How to Value Gold in this Crisis

How high can gold go using M1, M2, Public and Private Debt to calculate different scenarios

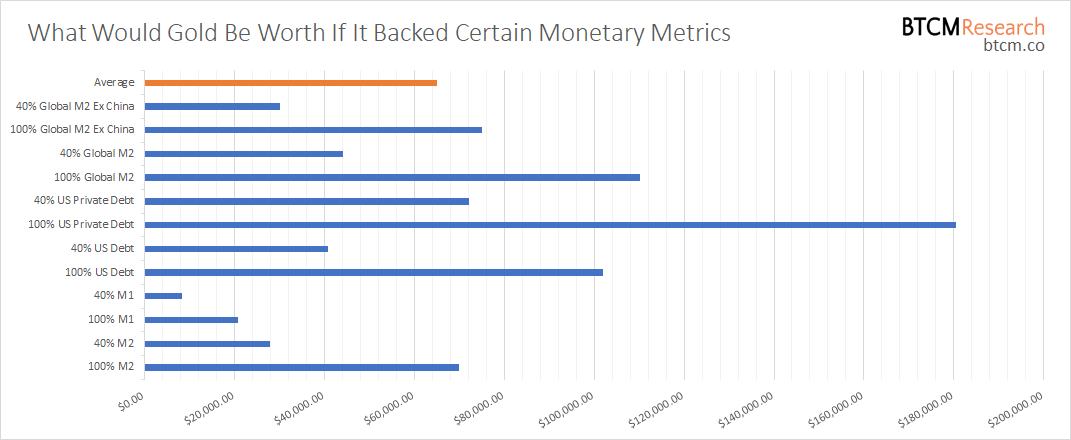

After a 9 year hiatus there has been a lot of excitement around the price of gold. Pundits like Peter Schiff and James Rickards have been throwing around price targets of $5,000 all the way up to $15,000 an ounce; some even claiming a gold standard is near. Gold advocates say things like, "No price is too high because the dollar will hyperinflate." We'll have to save a rebuttal to that specific claim for another post but, suffice it to say here, a global reserve currency has never hyperinflated, the dollar (DXY) is 30% above its 2008 pre-QE lows, and 5% above its 2018 lows.

Gold has performed very well since late 2018 and typically does well in times of uncertainty but where do these pundits get their price projections? Below we offer a few ways to calculate potential valuations for gold. We make no claims about these numbers, we are simply crunching the numbers. A new equilibrium price of gold will be different for each currency but for the US dollar it will likely be somewhere within these ranges.

Gold-backed M2 and M1

One of the most commonly cited potential valuation methods for gold is if M2 were backed by gold. M1 is the measure of money supply consisting of cash and demand deposits, while M2 money supply consists of M1 plus savings and time deposits, certificates of deposits, and money market funds. We will look at valuations of a full backing and 40% backing by US gold reserves of M2 and M1. We use 40% because that is the amount of backing originally required by the Federal Reserve Act in 1913 and until 2000 the Swiss Franc was the last gold backed currency, with a 40% gold backing.

US gold reserves: 8133.50 tonnes or 261,498,097 troy ounces

M2: $18,259,600,000,000

- 100% backing of M2: $69,826.89

- 40% backing of M2: $27,930.75

M1: $5,409,100,000,000

- 100% backing of M1: $20,685.04

- 40% backing of M1: $8,274.01

US Government Debt Backed by Gold

In this next methodology, we derive the potential value of gold by figuring what its price would have to be to back all US government debt by its gold reserves. This metric doesn't make a ton of sense, because governments can run deficits and be in debt; however, we find the exercise to be informational.

US government debt: $26,658,832,000,000

- 100% backing: $101,946.56 per ounce

- 40% backing: $40,778.62 per ounce

US Private Debt Backed by Gold

In our modern monetary system, money is created through the loan process. Loans are not made from other people's deposits as many people think. The conventional wisdom says that if a customer deposits say $1000 then they are paid 2% interest. The bank then takes that deposit and loans out $1000 at 8% interest. In this scenario the bank profits by 6% and everyone is made whole at the end of the day.

The existing system does not work like that. Banks lend out much more money than they have on deposit and their margins are much more thin. For example, if a bank receives $1000 in deposits and pays the depositor 2% interest, according to the current international banking agreement Basel III, banks can lend out many times more than $1000. This practice is called fractional reserve banking. The key takeaway here is that the actual amount of money in the financial system is many times larger than the amount of deposits.

Where does the money come from if not from deposits? It is conjured out of thin-air and added to banks' balance sheets, simple as that; modern money printing.

If we then want to calculate how much money is out there in the system, we must consider the total private debt (loans outstanding). We can then take this total and divide it by the number of ounces of gold held in reserve to calculate a potential valuation.

US GDP (2019): $21.43 trillion

US private debt to GDP (2019): 220.2%

US private debt: $47.189 trillion

- 100% backing: $180,456.38 per ounce

- 40% backing: $72,182.55 per ounce

Using Global M2 to Calculate the Price of Gold

In this section we'll use the currencies in the DXY + China as a proxy for the entire world. Of course, this isn't perfect, but most of the global money supply will be covered this way. All M2 measures are converted into USD using the exchanges on 8/21/2020.

| Country | M2 (in USD) | Gold reserves (million oz) |

|---|---|---|

| US | $18.259 trn | 261.5 |

| EU | $15.548 trn | 346.2* |

| Japan | $10.501 trn | 24.6 |

| UK | $3.522 trn | 9.97 |

| Canada | $1.528 trn | 0 |

| Sweden | $460.2 bln | 4.1 |

| Switzerland | $1.156 trn | 33.4 |

| Subtotal Ex-China: $50.9742 trn | 679.77 | |

| China | $30.750 trn | 62.6 |

| Total: $81.7242 trn | 742.37 | |

| Table 1 | ||

| Source TradingEconomics | ||

| *includes reserves from Germany, Italy, France, Netherlands, EU, Portugal, Spain, Poland, Belgium, and Austria |

M2 for selected countries: $81.7242 trn

- 100% backing: $110,085.54

- 40% backing: $44,034.21

M2 Ex-China: $50.9742 trn

- 100% backing: $74,987.42

- 40% backing: $29,994.97

The reason for excluding China the controversy of both their gold holdings and their M2. Their official gold reserves sit at 1948 tonnes, but many gold market experts claim it is much higher. China has significant gold production and doesn't export any gold. They are also a huge importer of gold similar to India. Whether that gold is held in private or public hands is a tricky question in an authoritarian communist regime. M2 is in China also has similar problems; the numbers are almost certainly doctored. Chinese numbers are notoriously unreliable. We do know that the debt levels in the country are insanely high and expect other money numbers to be significantly worse than reported. Taking all this into consideration, we provide a number including China and one excluding China.

Problems with this Methodology

This methodology for finding a potential valuation of gold has several problems. First, there are several hidden assumptions. 1) The dollar will suffer massive inflation, which is not borne out on any chart or in historical terms. 2) Supply remains constant as price increases dramatically, where in reality, production will increase, whether through mining, recycling, or new production methods. 3) Gold is destined for a monetary role in the future. All of these assumptions remain speculative.

To be comprehensive we also need to discuss how prices are formed - i.e. market clearing price versus marginal price, supply and demand curves, stock to flow, and gold's potential monetary role in the future. We will save that lengthy discussion for a future post, but quickly, there is no level of supply or demand without a price. You need four things, price, supply at that price, demand at that price, and market condition (surplus or deficit); in other words, a dynamic supply and demand curve. As price goes up, supply will also go up (this is true for every single asset other than bitcoin).

Conclusion

Some of these methodologies are in the realm of the absurd. The average at $65,000, is also very high. Gold pundits will claim it's completely possible as the dollar inflates, but our position here is that the dollar as global reserve currency will remain strong for the foreseeable future. Therefore, there will be little reason to back any of these metrics with gold.

We do expect gold to rally quite significantly versus the dollar over the next few years, but would put the very upper end of our predictions in line with the lowest numbers in this post. However, against other, significantly weaker currencies, price growth like listed above is more realistic.

While a gold standard would be beneficial to our standard of living, it's a question of getting from A to B. Realistically, a re-monetization of gold is a very difficult problem gold pundits do not seem to appreciate. A gold standard relies on a central authority, so the State has to want to put financial restraints on itself; not likely in a modern globalized economy. However, gold is a tremendous preserver of wealth today and will continue to fulfill that role.

Ansel Lindner

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in