset olders benefit at the expense of non asset holders. While the value of assets held by the silent and boomer generations have skyrocketed, the increased cost of trying to acquire similar assets has put said assets further and further from the reach of subsequent generations. Tinkering with interest rate policy creates a zero sum game where the current asset holders benefit at the expense of the non-holders. The current distribution, or lack thereof, of financial assets is beginning to resemble our more feudal past.

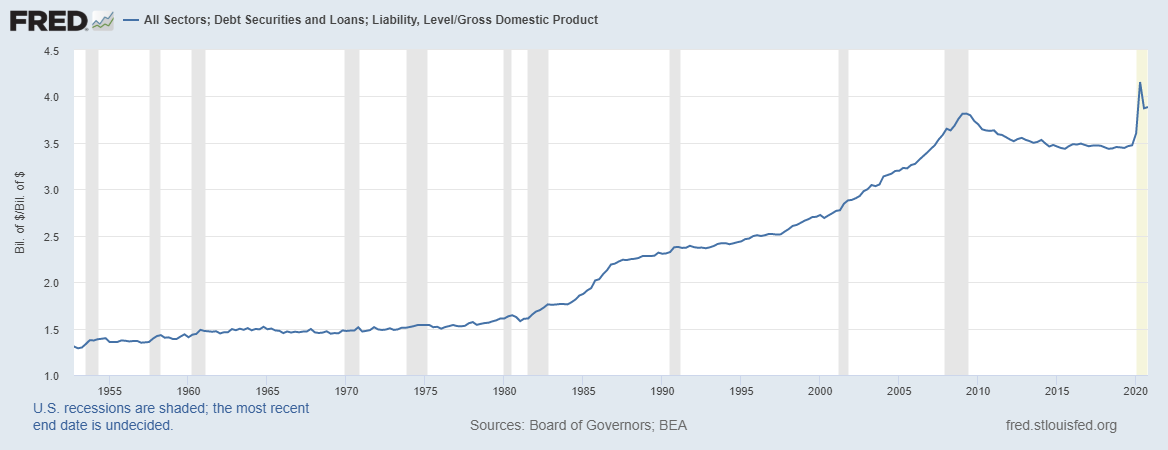

Total Debt, Public and Private, as a % of GDP

Increasing the amount of debt in the system is always sold to the public as some sort of panacea whenever a financial crisis rears its ugly head, however, large increases in debt are strongly correlated to rising levels of wealth inequality. This may sound counterintuitive on it's face but I will explain how it works.

When comparing the 10 year treasury chart from the previous section with the total debt chart from this section we see an inverse relationship. Historically, as interest rates have decreased, the amount of debt in the system has increased. People tend to think that they will be able to take advantage of the lower interest rates but that is not really how things work in practice.

Max Keiser uses the term "interest rate apartheid" to describe an environment where low interest rates for corporates and sovereigns operate alongside high interest rates for the average consumer, creating an artificial class construct. The big key is this, access to cheap credit is only granted to the wealthy and politically connected. These elites then use this credit to pump the prices of assets that they own. An example would be when the board of directors of a given S&P 500 company chooses to take advantage of the low interest rate environment and issue bonds to borrow money for cheap. They then use this money and engage in stock buybacks which increases the value of their portfolios. Additionally, in the 1980's, it was fashionable for the well connected to access cheap credit, use the credit to purchase control of a targeted American company, strip mine said company for any valuable assets while simultaneously laying off its workers, then sending the company abroad to a cheaper cost of labor environment. These types of transactions are more commonly known under the terms mergers and acquisitions.

While the elites were borrowing cheaply and increasing the amount of debt in the system to pump their assets, a consequence of this behavior appeared in the forming of rising wealth inequality, since it became more and more difficult for the average person to acquire financial assets. When you create a two tiered system where one class can borrow near infinite amounts of money for cheap and essentially purchase the entire wealth of a country, it is only a matter of time before wealth inequality begins to expand.

Wealth Inequality has Skyrocketed

When using the last century, as well as Jim's tweets from above, as our context the senate and congress reached their youngest average age in 1981. This is interesting because in the case of Chuck Schumer specifically, he is not only a current member of the oldest senate/congress in history but was also a member of the youngest senate/congress back in 1981.

Please keep the year 1981 in mind as we work our way through the next couple tweets from Sven Henrich. Also note that the total percentage of assets held by the top 10% is represented by the blue line with the percentage total listed on the left. The total percentage of assets held by the bottom 50% is represented by the red line with the percentage total listed on the right.

12 years of central bank printing.

— Sven Henrich (@NorthmanTrader) March 17, 2021

The underclass couldn't be happier with the Fed's efforts. pic.twitter.com/6y33nnBz51

While interest rates have been consistently decreasing since the 1981 peak, asset ownership among the bottom 50% still managed to increase initially, if only for a time, reaching it's peak around 1995. The reason the bottom 50% still managed to do well between 1981 and 1995 is likely due to the fact that interest rates were declining from artificial levels that were set far too high by a deliberate Federal Reserve policy designed to reign in the high inflation of the 1970's and early 1980's. As a result, interest rates were likely to be far above their natural market equilibrium and needed to decrease, a process which took time.

Since 1995, the total assets held by the bottom 50% has decreased from 8.7% to 5.6%. Meanwhile, total assets held by the top 10% has increased from 56% to 64% over that same span. The most agressive bifurcation between the wealth of the top 10% and the bottom 50% occurred just after the 2008 financial crisis when the Fed began a deliberate policy of buying distressed assets and targeting lower rates, eventually setting the rate of interest for the 2 year treasury at 0%. This was a godsend for the political class, as well as the silent and baby boomer generations, as they became the beneficiaries of enormous bailouts which not only protected their assets from the steep price declines that ruined many average Americans, many of whom never recovered, but have since made those assets even more valuable. It should come as no surprise but every active politician that was cited earlier voted for the 2008 Wall Street bailouts which no doubt served their own self interests at the expense of the general public. Keep in mind, their poor stewardship lead to the crisis in the first place and yet, instead of being responsible for their actions, they came out of it even more wealthy and powerful than before. As Rahm Emanuel said during the depths of the 2008 GFC “You never want a serious crisis to go to waste.”

Pew Research published a study in 2020 comparing the U.S. aggregate household income by income tier (i.e. upper, middle, and lower income) for the years 1970 and 2018. The breakdown of aggregate income for each tier in 1970 was as follows: upper income (29 percent), middle income (62 percent) and lower income (10 percent). By 2018, the upper income tier had consumed nearly half of all aggregate income at the expense of the middle and lower income tiers: upper income (48 percent), middle income (43 percent) and lower income (9 percent). In this scenario the reader can clearly see that a large portion of income that once flowed to middle income earners has been diverted and now flows to the upper income earners, destroying the middle class in the process.

Lastly, Jim provided information earlier on each generation in terms of their share of the population and their share of it's wealth. I had to do a little quick math to derive the numbers for the silent generation but here are the findings. The silent generation account for about 6% of the population and yet account for 25% of it's wealth making them overrepresented by a factor of 5. The baby boomers account for 21% of the population and yet account for 57% of it's wealth making them overrepresented by a factor greater than 3. Generation X accounts for 20% of the population and yet only accounts for 15% of it's wealth making them underrepresented. Even worse, millenials account for 22% of the population but only account for a paltry 3% of it's wealth.

Again, it is understandable that there should be some wealth imbalances between generations since age is a key factor in terms of wealth accumulation and distribution, however, the oldest members of Generation X are already in their mid 50's and have been in their peak earning years for nearly two decades while the oldest millenials are already 40 and likewise have been in their peak earning years for the better part of a decade. From the data provided in this piece a clear pattern emerges: as the amount of direct intervention into financial markets has increased over time, in terms of monetary and fiscal policy, so has the country's wealth inequality. This wealth inequality rests squarely on the shoulders of our more geriatric and self absorbed class of politicians, along with their silent and boomer peers to a large extent.

Summary

Political agency has managed to remain in the hands of a small number of elderly individuals, not because of their strong leadership, but because of their ability to game the system. As we have seen in the areas of representative politics and wealth, this is a zero sum game where one age group benefits at the expense of all others.

It is also important to remember that when Jay Powell or Janet Yellen come on the television extolling the virtues of low interest rates, what they are really doing is protecting the political establishment comprised mainly of their peers, the silent and baby boomer generations. Likewise, if Nancy Pelosi or Chuck Schumer come on the television clamoring for massive increases in debt, it is in an effort to pump their own bags along with the bags of their donor class.

While under the influence of the silent and boomer generations we have watched: divorce rates, wealth inequality, income inequality, obesity, diabetes, depression, and drug addiction as well as the cost of housing, medical care, and education skyrocket while fertility rates and family formation have plummeted. While a single income could support a family in the 1950's and 1960's, not even the dual incomes of men and women today can accomplish the same.

The policymakers mentioned previously in the article have not only presided over the bursting of three of the largest, and most destructive, financial bubbles in U.S. History: Dotcom, GFC, and Covid, but have also looked the other way while their constituents individual debt burdens balloon and their jobs are shipped overseas. Keep in mind that policy targeting the lowering of interest rates, accompanied by increasing debt levels, have been the tools used by those in power to erode the economy for their own benefit, much like a cancer acting upon an internal organ. It is no coincidence that when interest rates and debt began to increase in 1981 so did the average age of our political class, which led to increased wealth inequality between the older and younger generations as well.

Many statists, particularly socialists, believe grifters, like the policymakers covered in this piece, should "serve" as the arbiters of financial affairs in place of the free market...because of democracy or something. Well, where has this gotten us today? From unaffordable housing to record levels of student debt the younger generations of today are set to become possibly the first since the founding of this country to be worse off than their parents. While most people in their 70's and 80's would be long retired, or even dead, our current geriatric political class seems unwilling to cede power, preferring to keep their boots squarely on the necks of the young people they claim to represent.

In summary we leave you with two important quotes to consider:

"When the people find that they can vote themselves money that will herald the end of the republic."

-Ben Franklin

" The urge to save humanity is almost always a false front for the urge to rule."

- H. L. Mencken.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in