Investing In Argentina

Welcome to Bitcoin and Markets Research. This post will be the first installment of a 2020 Emerging Markets Series. In this series, we will be juxtaposing various emerging market fiat currencies with the three forms of money that are currently vying for global dominance. The three competitors are: Gold (the global reserve currency of the past), the US dollar (current world reserve currency), and Bitcoin (future world reserve currency in our estimation). Our objective is to derive meaningful information about the relationships between a particular emerging market currencies and those three competitors.

Argentinian Peso

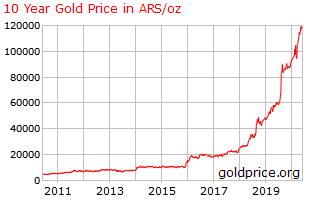

Versus Gold

The velocity with which the price of gold is increasing versus the Argentinian Peso continues to accelerate. In the 8 year period between 2010 and 2018 the price of gold roughly tripled; however, from 2018 forward, the gold price tripled again in about 1.5 years. Since January 2018, the price is up 600%. What initially took six years to occur is now being done four times faster. We also do not know if the prices indicated above are representative of “official” rates or black market (read: free market) rates.

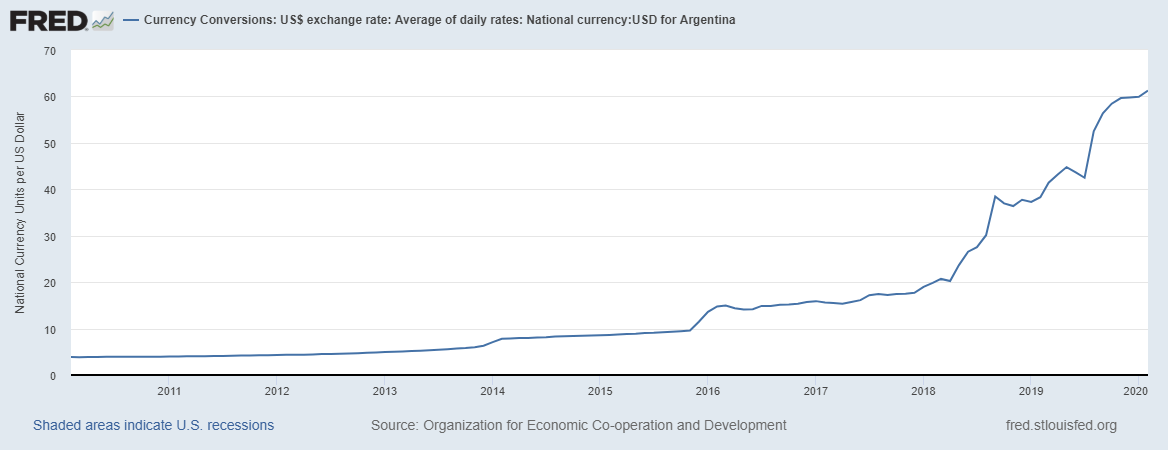

Versus the Dollar

Several years ago, inside the Belo Horizonte, Brazil airport, I was approached by an Argentine national asking if I had any dollars I would be willing to sell her. She was traveling back to Argentina and wanted to bring dollars back with her. Argentina is famous for its multiple currency crises over the last decades. The Peso is so bad, the US Dollar is widely used in commerce within Argentina. As you can see in the chart above, at no point in the last decade would it have been beneficial for an Argentine to hold Pesos instead of US Dollars.

There is much more to this story however. As you can see in this article by Reuters from May 2020, the free market exchange rate is actually 136 pesos per dollar. This suggests the real-world benefit of holding Dollars instead of Pesos is almost double the official numbers. As is always the case, the official exchange rate simply presents another opportunity for the government to further gouge its citizens and tourists.

Versus Bitcoin

The most interesting thing about this bitcoin chart is that Bitcoin is doing a wonderful job functioning as a long-term store of value in Argentina. In US Dollar terms, the price of Bitcoin remains 50% below its all time high; however, in Argentina, the Bitcoin price has appreciated by over 200% since the end of the last Bitcoin bull market in 2017 and 400% since January 2018. This is really quite astounding.

Summary

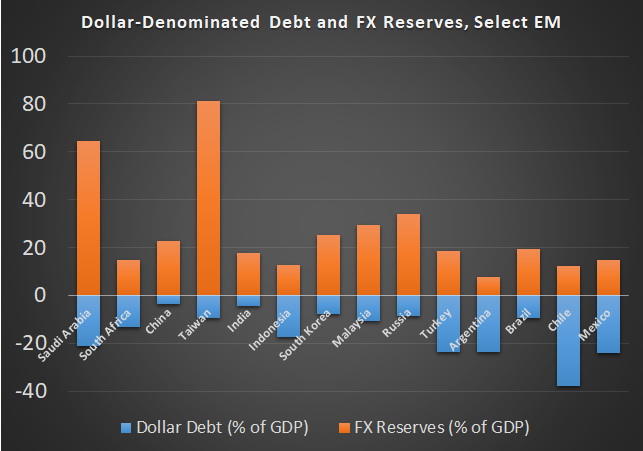

The final chart will be featured numerous times in this series. It shows the % of US Dollar denominated debt by country versus the % of Dollar reserves relative to its GDP. Understood another way, it represents the amount of outstanding loans, in Dollar terms, versus the amount of Dollars which can be used to discharge this debt. Some countries, like Saudi Arabia and Taiwan, have very significant savings of US Dollars and very little Dollar denominated debt. Argentina, on the other hand, has very poor savings in dollars and essentially no ability to repay their Dollar denominated debt without borrowing.

Furthermore, Argentina does not currently have swap lines with the Federal Reserve. Swap lines are direct currency exchanges between Central Banks. The Federal Reserve swaps Dollars for foreign currency in an attempt to help the illiquid global condition in Dollars. This typically requires swaps of increasing sizes over time, despite best intentions, devaluing the foreign currency. Only specific countries can access swap lines, and Argentina is not one of them. That inability to access liquidity will likely increase stress on the Peso for the foreseeable future. So, it is a "damned if you do, damned if you don't" situation.

Lastly, we must mention, just two weeks ago, Argentina defaulted on a loan from 2016. This loan was originally extended to avoid a previous default.

The weakening of the Argentine Peso is in a bad position versus the Dollar due to no Federal Reserve provided Dollar swaps. Gold has performed best against the Peso since January 2018, but this was during a bitcoin bear market that is coming to an end. The Peso's weakness is almost guaranteed to continue so could provide low risk trades versus gold and Bitcoin.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in