Yield Curve Control Skepticism

Yield Curve Control (YCC) is where the Federal Reserve or central bank uses Quantitative Easing (government bond purchases) to target a specific interest rate somewhere in the yield curve other than their benchmark rate. For example, Australia is targeting 0.1% on their 3-year government bond rate. They accomplish this by being the buyer of last resort. If the market fails to provide enough demand to keep yields that low, the central bank will come in and buy as many 3-year bonds as necessary to peg the rate at the desired level. Instead of a set amount of bond purchases every month in QE, it becomes a blank check, they will buy whatever amount is necessary.

Many people consider YCC inevitable in the US because they believe the Fed controls interest rates and The-Powers-That-Be cannot afford to let yields go up, else they risk losing power as the over-leveraged global economy goes bust.

This post is going to examine YCC with a skeptical lens. Is it going to happen in the US, and if so, what will it look like? YCC is already taking place in other economies like Japan and Australia, but it is not a given that it can happen in the US, the home the global reserve currency?

Central Bank Policy Tools

The Federal Reserve has several monetary policy tools. It uses these tools in certain proportions supposedly to control and centrally plan the economy. They include, setting the benchmark interest rate, in the US called the Fed Funds rate and Quantitative Easing (QE) AKA large-scale asset purchases, where the Fed buys US Treasuries or Mortgage-backed Securities (MBS) from banks in exchange for reserves held at the Fed.

Another tool they have is forward guidance, something I call "expectation management". The theory behind forward guidance is the Fed can telegraph its future actions to mold market behavior based on people's expectations.

The Fed supposedly uses these monetary policy tools to provide stability to the economy, specifically their mandate is to maintain maximum employment and stable prices. However, what we get is one existential crisis after another. No discussion of QE and forward guidance should pass without emphatically stressing these policy tools have failed miserably. Perhaps, one would respond to that, that their policy tools are used to fight unforeseen market events like COVID by stimulating the economy. Okay, apart from not being the stated reason from the Fed, that hasn't been very successful either.

All of the Fed's actions have been utter failures to revitalize the economy or push inflation past 2% (and it's not just the Fed, these same policy tools in other major economies have failed, too, like Japan and Europe). The Fed thus far, since 2008, has been completely impotent. They have managed to help the banks mathematically avoid insolvency, but haven't actually fixed a single thing. Indeed, we could say they have made it impossible for the real economy to heal itself.

With this understanding, we now must look at YCC.

Yield Curve Control

The Fed typically influences interest rates by setting the shortest term rate, the rate at the overnight window, or the Fed Funds Rate. They can lower or raise this rate in an attempt to affect the rest of the curve. The way interest rates are transmitted from the short end of the curve (overnight) to the long end (10-30 year bonds) is somewhat opaque but large factors are supply and demand and the banks' need for marginally higher long rates as a source of profit.

Banks "borrow short" at low rates and lend long at higher rates. Banks will set their rates at a competitive market level that enables them to stay in business.

Example: Bank of America will access capital at the short-term rate of 25 bps (0.25%) and lend it out at 5% in mortgages or business loans. This spread is necessary and natural, and not a conspiracy to fleece the people. BoA then rolls over their short-term funding nightly, weekly or quarterly, whatever they need, but always at lower rates than they charge for loans. If the Fed raises the shortest term rate to 1%, that will tend to force BoA to move their longer term rates up to 6% in our example to maintain the minimum margin to stay in business.

During "normal times" this action will result in a nice positive sloping yield curve.

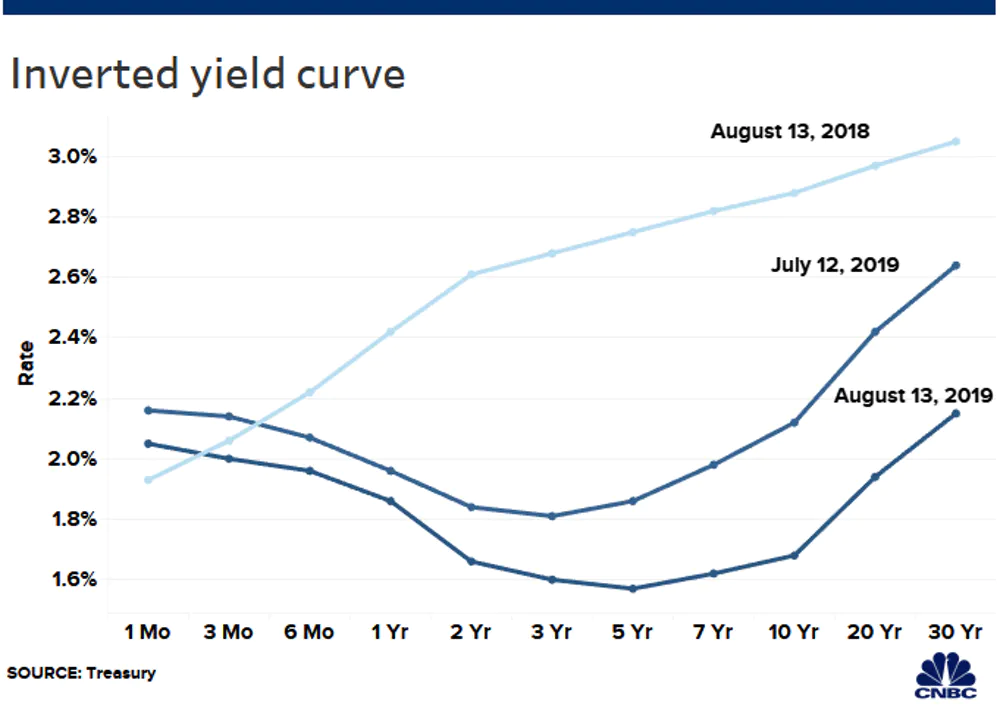

However, there can be periods of "inversion" where longer rates drop below shorter rates. The most important comparison in this regard is the 2y/10y spread. Every time the 10-year yield has dropped below the 2-year yield it was followed by a recession within 18 months.

Side note: You can see in the chart immediately above, the yield curve had inverted prior to 2020's Chinese virus crash. The recession was already in the cards. It was very convenient that something came along that the monetary authorities could use to hide their failure once again.

Yield Curve Control is supposed to work by the central bank buying bonds further to the right on the yield curve, with the intention on capping certain rates, or even pushing them down. Academic economists at the Fed think this will simulate the economy, because lower rates means more borrowing, right? Nope. Lower rates signal tight money conditions and something wrong in the economy. In other words, it is a market signal that something is off about supply and demand for credit.

YCC is assumed to have two other "benefits": 1) cash is forced out into the economy and that is expected to 2) stimulate the economy with inflation. Inflation will naturally push interest rates higher, because who would hold a 5-year bond yielding 1% if inflation was 5%? Lots and lots of assumptions here. Central bankers think if they can cap rates on the short end of the curve, say 0-2 years maturities, that will force up the long end due to inflation, resulting in a nice healthy positive sloping yield curve.

Problems with Yield Curve Control

I take issue with YCC for different reasons than most economists. The textbook worries like inflation are not found in reality, just look to Japan or Europe, where they actively do YCC yet continue to struggle with deflationary forces. The textbook is wrong because it is based on several wrong assumptions I address below.

Assumption #1: Yield Curve Control is Inflationary

I've written about this elsewhere on this blog, but we need to address this up front when talking about YCC. The central banks buys assets the same way in YCC as in QE, and we have seen that QE is not inflationary. Reserves held at the Fed are not money, they are inert balances used as a tool to doctor the balance sheets of banks.

We are told by inflationists that the central bank uses "cash" to buy assets like US Treasuries, both in QE and YCC, but that is not the case. The reserves at the Fed are not cash, they are just inert balances on the Fed's balance sheet. These inert balances might look like a duck but they definitely do NOT quack like a duck or walk like a duck.

What we do know is that assets taken out of the productive free market and onto the central bank's balance sheet lose all economic benefit. When Treasuries are out in the economy they can stand as collateral, facilitating money movements and healthy functioning of the current financial system, they grease the skids as it were. However, when sitting on the Fed's balance sheet, all economic value is lost and the gears of the economy begin to squeak.

Therefore, instead of inflation we should expect YCC to add deflationary pressure to the economy as it withdrawals the lubrication from the financial system.

Assumption #2: Low Interest Rates Stimulate the Economy

This is one of the more pernicious myths in modern monetary economics. It is the central idea behind why the Fed moves the Fed Funds Rate around and participates in Quantitative Easing (QE). However, this is the Interest Rate Fallacy. Jeff Snider puts it like this:

When money is plentiful, interest rates will be high not low; and when money is restricted, interest rates will be low not high. [...]

When nominal profits are expected to be robust, holders of money must be compensated for lending it out by higher interest rates. Thus, the same holds for inflationary circumstances, where nominal profits follow the rate of consumer prices. During the Great Inflation, interest rates weren’t low at all, they were through the roof well into double digits and higher by 1980. At the opposite end in the Great Depression, interest rates were low and stayed there because, as Wicksell wrote, the rate of profit was low and was expected to be low well into the future. High quality borrowers were given as much money as they could want while the rest of the economy was deprived of funds; liquidity and safety being the only preferences in what sounds entirely familiar.

Good times lead to high profits and high interest rates, bad times lead to low profits and low interest rates. Therefore, low rates tells us we are in bad times. They do not stimulate borrowing and economic activity, they actually do the opposite!

Capping rates with YCC will not stimulate the economy. As we've seen over the last decade, low rates signal money tightness. Dynamic healthy activity is hampered by market interference and the withdrawal of high quality collateral in the form of Treasuries. QE and YCC is economic bloodletting.

Assumption #3: Treasuries Are Held Only For Fixed Income

This assumption is less explicit, but does affect people's ability to understand the workings of the global financial system. The dogmatic view of why people own bonds is for interest income. While true, that is only a small fraction of the total usefulness of a US Treasury Security.

For one, owning Treasuries can also fulfill regulatory requirements. Banks must hold a specific level of Tier 1 capital which is cash or cash equivalents like a UST. Banks and large entities also use USTs to access capital markets through repo. Or to lend the UST for others to use in repo creating a chain of liability and rehypothecation. The web of ownership in funding markets is extremely complex and liquid (in good times).

Money needs to flow smoothly through this complex web of the financial system. The way it does that is with collateral; cash flows one way, cash equivalents the other. But ask yourself, without the collateral, money can't move, so should the collateral be considered a property of the money itself, like in bitcoin the block chain is part of the whole? USTs are part of what the market uses as money. If money doesn't function the same without the collateral, in other words the collateral is absolutely necessary for money to work, isn't the collateral part of the definition of the money? I think it is. When central banks take collateral out of the system, they are in effect taking money out of the system.

Treasuries therefore, while they are held by some as part of a fixed income investment, it is a very small percentage of their overall use as part of a cash position within the financial plumbing.

What is the Outcome of Yield Curve Control?

There is no question that the central banks can do YCC by buying long dated bonds. It happens in many countries today. But it is a different question whether or not it will result in the aims the central banks proclaim. Remember, QE is also happening, but it has not resulted in what the central banks wanted - specifically getting recovery and inflation (credit creation) off the floor.

Forward guidance happens, too. Powell famously went on 60 Minutes and told the public that they electronically print money, which if true would have resulted in unmissable, undebatable, massive inflation. Again, this hasn't manifested in the real economy, it has failed to revitalize anything. Current global conditions once again are slumping and threatening deflation (!).

YCC will result in the same failure. Sure, they will be able to keep certain targeted rates, e.g. the US 2-year Treasury under 0.25% (it would not be that hard considering it is 0.16% today), but it will not have the desired effect. It will depress potential growth further, exacerbate monetary tightness, and will chase people even faster into alternative assets with promises of growth unburdened by massive debt.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in