Dollar Index DXY versus Broad Dollar: Death of the Euro

I've written about the different dollar indexes in this post. When looking at the dollar, it is important to remember what that index is measuring, and what differences between the two could be telling us.

Of course, that is a famous talking point of the inflationists. They'll say things like, "the dollar is only going up against other fiat currencies." I've talked and written a ton on why that is a false argument, but here, I feel like I'm kind of doing the same thing. The point of this post is to look at the differences between the DXY and the Broad Dollar Index to see if we can learn anything important.

I'm no slave to my strong dollar thesis. I arrived at it because that is where the data led me, and to toot my own horn a little, I was the first bitcoiner to call specifically for a strong dollar. Now, where I won't claim by any stretch I was the first person to call for a strong dollar for the reason I proposed, I learned a lot from Jeff Snider and Brent Johnson, but I think I was the most open-minded hardcore bitcoiner to synthesize this new data into my view of the market. And I was right.

They Miscalculated

Anyway, here we go. What has changed recently?

I don't have to tell you that there is this conflict happening over in Ukraine. In the build up to the conflict, there was a lot of discussion about how exposed Europe was to this kind of conflict. The West wanted to put sanctions are Russia earlier as deterrent, but concluded they'd be shooting themselves in the foot.

They knew it, and they know it now. They were hoping to impose much more damage on Russia, both economically, in domestic politics, and international politics. The West had hoped this would be a short war, or shortly turn against Russia and they'd sue for peace back with the original pre-February borders.

Well, what they expected early on is what happened. They were clouded by the false belief that their technocratic superiority would find a way. It hasn't. The sanctions have wrecked Europe, both their current economy and any immediate economic future. Europe has been turned into the beggar of the world now for energy.

Many people have expected the Euro to end in the next couple of decades, but this really sped things up. The sanctions changed the calculus for currencies.

Dollar Charts

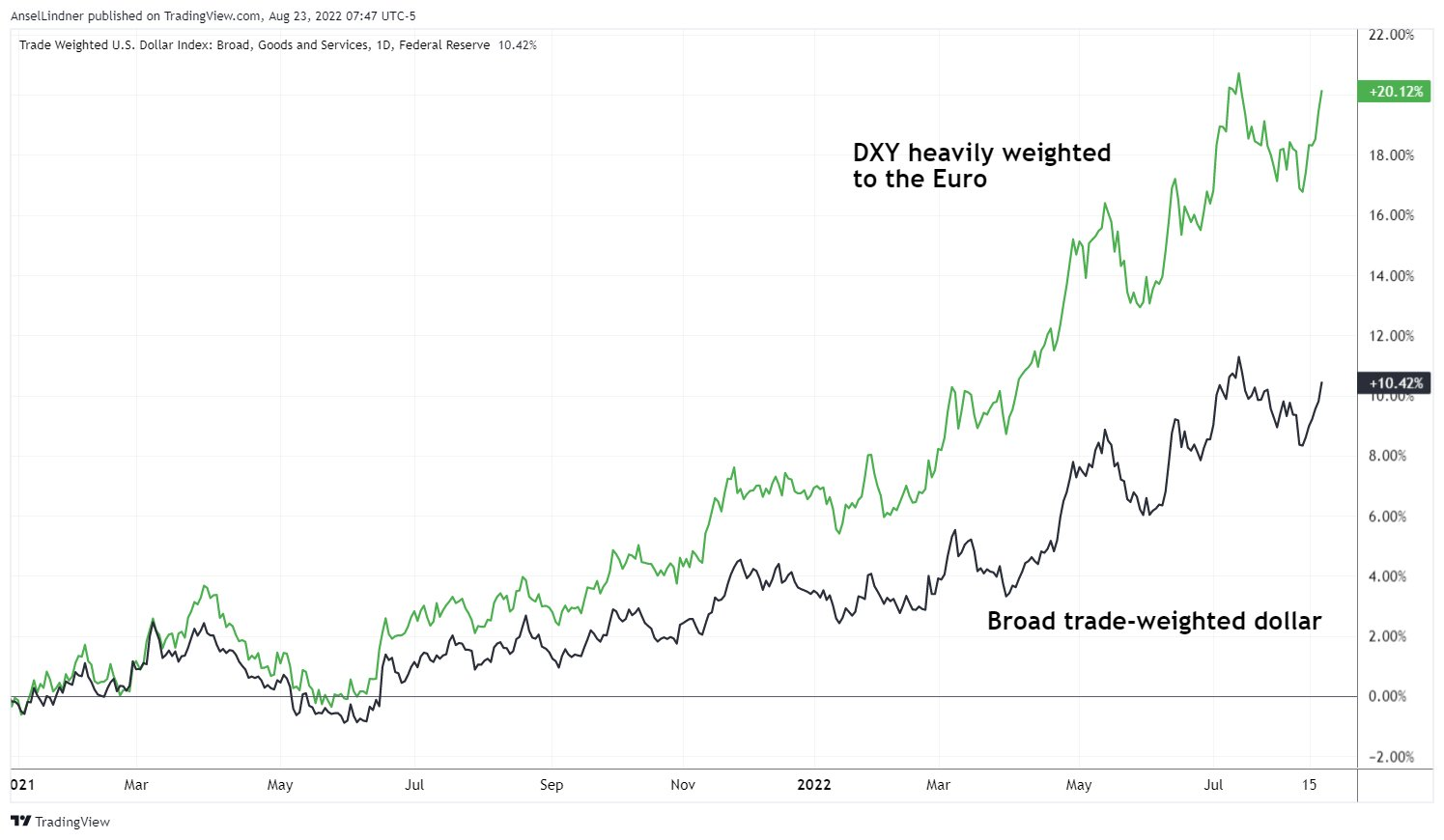

As you can see below, the broad trade-weighted dollar has not had the same rally as the DXY. The DXY was already ahead of the broad dollar prior to the conflict, but since March on this chart, you can see a rapid escalation.

Zooming out a little more...

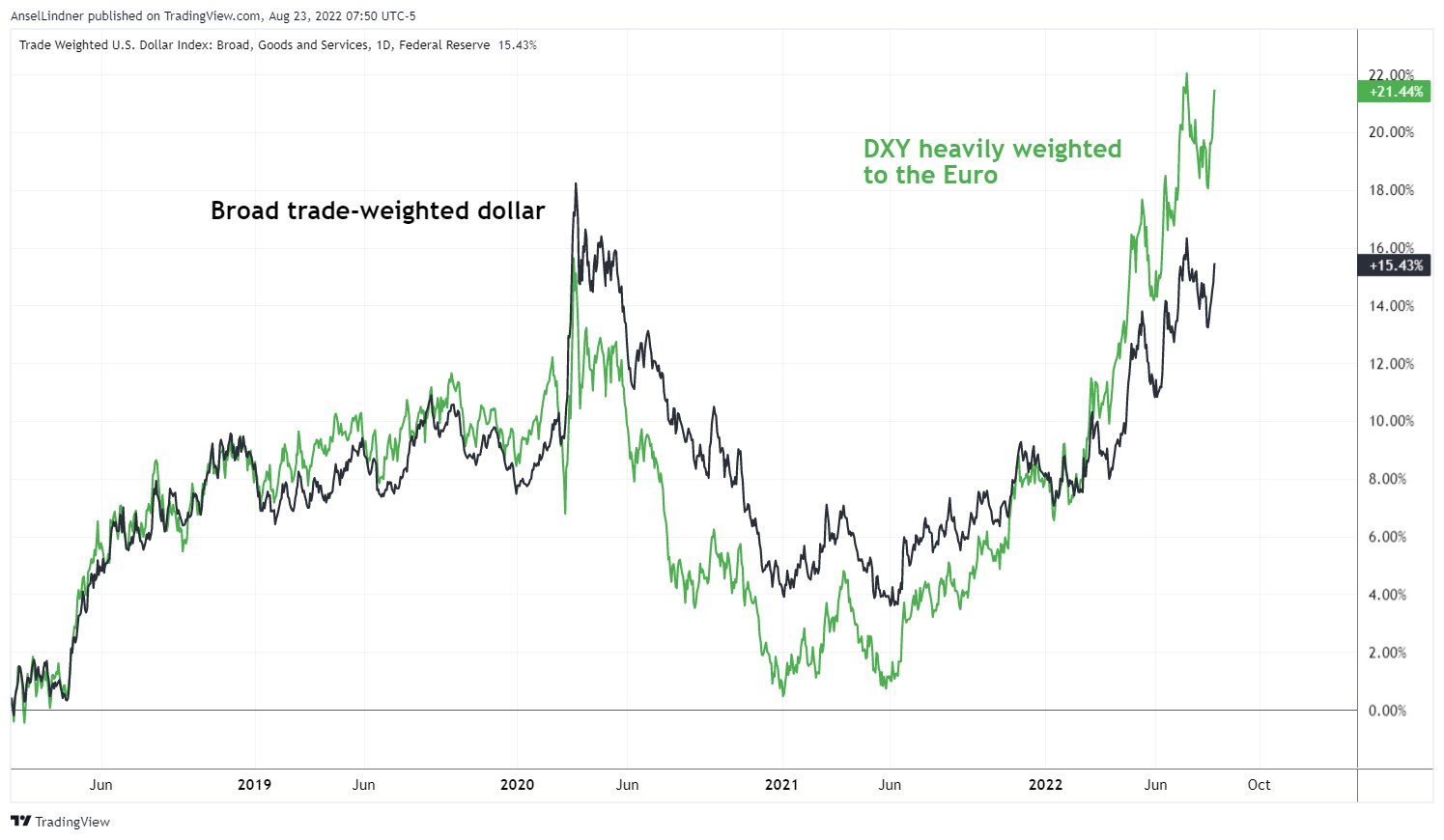

Here, I went back to the 2018 low in the dollar. Throughout 2018-2019, these two dollar indexes were relatively close. The big change happened in the Corona Crash. That is when the emerging markets, a part of the broad trade-weighted dollar index, collapsed much more versus the dollar than the Euro, Yen and Pound, the primary constituents of the DXY.

That makes sense, because is an acute crisis, the larger currencies will all get some bid relative to the smaller currencies. The DXY dropped more, but then, starting around June of 2021, the broad dollar received less of a bid, meaning emerging markets/China currencies were stronger versus the majors (Euro, Yen, Pound). Once again, we can really see the escalation earlier this year.

EURUSD and Gold Charts

If you've been following me for a while, you know I've been watching this red line on the EURUSD chart for a few years. Guess what month price broke through that multi-decade support line? That's right, March 2022.

I truly believe, we have entered a new phase for the Euro. Things have changed. When we get updated data on reserve currency percentages, the Euro is going to crash from ~22%, to maybe as low as 10%. The Euro is a dead man walking.

We can also take a look at the gold chart to see if the this is dollar strength issue or a Euro weakness issue. As you can see, nothing has drastically changed for the dollar versus gold. It hit a high recently (gold dropping to $1700), that is not unusual in the last few years.

Conclusion

The Euro is in a dire situation. The future of the currency, its parent central bank the ECB, and even the European project rest in the balance.

Many people who were late to the strong dollar party are now looking at the raging DXY as a sort of signal against the US economy and bitcoin. It is not. The rising DXY is a signal of a death in the index. The Euro is dying, so naturally the dollar will relatively gain.

They have forgot their own argument, that the DXY is only versus other currencies, and in this case versus only a very limited number (66% against the Euro). When commentators are showing the DXY and saying that the dollar is so dang strong, this will hurt bitcoin, are now overemphasizing the strength of the dollar, where they were underemphasizing it before.

/End of rant

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in