What Should One Expect to Find in an Inflationary Environment?

Increases in the price of goods and services can emanate from a number of sources. Sources include increases in the money supply, supply shortages, increases in shipping/transportation costs, or increases in taxation and regulation. But for some reason increases in the money supply seem to draw the most attention from everyone ranging from gold bugs to the financial media. According to folks, whenever asset bubbles inflate or food prices go up the proximate cause is always "money printing." But how can we tell if it is indeed money printing that is at the root of the problem? Fortunately for us we have two strong companions in our search for the truth, namely historic rates of interest and behavioral dynamics.

In order to understand what to expect in an inflationary environment we will be using history as our guide. We will mainly be observing the historic relationship between currency debasement and the rate of interest during the modern era of fiat currencies. The inflationary episodes presented below are organized in chronological order and should give the reader clues as to what one would expect to find in an era of high inflation (note: I use the term inflation in the historical sense, meaning an increase in the supply of money). We begin with Bolshevik Russia.

Soviet Russia

"World War I and the Revolution of 1917 led to a period of unprecedented inflation. By 1917, the ruble had lost 75% of its 1913 exchange value; by 1920, it had lost 99.9% of its 1913 foreign-exchange value. The commodity price index rose 5800% between 1913 and 1918 and rose 4.9 million% between 1913 and 1921."

-A History of Interest Rates, page 598

One of the important hyperinflationary episodes that has been largely forgotten was the Soviet hyperinflation that directly followed the Bolshevik Revolution. The example provided above might remind people of more modern episodes such as the experiences of both Zimbabwe and Venezuela. We know what was happening to the Soviet ruble during this time but how did interest rates respond? According to the text deposit rates at the Gosbank were as high as 72% in 1923, however the text also indicates that these rates were not indicative of supply and demand, instead being determined by Soviet commissars, and thus would have likely been much higher. On the lending side interest paid on loans exceeded 216% during the same year. Additionally, pawnshops could charge upto 120% for advances of credit. The aforementioned Soviet commissars controlled all aspects of banking during this period so black market rates were likely to be much higher than those stated above.

Weimar Germany

"The only thing to do with cash by that time (February 1922) was to turn it into something else as quickly as possible. To save was folly. Undoubtedly, however, as in Austria, there were many farmers who behaved outrageously. Dr. Schacht's account of the inflationary years recalled that farmers 'used their paper marks to purchase as quickly as possible all kinds of useful machinery and furniture-and many useless things as well. That was the period in which grand and upright pianos were to be found in the most unmusical households.'

-When Money Dies, page 109

From a behavioral point of view one of the things you would expect to see during a period of high to extreme inflation is for consumers to try and get rid of their rapidly depreciating currency as quickly as possible. During the years immediately following WWI this is exactly what you saw in Germany. Consumers would rush to purchase whatever they could the moment they were paid. In fact, the situation got so bad that producers and retailers couldn't, and didn't want to, part with their wares and responded by limiting the number of hours that their doors were open otherwise their inventory would be quickly cleaned out and the shopkeepers would have been stuck with the rapidly depreciating German mark. Additionally, loans in excess of 10,000% were recorded in Germany during this period but due to the chaos of the hyperinflation, the occupation by the French of the Ruhr, and political extremism true black market rates could have been much higher.

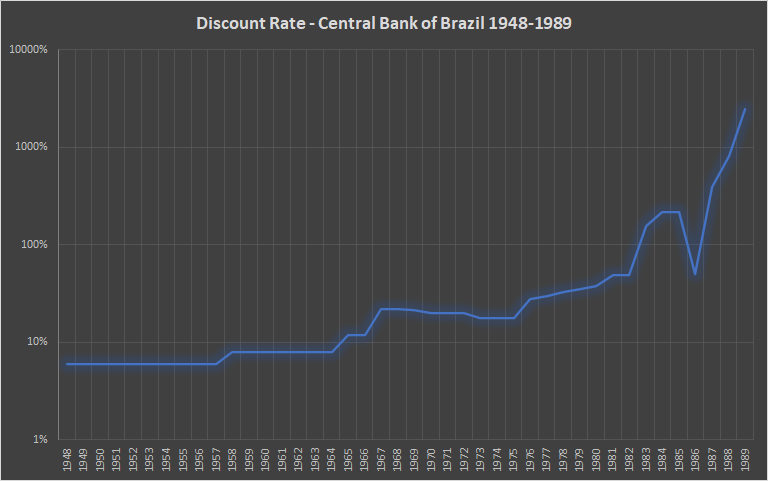

Brazil

The discount rate for the Bank of Brazil between 1948 and 1989 is provided above. Due to the volatility in interest rates during the period in question the chart is set to log scale. Following the military coup in 1964 the Brazilian government began the process of debasing the nation's currency, the Cruzeiro, in order to combat the various crises that occurred over this period such as the 1979 Oil Crisis. The currency itself went through 3 iterations in total before finally collapsing in 1993 due to hyperinflation. We can clearly see from the chart above that interest rates went parabolic just before the final implosion of the Cruzeiro, therefore, there is clear cause and effect relationship between the money printing taking place and the rate of interest. When money is printed, the rate of interest is shown to increase as a consequence. We see this type of behavior time and again.

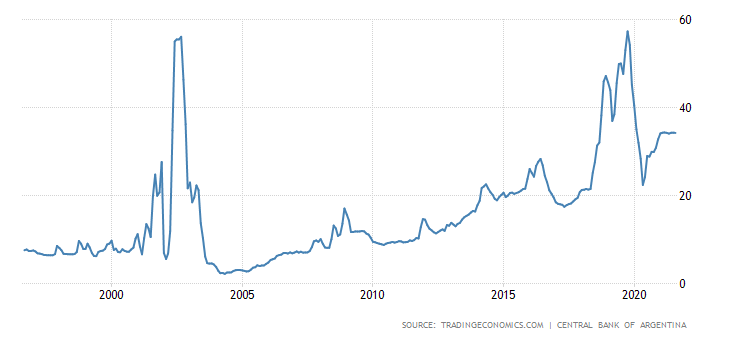

Argentina

Argentina's struggles with inflation are well known. The two main inflationary episodes of the last 20 years coincided with the Argentine Great Depression of 1998-2002 and the Argentine Monetary Crisis of 2018. During the peak of both crises interest rates skyrocketed in response to the depreciating value of the peso. The chart above shows the rates of interest that banks have been paying their depositors over the last 25 years. At the time of writing, September 4, depositors are earning 34% interest on their deposits again illustrating that periods of great inflation lead to large increases in the rate of interest.

So Are we Living in an Era of High Inflation?

Time and again we see episodes of currency debasement followed by ever increasing rates of interest. The quotes and charts from the section above provide consistent evidence that high rates of inflation lead to higher and higher rates of interest. Furthermore, from a behavioral perspective, we saw that during the Weimar hyperinflation, a well documented event, German citizens would always try their best to exchange the mark for almost anything that couldn't be conjured from thin air. While not shown in any charts provided it also bears mention that during highly inflationary episodes wages also tend to increase significantly in an effort to try and keep pace with the costs increases within the economy. We will conclude this article with a quote from Milton Friedman regarding the relationship between interest rates and monetary policy:

“As an empirical matter, low interest rates are a sign that monetary policy has been tight-in the sense that the quantity of money has grown slowly; high interest rates are a sign that monetary policy has been easy-in the sense that the quantity of money has grown rapidly. The broadest facts of experience run in precisely the opposite direction from that which the financial community and academic economists have all generally taken for granted.”

There you have it. Periods of high inflation are always quickly joined by increases in the rate of interest. If things get really out of hand then people will rush as quickly as possible to purchase anything that is finite in nature to be utilized as a store of value.

Even though the differences between an inflationary and deflationary environment may be somewhat intuitive at this point, we will still be using our next article to explore the attributes one might find in a disinflationary/deflationary environment.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in