Yield Curve Comparison in Recessions

In this post, I want to compare and contrast the behavior of the US Treasury yield curve during the Great Financial Crisis, the lead up to the 2020, and currently. Then, see if we can use this to help anticipate the next 6-12 months of Fed policy and the economy.

The tenors I've selected are the 4-week, 3-month, 2-year, 5-year, 10-year and 30-year.

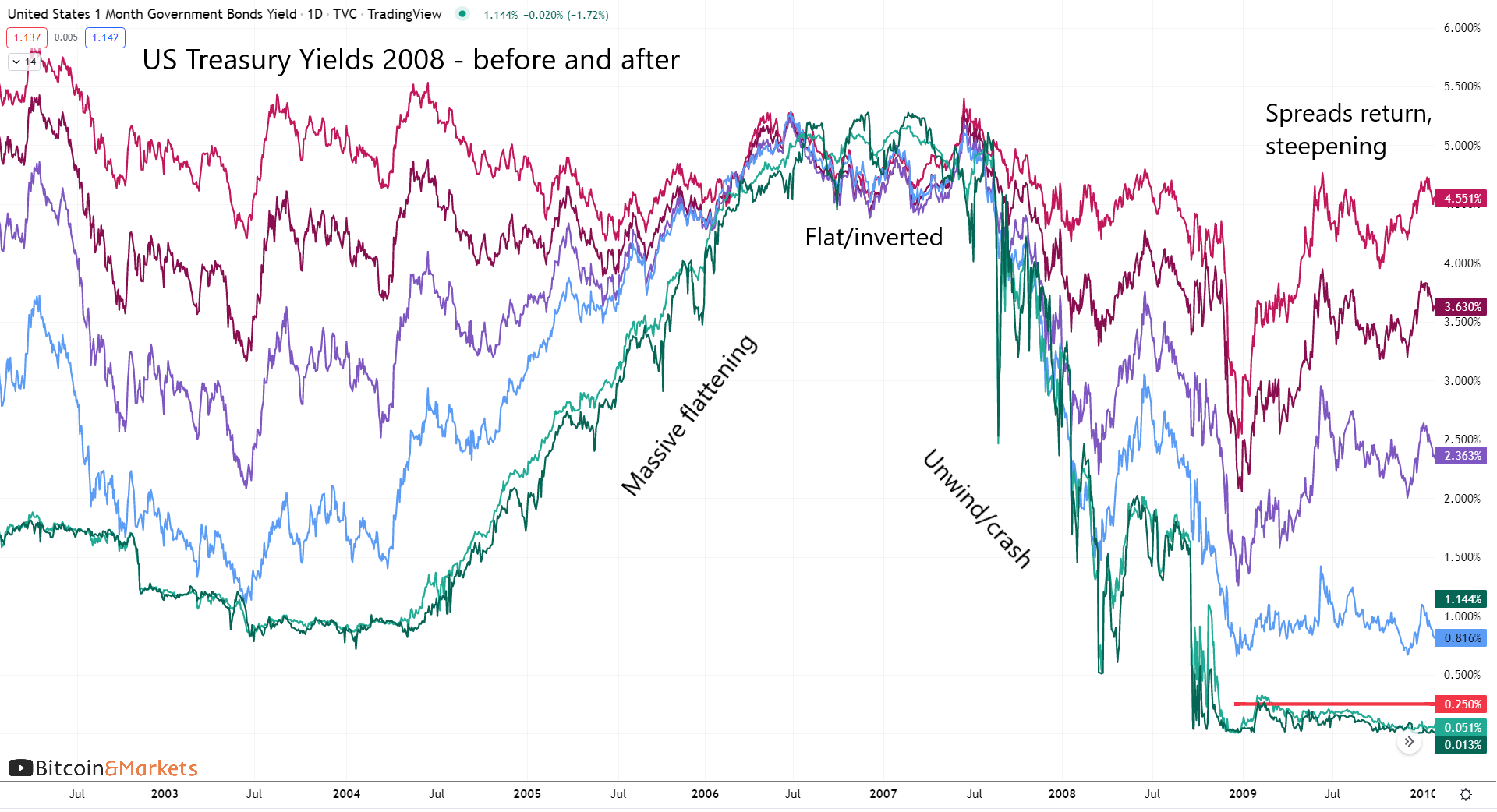

Great Financial Crisis

The build up to 2008 was very obvious in hindsight. The Fed was raising rates from 2004 and the short-end of the curve followed along, dipping briefly round the end of quarters. However, while the short-end was playing nice, the long-end wasn't budging and, in fact, dropped slightly. This created a very evident flattening of the curve, with an inversion happening in early-2006 and staying flat/inverted for over a year.

This situation quickly unwound throughout 2008, resulting in a steepening of the curve in reflation.

Globally Synchronized Growth

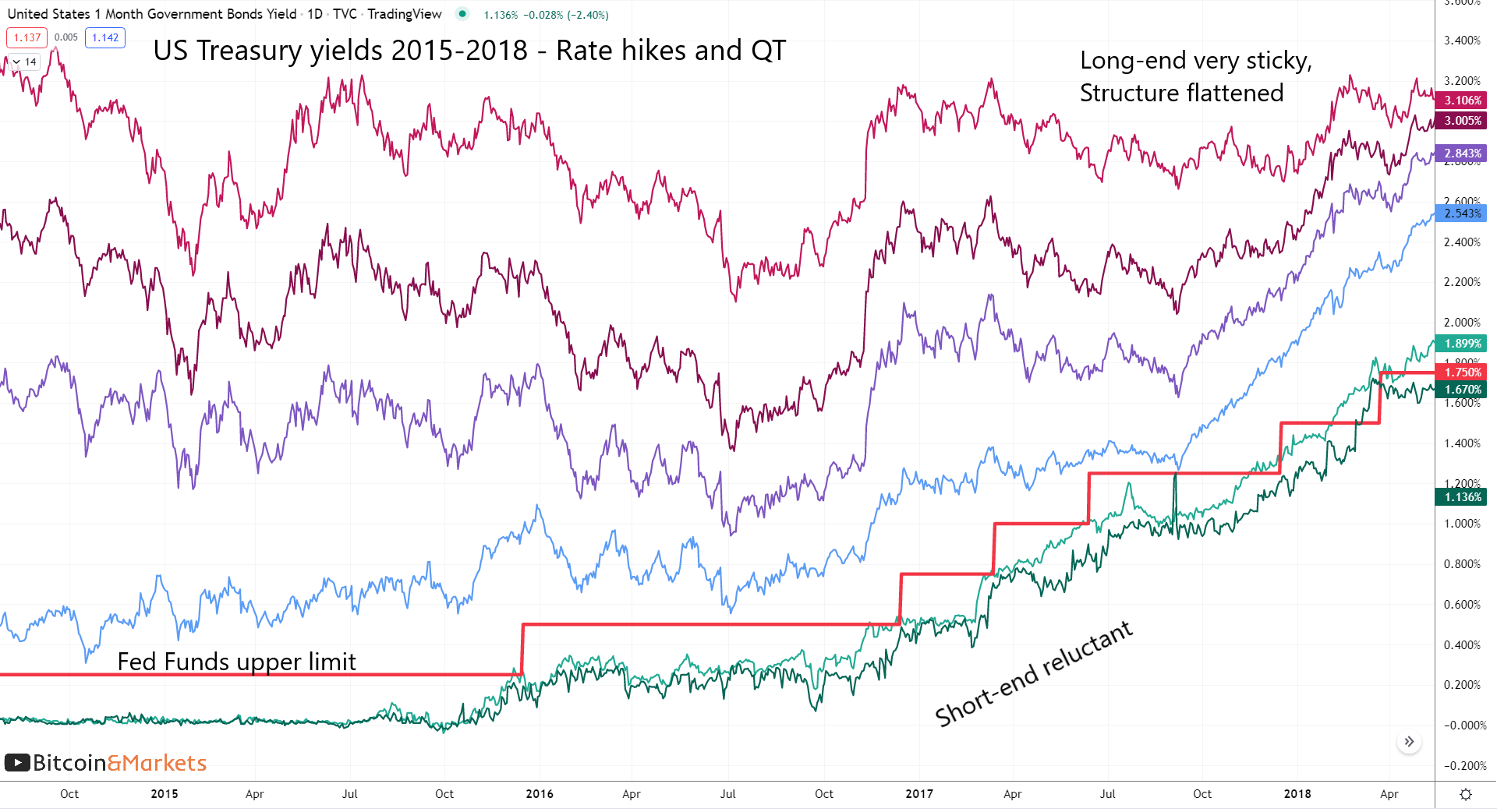

Now, let's take a look at the period where the Fed was raising rates, ever so gingerly, in 2016 and 2017.

What we can see here is once again, the short-end somewhat reluctantly obeying the Fed, while the long-end only bought it for a brief period at the end of 2016. Pretty much the whole time, the yield curve was flattening.

Moving into 2018, the curve from the 2Y out, started to very noticeably flatten, but never inverted. At the same time, the short-end was beginning to anticipate the Fed, or we could say, the short-end started to naturally close the spread and flatten.

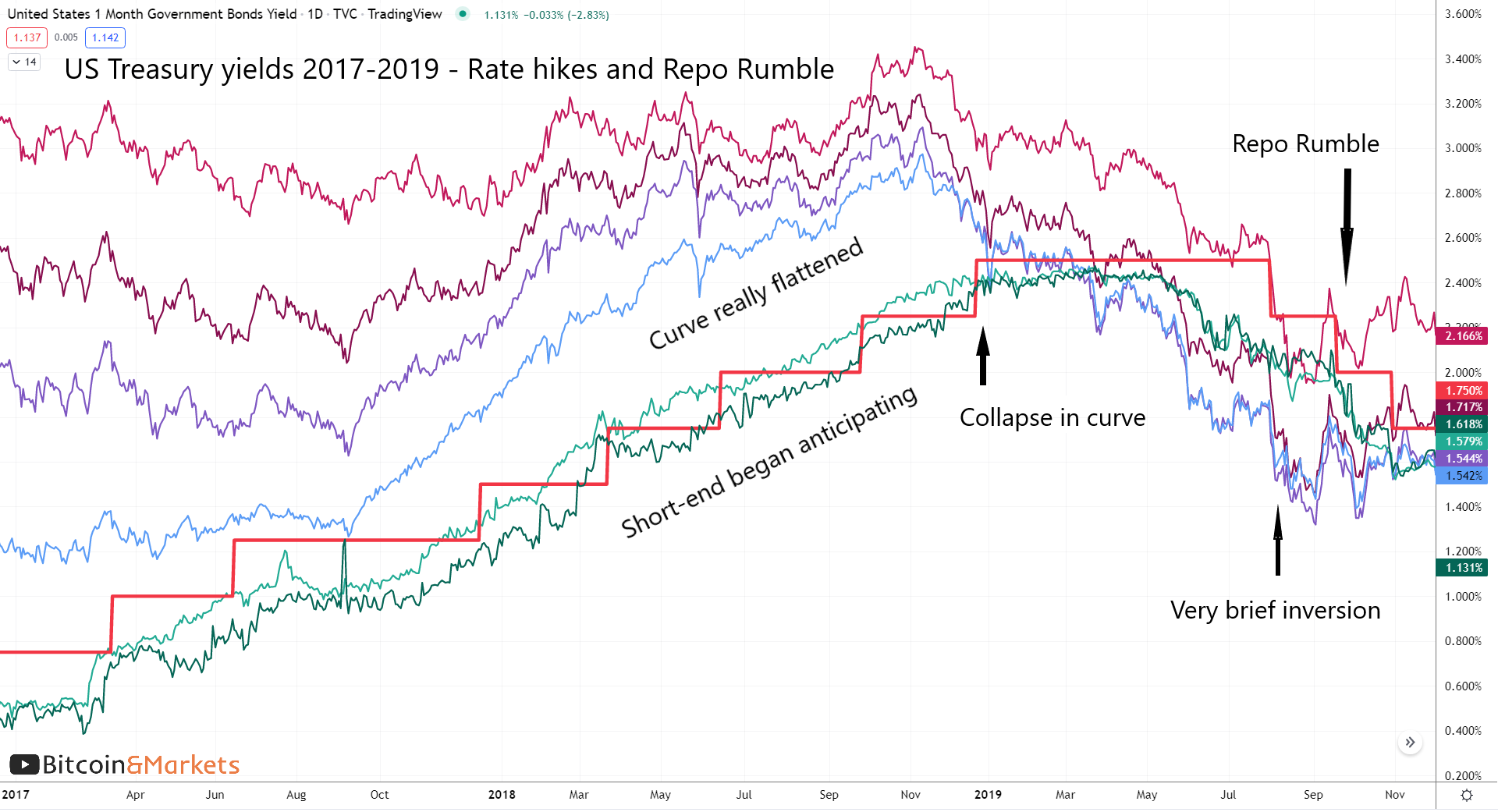

Powell Pivot in 2019

At the end of 2018 is when things really started to heat up. The long-end crashed down to the rising short-end, right into the Fed's policy rate at the time. These things converged in Jan 2019, and it was at that meeting that the Fed paused its rate hikes.

Most people say the Fed is in control of interest rates, but this episode conclusively displays the opposite. Interest rates were crashing because of the global economic environment. If the Fed were to continue to raise rates, they would have been totally exposed as not in control, so they paused.

After 6 months, with rates continuing to fall, the Fed reversed course and started cutting, right as the curve inverted for the first time in this episode. Two months later, the Repo Rumble happened. We can plainly see that the repo rumble did not come out of no where. Stress in the system was obvious.

Current Situation with Yield Curve

These first two episodes were not the same. In the GFC, yields inverted early on, and the curve stayed flat, hanging in the air for a whole year. In 2018, yields never inverted but marched downward consistently for 1 year, from the top all the way to the Repo Rumble.

If these first two episodes were different we can expect that this current episode will also be different.

The below chart starts with the corona crash in March 2020. After the initial response we can see the curve steepening into 2021, as the economy hopes for the best.

After the March 2021 peak the curve started flattening again, despite the Fed introducing a floor for their reverse repo facility. What we see next is kind of amazing. The Fed hard pivots to tightening, and from September 2021 to March 2022, the curve flattens at an amazing rate. Nothing in the last two recessions compares to the speed of this flattening.

This time, instead of the short-end being reluctant and following the policy rate higher, it started to rise rapidly similar to the end of the GFC process. The long-end rose as well, but the curve drastically flattened as it rose, inverting very early on in March 2022.

Conclusion

The main reason the long-end is rising and hasn't already collapsed onto the short-end is because of the state of the global economy. The only thing crashing faster than the US economy is every other economy. China and Japan are selling their US Treasuries at an elevated rate in order to raise cash to keep their economies somewhat afloat (not working that well, but the situation is forcing them to sell).

Rising short-term rates and RRP, put pressure on low rate economies where their government bonds yield below RRP. Foreigners sell their Treasuries to get cash, this pushes up US long-term rates. The selling stops when all the Treasuries are held in solvent hands. That's when we get a sudden crash in yields, and the financial crisis becomes very real.

I see two possibilities modeled off these last two recessions. 1) Yields crash like 2007-2008 due to an acute liquidity freeze. 2) Rates gently come down reflecting worsening global economic conditions as in 2019 (not including corona crash). I heavily lean towards the former. We are likely headed toward a 2008-type liquidity event.

What the Fed cannot do is risk the entire financial system. They are posturing and taking advantage of the room under long-term rates to hike. But the market will force their hand with a liquidity event. CPI inflation is not really a concern, since it is almost wholly due to supply shocks and the Fed can't do anything about that, other than throw the President under the bus.

If Powell anticipated the 2019 trouble a little bit, will he do it again with a pause in rate hikes. Is it likely that he speeds into an brick wall? I don't think so. I think he is ready to pivot and has shown he is capable of it.

Therefore, I expect an anticipatory pause. I thought it would be at the July meeting, but that might be too short of the timeline. I'm now leaning toward the September meeting. This also happens to the be the end of Q3 which is traditionally the most volatile quarter end.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in