What is going on with Reverse Repos?

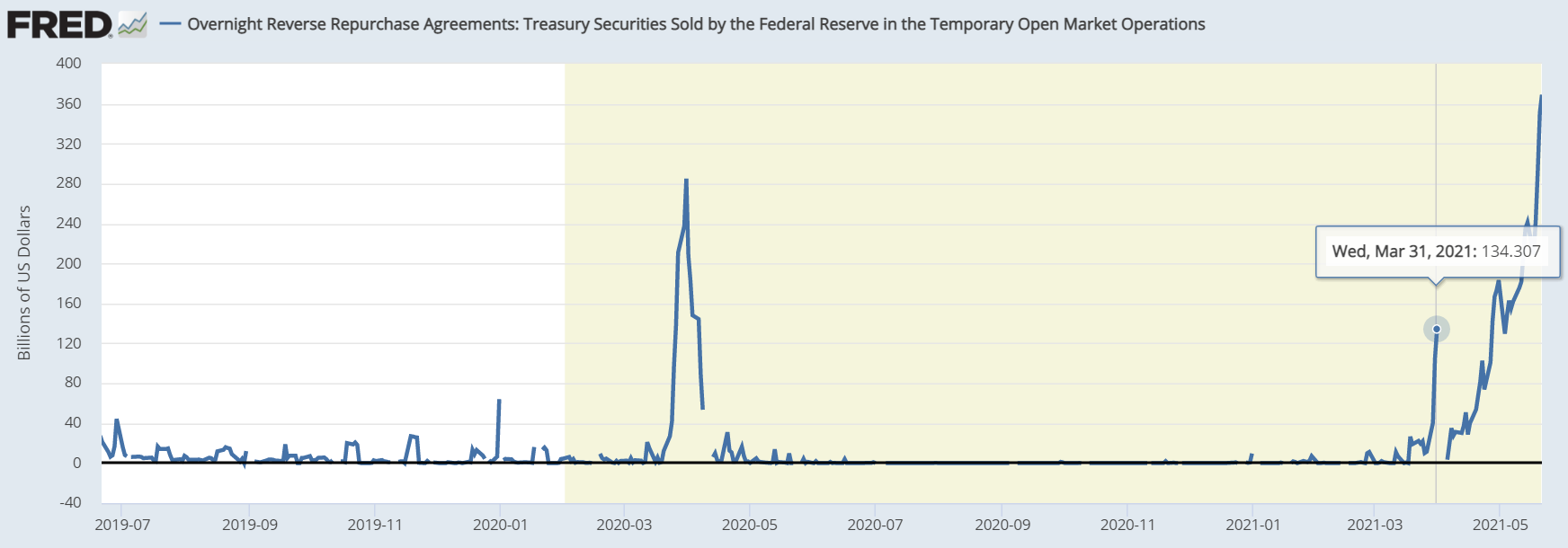

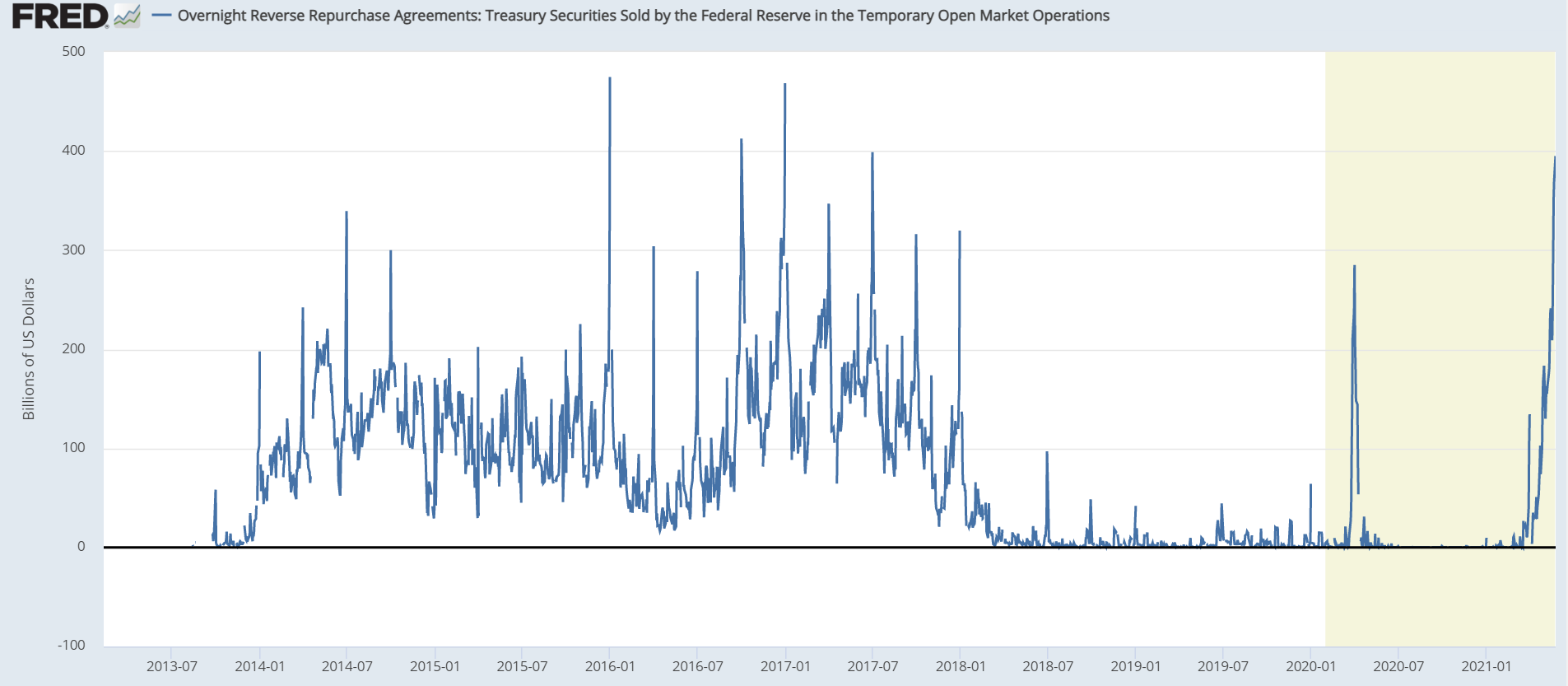

Over the last couple of weeks reports have started flying that the Fed is partaking in a record amount of reverse repo transactions. Some people have jumped to saying it is stealth QT (quantitative tightening) because the Fed is worried about too much inflation. We've seen headlines like these:

- NY Fed eases eligibility requirements for reverse repo facility

- Repo Crisis Looms: Fed's Reverse Repo Usage Soars To $351BN, Fifth Highest Ever

- Fed Alert: Overnight Reverse Repo Usage Soars Above Covid Crisis Highs

- "RRP Explosion": Fed Reverse Repo Soars To Third Highest With "Incredible Amount Of Cash"

Why is this worthy of the label "Crisis", "Alert", "Explosion"? It is my contention that we are seeing rising levels of reverse repo because of the expiration of the SLR exemption forced a situation where banks can't accept more deposits and their ability to absorb more reserves is questionable. Right now, there is no imminent crisis, but the system is definitely signaling fragility, exactly what the Fed doesn't want in an era of deflationary pressure and a depressionary mindset.

Let's dig in and find out what we can learn.

Background

What is a Reverse Repo?

Reverse Repo works in the opposite direction as QE. In QE, the Fed takes Treasuries and MBS out of the market by swapping for reserves held at the Fed. While reverse repos are when eligible parties swap dollars for Treasuries, taking dollars out of the market and bringing Treasuries back in.

According the NY Fed:

A reverse repurchase agreement conducted by the Desk, also called a “reverse repo” or “RRP,” is a transaction in which the Desk sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future.

When the Desk conducts RRP open market operations, it sells securities held in the System Open Market Account (SOMA) to eligible RRP counterparties, with an agreement to buy the assets back on the RRP’s specified maturity date. This leaves the SOMA portfolio the same size, as securities sold temporarily under repurchase agreements continue to be shown as assets held by the SOMA in accordance with generally accepted accounting principles, but the transaction shifts some of the liabilities on the Federal Reserve’s balance sheet from deposits held by depository institutions (also known as bank reserves) to reverse repos while the trade is outstanding.

An important aspect of repos are their short-term nature. A vast majority are overnight loans (all of the recent Fed activity is overnight (O/N), "rolled over" day after day. In this fashion, when we look at charts of reverse repo levels, we must understand that these are not cumulative. If there were $100 billion in reverse repo yesterday, and $105 billion today, the current total is $105 billion, not $205 billion. Also, when this activity stops, it only takes one day to unwind.

What is the SLR rule?

This rule is all about the ratio on a bank's balance sheet of certain risk assets relative to deposits. You can think of it like a tailored reserve ratio in fractional reserve banking. The SLR is designed to limit risky lending by big banks. Treasuries and Fed reserves are counted as one of these assets, however they are given a lower weighting than other more risky securities, like corporate bonds.

The SLR effect comes from this weighting. Banks are disincentivized to make loans in favor of holding more Treasuries and reserves than they otherwise would. The SLR rules are part of the Basel III international banking regulation, with the primary focus of limiting the risk in large Global-Systemically Important Banks (G-SIBs). If banks are penalized for holding more risky securities, they will tend to contract their lending business by increasing lending standards.

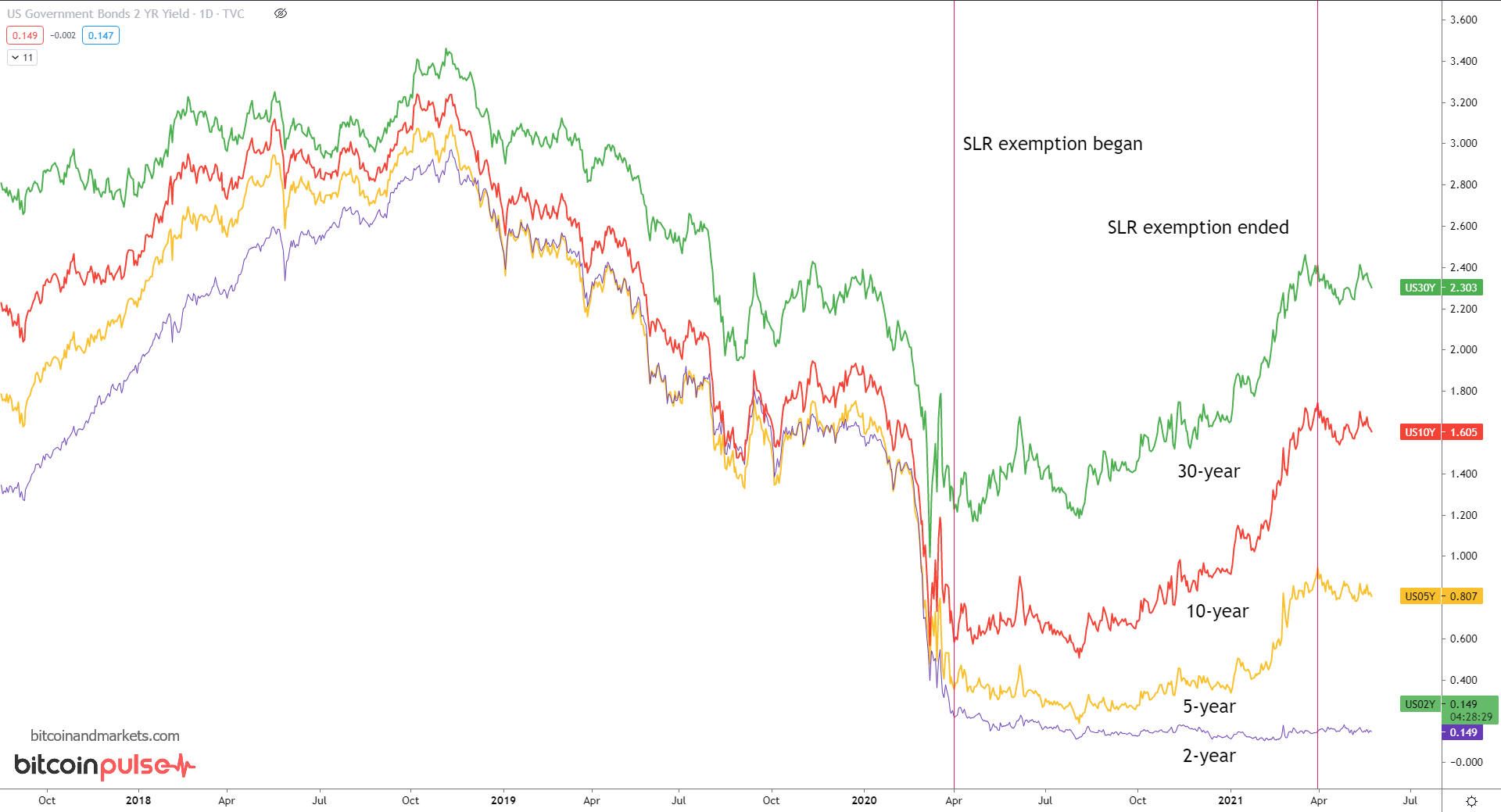

On April 1, 2020, at the height of the corona crash, the Fed instituted an exemption to the SLR, stating that banks did not have to count Treasuries or Fed reserves in this ratio. Some experts claimed the Fed wanted to ensure a ready market for QE. However, there is no shortage of global demand for US Treasuries and banks. In fact, at that exact moment the problem was too little collateral.

The SLR exemption was important because at that time, primary dealer banks who partake in QE were full of reserves, and didn't have room or incentive to increase lending into the part of the economy that really needed access to capital. Instead of this exemption boosting Treasury purchases, it boosted riskier lending, exactly at the time when risk was the highest.

RRP concern started growing in March 2021

In March 2021, as the SLR exemption was about to expire, people who were under the impression that banks had loaded-up on the exempted securities, were worried banks would dump these "excess" Treasuries they had accumulated in 2020. But the banks never were stacking Treasuries. We can check this by simply looking at rising Treasury yields during this whole period (except shorter terms and bills).

Something definitely important happened April 1st. Of course, there are other factors having to do with the end of quarter, but this should tell us that whatever is behind the reverse repo dynamic is extremely important.

QE and Fiscal Spending Piece of the Puzzle

As the SLR exemption ended, banks started counting their Treasuries and Fed reserves again, forcing them to reduce the other riskier securities. Unless, that is, they could increase their deposits. And what did we see around the same time? The $1.9 trillion pandemic relief and the $1.2 trillion TGA drawdown. Both these things boost deposits.

As deposits go up, banks' ability to carry SLR leverage assets increase, but it is unlikely to increase at the same rate, because much of the money flooding the system will go to paying down debt or finding its way into other accounts, like trading accounts, not to the large primary dealer banks.

In my research for this post, I stumbled across a great blog post from JC Brewer whom I am unfamiliar with, however, he correctly predicted the increase in reverse repo to coincide with the end of the SLR exemption.

I admit, I'm still trying to fully understand it. He summarizes his thinking in several parts, some theoretical, some practical. I'll quote this passage at length (emphasis added):

Theory (Part A): when the Fed conducts QE and buys an asset (UST, MBS) from a bank, the bank receives a Fed Reserve Deposit (effectively a digital token of equivalency to cash, against which can only be used in the Fed Funds Market) in return for selling the UST/MBS to the Fed. As explained above, a bank’s TLE includes both Treasuries & Fed Reserves. Therefore, as banks enlarge their balance sheets (shown in below table from Bloomberg) when participating in the Fed’s QE, they will need an extension to the SLR exemption to continue participating in the QE programme (unless their numerator grows proportionately, though this is unlikely). Put another way: from the bank’s perspective, Fed reserves are a negative externality from participating in QE.

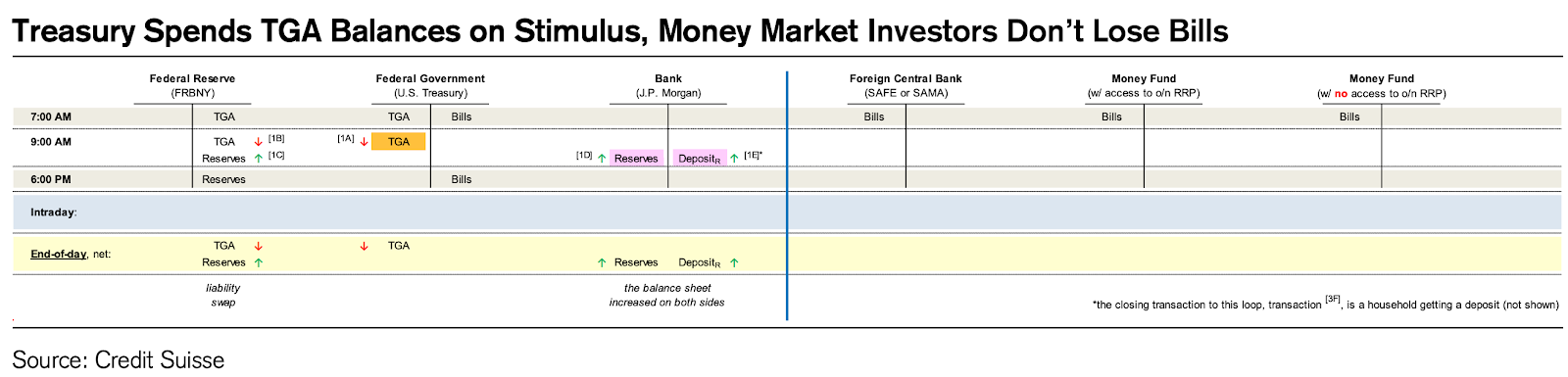

Theory (Part B): customer deposits held with banks can either be used to underwrite loans or held as USTs or Fed reserves, all three of which generate positive carry. However, without SLR exemption being extended, the additional deposits coming from (i) President Biden’s US$1.9trn fiscal package and (ii) US$1.2 trillion decline in the Treasury General Account (TGA), will mean banks will either need to (a) charge negative interest on deposits (to maintain their ROTCE) or (b) turn away deposits, which will mean the only place left are (i) depository institutions (State Street, Bank of NY Mellon) or ([ii]) money market funds, which are capped to US$30bn on direct inflows into the overnight RRP facility. In fact, uncapping direct inflows (from $30bn) on overnight RRP facility and hiking the overnight RRP rate to just above 0% would go along way towards alleviating the balance sheet pressure on commercial banks with or without extension to the SLR exemption. The mechanics of the US$1.2trn TGA drawdown is shown in the below table from Credit Suisse, and illustrates the reserve constraint that banks will face.

In other words, banks are full of reserves. The reinstitution of counting reserves in the SLR has created a nasty situation. The banks won't except deposits unless they can get a positive carry by investing it somewhere, but they can't because rates are so low. Riskier lending with an adequate return are disincentivized by SLR. Deposits from fiscal spending and the TGA make their way into money market funds who happily do reverse repo!

Dollar

We can also see this date in the dollar (DXY).

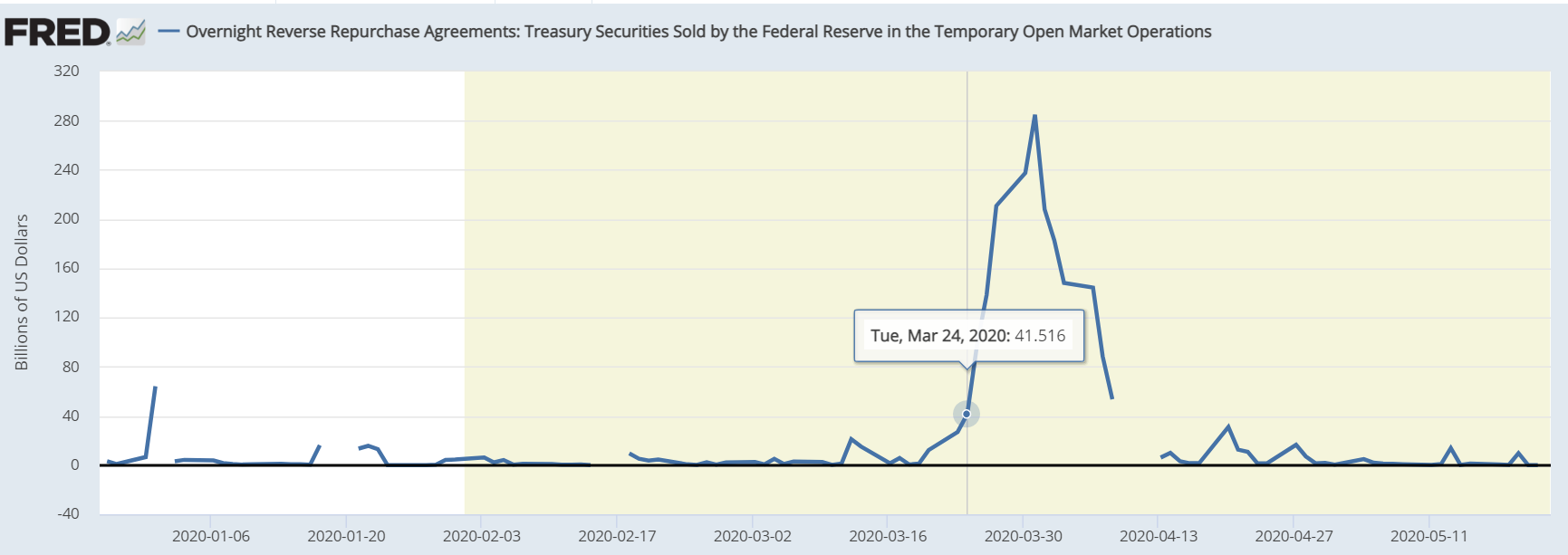

Scrolling back to March of 2020. I want to point out a few things with the interplay of the dollar, the SLR and the amount of reverse repos.

Reverse repos picked-up pace on March 24, 2020, simultaneously with the dollar peaking at 103. Remember, reverse repos are swapping dollars for Treasuries/collateral. There seemed to be a very acute dollar shortage the last week of the quarter, followed by an acute collateral shortage. The dollar immediately switched direction and started dropping. A week later, the SLR exemption went into effect. The dollar continued to drop.

The end of the exemption was also pivotal for gold. The dollar and gold were going down together for most of the SLR exemption period.

What does it all mean?

Clearly the SLR exemption was important, and the ending of the exemption has affected the market. But why are we seeing reverse repos kicking into high gear, and what does it mean?

Let's do a little thought experiment. What if the government spending programs flooded the banking system while the SLR exemption was in effect? In that case, the banks would not be facing the forced rebalance out of riskier securities, they would be able to invest those deposits into securities that netted them a positive carry.

In other words, the banks could accept the deposits because they could make the math work, expanding their balance sheets would be profitable. That means the reflationary bounce would have continued, pushing CPI higher, as banks created more credit in commercial and industrial loans. Now CPI will likely flip lower.

Our little thought experiment shows us what we are dealing with here. Banks can't expand their balance sheet profitably, unless 1) they can charge negative rates on deposits or 2) expand riskier investments with higher return. Until then dollars will make their way through the money market funds into reverse repo.

What does this mean for the future of QE?

The SLR rule dictates the reserve ratio and make-up of the balance sheet for large banks (G-SIBs). It consists of a weighted ratio of assets (securities including Treasuries, reserves and riskier loans) and liabilities (deposits). When banks participate in QE, they are locking Treasuries into Fed reserves, acting like deadweight on their balance sheet, limiting the expansionary activities the banks participate in.

As the banks continue to take part in QE, balance sheet rigor mortis is setting in. They won't stop participating in QE, but will need to tighten lending standards even more to shrink the amount of useful securities, productive assets, they own, because they are weighted more heavily in SLR. Tightening lending standards will slow any recovery there was, force interest rates lower, and exacerbate wealth inequality.

QE is a non-stop drain of useful collateral from the financial plumbing. Right now, that is being compensated for by money market funds doing reverse repo, pulling that collateral back out into the system and draining dollars.

Can QE continue? Yes, but it will be less and less effective. We'll probably start hearing rhetoric around "transmission of monetary policy," Fed code for 'what we are doing isn't working like we thought it would.' The Fed can get around this by exempting reserves from SLR, but the whole point of QE is to add reserves to banks' balance sheets to bolster counterparty confidence in the financial system.

What does it mean for the dollar and gold

During the previous period of elevated reverse repo activity, 2014-2017, we saw a massive rise in dollar strength and a giant bottoming pattern for gold. Oil also sold-off dramatically during this 2014-2017 period. Bitcoin was also consolidating after the MtGox cycle. Of course, bitcoin is uncorrelated in its monetization phase.

Conclusion

As I said in the beginning, the reverse repo levels are not signaling an imminent crisis, but they are signaling that fragility has not gone anywhere. The market is trying to deal with a collateral shortage caused by QE, when the banks are full of reserves, and the government is creating a lot of deposits.

The market is dealing with circumstances the best that it can, effectively reversing QE with reverse repo. This can stave off imminent issues, but creates a system stressed and out of balance. A collateral shortage could morph into a dollar shortage if it behaves to similar times in the past.

All of that and we didn't even mention unemployment or geopolitical matters in this post, both being a huge concern as well. Bottom line, the economy is not going to grow anytime soon. And that means no inflation. It's now a waiting game for the next crisis.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in