Disregard the Fed's interest rate hike, Here's why!

First appeared on Bitcoin Fundamentals Report #190.

As expected the Federal Reserve raised its target range for Fed Funds to 75-100 bps in a very well-choreographed move. In times like these, when people seemingly reach to the news out of the Federal Reserve like it is Moses coming down from the mountain, it is important to remember that the Fed's influence is nearly all mental. Therefore, raising their target range like this doesn't actually do anything.

It only took the market about 12 hours to figure out nothing changed. Can you pick out the days of the two rate hikes this year on this S&P 500 chart?? Don't peek at the second chart. Be honest, what jumps out at you on this chart as an important day, anything?

Here they are. As you can see the days of the rate hikes are not pivotal, at least to the downside like we are led to believe. What I'm trying to show is that the rate hikes themselves are not the Fed's primary tool. Talking about hiking rates, is the primary tool, along with fostering the belief in the magic of the Fed. Still though, the Fed is not in control.

If the Fed were in control of anything, they could deftly manage the economy, which they obviously cannot. You can't have it both ways, that the Fed controls the economy in the ways claimed and that central planning doesn't work.

If QE was "quantitative" they wouldn't need to do it so many different times and at different levels, for uncertain timeframes. It is also very strange that CPI, inflation, and GDP could be kept in such a narrow band, for so many years, with Fed doing seemingly arbitrary round number intervention; $30 billion/month QE for example. Shocker, Fed control is an illusion.

It's is extremely difficult to break the Fed's programming because it's repeated like a mantra in the mainstream financial press, as well as the alternative financial press by the Austrian School of Economics folks, and in the new Bitcoin media; "DO NOT FIGHT THE FED", "the Fed is all powerful", "the Fed is the root of all financial evil and inequality".

What we have to do is flatly disregard everything the Fed does and only briefly listen to what they say. We should properly view them as followers, not leaders.

The economy is trending in the way that it is trending, regardless of the Fed. They can perhaps tidy up the edges and provide a narrative for the economy, but the market is sovereign. Here is just one example of how the Fed isn't in control of the economy or inflation. I can give many more.

As you can see, the price of gold was already moving up before QE started in Nov 2008. Then it crashed while QE was going full blast! Shortly after that, during no QE, gold bottomed and began trending higher during Quantitative Tightening! Only after gold broke out did QE begin again. Finally, gold crashed prior to QE ending earlier this year.

Without my arrows, could you tell where QE started and stopped, or would you get it exactly backwards?

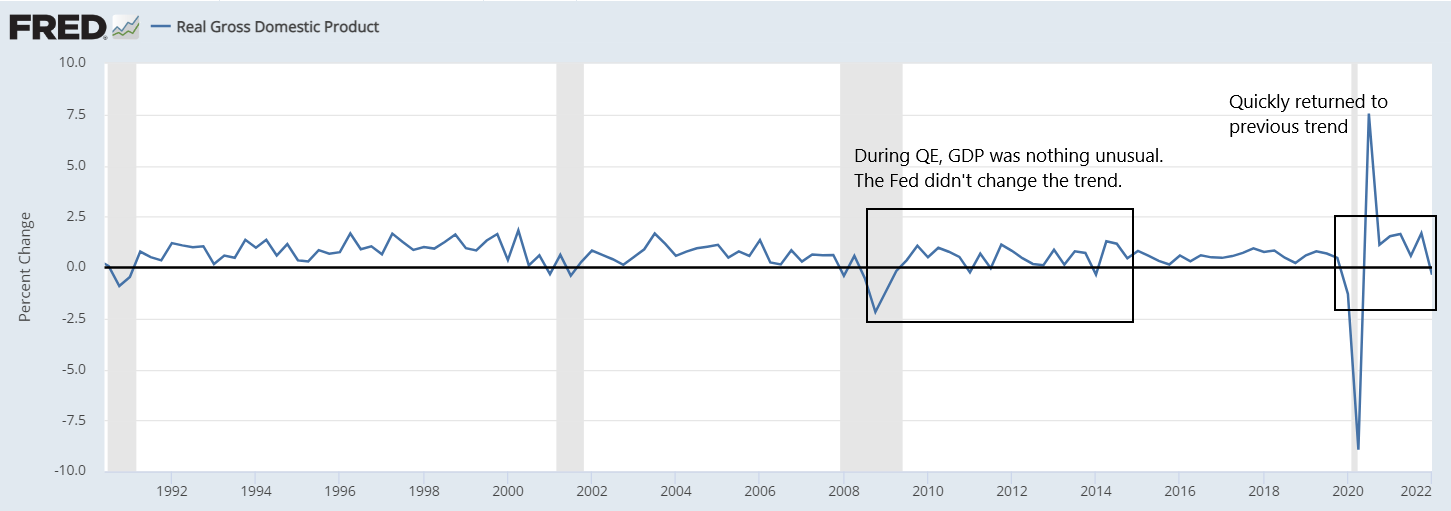

How about GDP? Did QE affect GDP in a noticeable way? I don't think so. It might have help the recoveries slightly, from a confidence perspective, but it did not lead to massive unusual periods of growth and expansion.

I know we are supposed to think QE and rate hikes and all of that make a meaningful impact, at least on stocks right? Not really here either. The S&P 500 is pretty much straight up during this era, no matter if QE was happening, or QT or rate hikes. Nothing mattered.

The financial press normies are starting to realize this. It is common today to hear people say things like, "QE is not inflationary, but QE + fiscal spending is." They are halfway there. Pretty soon the normies will come to realize that fiscal spending is pulling demand forward in time and leaving a landmine of low demand in the future. It's not money printing, it's manipulation, and ensures deflationary credit pressure will become more acute in the near future.

In other words, the affects of fiscal spending by governments is... um... transitory. You can get a boost today, but a tightening of credit in the near future, so the net is zero. QE + fiscal is only a more potent psychological weapon. The mythological powers of QE seem confirmed by the temporary boost provided by fiscal, sacrificed from future demand.

Forget about the Fed's 50 bps hike. The economy is doing what it's doing regardless. We are rolling into recession, if we are not already there. US GDP growth was negative in Q1, and the global economy is going to fall off a cliff. China is also in recession, Europe is at unofficial war with their supplier. It's not looking good.

I've been talking about this for a very long time, the Fed has nothing to do with it.

The Fed will continue their theatrical hiking for another month or two, but the actual economy will force a narrative reversal.

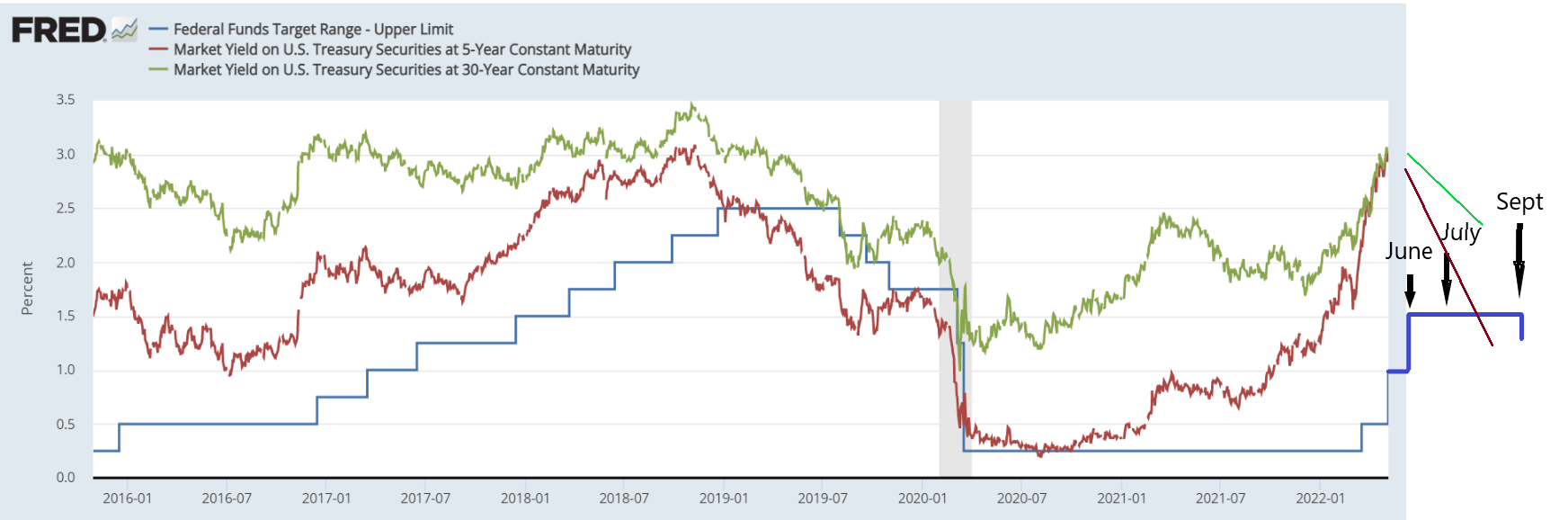

My prediction at this time, is the Fed will hike another 50 bps in June and then pause in July. They do not have another meeting after that until September, and since they drink their own koolaid, the Fed won't want to risk "doing too much" before that long break. Then by the September meeting, CPI will have come down and it will be obvious the narrative needs to change, so they lower rates 25 bps (there is a always stress at the end of Q3 as well).

The above chart is a bit sloppy but you get it. Interest rates will start falling soon, perhaps before June's FOMC. Not because the Fed did anything, but because the Fed's narrative can no longer put off the reality of recession.

Does QE Affect Bitcoin?

Like the chart of gold in the first section above, I plot QE during the bitcoin era below. Bitcoin began trading after the US era of QE started in 2008. After QE ended in 2014, Bitcoin bottomed, $200-400, and then rallied 6000% in the absence of QE.

QT did seem to have some effect on the price of bitcoin, but if we measure from the top in Dec 2017 to the price at the end of QT in Sept 2019, it only fell 28% (not measured on the chart because it made the chart too busy).

My conclusion is that QE, QT and rate hikes do not materially affect bitcoin. Bitcoin is much more linked to its technology adoption curve and financial conditions in the market.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in