Bitcoin Seasonal Hash Rate

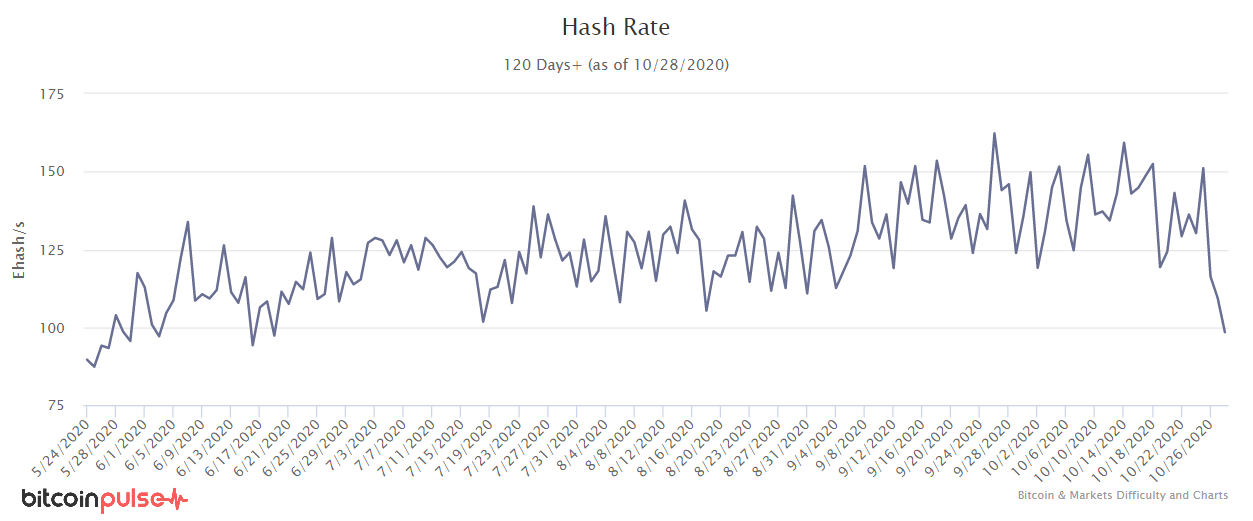

There has been a dramatic decline in the Bitcoin hash rate over the last week but should we be concerned? Is it the network weak or under attack of some sort? And how will it affect the price? Let's quickly describe mining, what happened this last week, and see if there's any other data we can use to evaluate the situation.

Bitcoin mining has become very professional over the years. Today, it's not unheard of for a new entrant to the industry to raise $100 million of capital or more to get started. The industry has several types of costs, chips and mining equipment, rent, internet connection, labor and electricity. There are many things that go into running a successful bitcoin mining operation at scale, but probably the most important is the last cost listed, electricity.

Bitcoin mining is an energy intensive process. Purpose built, next generation chips are used to run through quadrillions of calculations per second. What they are trying to do is guess a very difficult random number. Short-cuts have been eliminated by designed. The only option miners have is to brute force the guessing. More guesses require more chips, which need more cooling, more skilled operators, and everything requiring more energy.

Bitcoin mining is a hog when it comes to power. In fact, that's one of the biggest criticisms levied against it - "mining uses too much energy." What the critics don't get is bitcoin mining replaces the need for many industries. No longer do we need much of the expensive, fee driven, and corrupt financial industry for instance.

Bitcoin also enables the capture of excess energy. This is the energy that must be produced by a power plant to keep their systems running efficiently during off peak times. For example, a 1000 MW power plant operates most efficiently at or near its maximum output. If demand falls significantly in off peak times, the plant often continues to produce at peak efficiency and simply wastes that energy because it comes out to be cheaper for them. Bitcoin mining offers a consistent and productive use of that waste energy.

Lastly, Bitcoin mining can use waste energy right from the ground. Vent gases from the oil industry, which otherwise are dangerously released into the atmosphere, are being captured and burned. The reason this couldn't happen before Bitcoin is because power transportation is expensive. Bitcoin can harness that energy in remote places to productive use, all miners need is an internet connection. Bitcoin mining competes on the market for the energy and in doing so creates competitive forces that make all energy consumers more efficient.

Why is Bitcoin Hash Rate Dropping?

The bitcoin mining speed is called hash rate because the calculations it makes are called hashes. The hash rate is naturally variable. Perhaps a storm takes a mining farm offline for 12 hours, or a rack full of machines needs to be replaced, or you are moving to a new location with better electricity costs. There are any number of reasons that hash rate can be temporarily taken offline and new hash rate is constantly being added as well.

Even with all the variation in the hash rate it almost always trends up. In the early days of bitcoin it was much faster but, even today, hash rate in 2020 increased more than 60% until this week's decline.

The decline of roughly 1/3rd in the hash rate started to create a buzz around the bitcoin ecosystem that it could be an attack on the network. A 51% Attack is when an attacker or group of attackers attain a majority of the hash rate and use to maliciously - i.e. stop transactions from getting through on the network. This attack can't harm bitcoin other than simply not letting people transact while the attack is happening, which is very expensive. If a 51% Attack has a majority well-over 50%, say 60% of hash rate, the attacker could theoretically reverse his/her own past transactions and rewrite a few minutes worth of blocks.

The rumor of an attack quickly abated when a far more simple explanation was offered by mining experts. October 25th was the official end of rainy season electricity rates in China's Sichuan province.

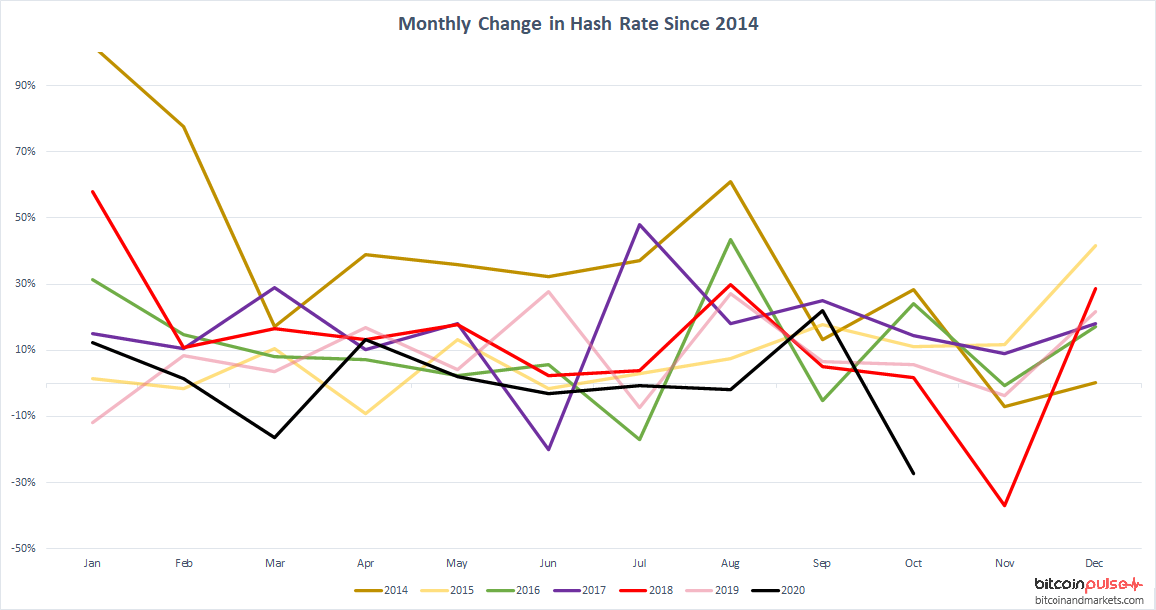

This event happens every year but has never affected the hash rate as quickly and dramatically as it did this year. Typically, hash rate peaks in August and September, after which point hash rate is more stable or even declines slightly. This year, however, will be the steepest October decline since 2009 (bitcoin's first year in existence, when mining could still be done on a laptop).

In the chart below, the first few years of hash rate data have been taken out for the sake of clarity. Instead, we use the monthly rate-of-change data for the last 6 years, starting in 2014. We can observe the increase in August and the trough in November very clearly for each year represented in our chart.

Why Was Bitcoin Mining So Strongly Affected This Year?

We believe there are two different forces that led to this year's quick decline in hash rate. First, the bitcoin mining industry is getting more professional every year. Where mining operations are affected by the rainy season energy rates, they have become more expert in forecasting their costs and have streamlined the strategic movement of their facilities. This rainy season was particularly bad, with record flooding up and down the Yangtze, and perhaps the miners were ready to get out of there ASAP. They can turn off exactly when the costs change, move to a different province in China, and be up and running in a week's time. Of course, we'll see how predictive this theory is in the coming weeks.

Second, the recent run up in price could be a factor as well. In past years, it is hypothesized that miners spread the movement of their operations out over several weeks, as to not be completely offline at any one time. However, with the halving this year, and the price rallying over 250% from March lows, miners probably wanted to mine as many coins as they could before a market correction.

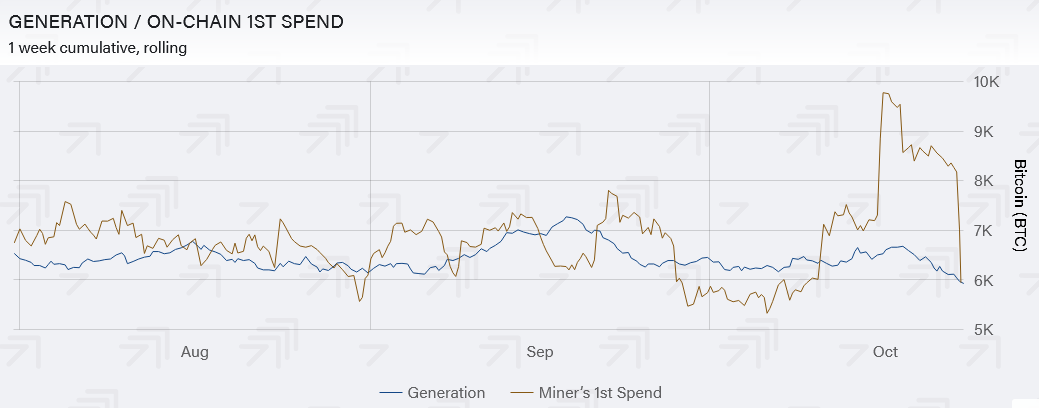

There is some evidence for this latter point as pertains to the idea that miners were trying to reap as much profit out of the rainy season as possible at high bitcoin prices. On the Fundamentals Report #112 last week, we included this graph of miner First Spends. It is a 7-day rolling average but plainly shows a large increase in miners selling their mined coins in October, taking advantage of the higher bitcoin price, just prior to the end of rainy season rates and moving their equipment.

What Does This Mean for Price?

Temporary slow downs in bitcoin mining have a positive impact on price. Blocks are found more slowly, meaning fewer transactions per second are able to be confirmed. Bitcoins then move more slowly throughout the world. If demand is constant, and fewer bitcoins can move to meet that demand, price will increase.

There are also fewer bitcoins being mined per day when blocks are slower. Bitcoin is designed to average one block every 10 minutes, or 144 blocks per day. With a block reward of 6.25 bitcoins per block, that comes to 900 bitcoins a day on average come onto the market to meet demand. However, if blocks are 10% slower, that means 10% fewer new coins will be mined to meet demand, 810 instead of 900. That doesn't sound like a lot but at the current market price of $13,000 that's $1,170,000 fewer bitcoins per day being mined and that figure can add up over time.

If the slow down in hash rate is not seen by the market as temporary, it could lead to a more sustained downward movement in price as the market loses confidence in the network itself.

We believe the recent price movement is, in some part, due to this dynamic playing out right now. But it also marks a point where price could consolidate for a while before continuing up. Price rises increase the value of everyone's coins and that naturally leads to people taking profits. As always, the market is finding balance so the next few weeks could be a period of finding a new stable price level before pushing higher into year end.

In summary, bitcoin mining is still healthy and there are no signs of an attack on the network. Price movement is somewhat predictable in this case and gives us more information about possible future price movements. Hopefully, industry professionals learn from this experience and are able to apply those lessons learned to future operations.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in