The Gold - Silver Relationship

The history of gold and silver could fill many books but in this piece we will simply establish some basics along with the dynamics involved.

Ancient History of Gold and Silver

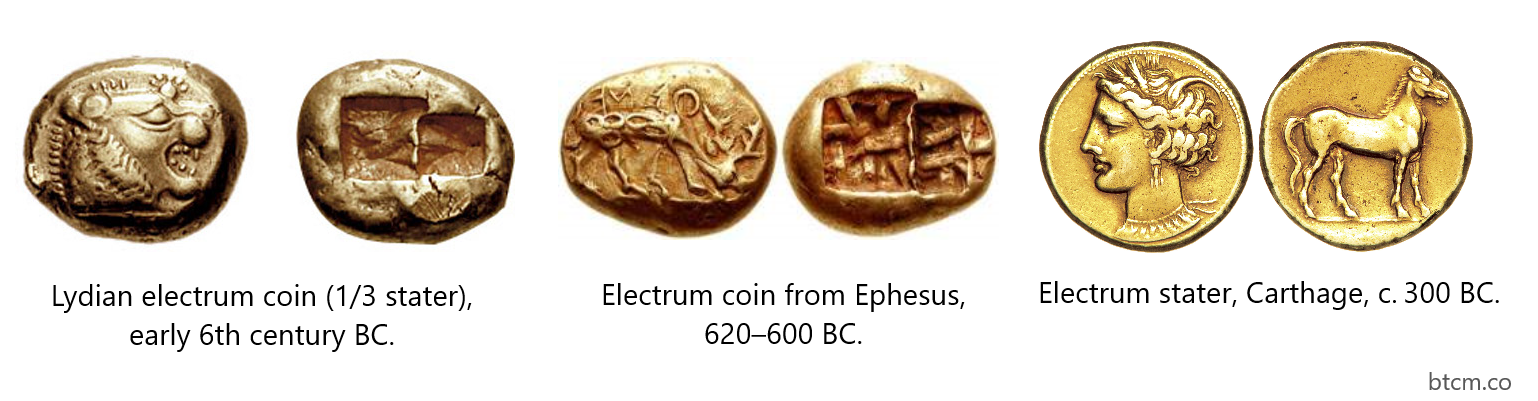

The use of both gold and silver money goes back thousands of years. In fact, the first coins minted in approximately 600 B.C. were electrum, a naturally occurring alloy of gold and silver. Believe it or not, precious metal money stretches back twice as far as those first coins, at least to the ancient Sumer and Varna cultures circa 2,500 B.C., where precious metals were produced as spirals of uniform cross section which could be clipped and weighed. Gold and silver have always been a natural marriage but not necessarily a happy one.

Gold and silver deposits can be found together but usually occur in uneven concentrations in the earth's crust. For instance, Hungary had several gold mines in the middle ages (and thus adopted the Florin standard very early), while the German mountains had silver mines (the Ore Mountains, home of Joachimsthal, famous as the progenitor of the thaler, or dollar). Famously, Mexico and Peru had readily available deposits of silver in Peru and Mexico starting from the early 16th Century; however, the Americas didn't yield a significantly productive gold mine until the turn of the 18th Century in Brazil.

Traditionally, kings set a denomination and conversion rate for gold and silver in their kingdom to aid the smooth flow of trade and to avoid liquidity issues from hoarding, melting, or exporting coins. Neighboring kingdoms with different conversion ratios lead to arbitrage opportunities (one reason for the boom in banking during the early Renaissance). If the silver to gold ratio was 16:1 in one kingdom and 20:1 in the neighboring kingdom, silver would flow to the former where it could buy more gold, then that gold would flow from the latter to the former where it could buy more silver (rinse and repeat).

Monetary Convergence

These merchants were effectively working to undermine the face (legal) value of the coins that their respective monarchs had put into circulation. This process results in capital being allocated into a financial industry instead of other lines of production (the modern foreign exchange market is $6.6 trillion per day and the estimated size of the global financial services industry is $26.5 trillion, both as of 2019). The intense economic effects and pressures, more often than not, led kings to voluntarily mint coins according to a single international reserve currency standard; Solidus, Florin, Dollar, etc.

This convergence toward a single standard increases the efficiency of trade but also makes debasement less profitable, since the market is quicker to react. If every major economy is using the same weight and measure of reserve asset at a fixed ratio, as soon as a monarch starts to debase their coins by lowering the precious metal content, traders would rather sell their wares in neighboring kingdoms for higher quality coins, thus lowering commercial activity within the kingdom responsible for the debasement. Debasement by any single ruler becomes less attractive.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in