Investing In South Africa

Welcome to installment #7 of the Emerging Market Series. This week we will be covering South Africa.

South Africa has the 2nd largest GDP on the continent of Africa behind Nigeria; however, they are arguably the most dominant economy in the region. As a member of the BRICS (Brazil, Russia, India, China, and South Africa) since 2010, South Africa is widely considered one of the most significant emerging market countries in the world. The purpose of the BRICS is to improve economic conditions globally as well as to find ways members nations can better coordinate economically. This membership gives South Africa a global working partnership that other African countries do not have.

Economic optimism began increasing in 2010 but has not fared well over the last couple of years. South Africa was already in a recession prior to the onset of Covid-19 and they have also been one of the hardest hit countries in terms of infections due to the pandemic. To add insult to injury, South Africa has had to apply for an emergency loan from the IMF of $4.3 billion and they are looking to borrow an additional $7 billion from other international financial institutions.

“Forecasts are for gross domestic product to shrink by at least 7% this year, and a budget deficit of around 15% of GDP.”

- Reuters

These forecasts tend to be very conservative estimates. Reality is often considerably worse.

Another issue of serious concern involves land reform. South African President Ramaphosa has proposed a law which would amend the constitution and allow expropriation of land without compensation as explained by The Elephant:

“The law proposed by Ramaphosa aims at amending section 25 of the Constitution to make the expropriation of land without compensation an explicitly legitimate option. In other words, the government could take this land away from white hands without paying them anything, as long as the reform doesn’t cause any damage to the nation’s economy, agricultural production, and food security.”

That last sentence would be impossible to quantify until after the expropriation has occurred but we don’t need to spend time hypothesizing regarding the outcomes of such a policy. The article goes on too mention the outcomes of two of the more recent experiments with such policies in other countries:

“A law to allow the seizure of land has a profoundly negative impact that goes well beyond the violation of fundamental human rights. Its consequences can be catastrophic on the industrial, agricultural, and banking sectors as well, and neighbouring Zimbabwe is a prime example. Just like Venezuela, another country where land was redistributed from the rich to the poor, today Zimbabwe needs to import nearly all the food it needs rather than producing most of it, as it did 20 years ago.”

It’s also no coincidence that both Zimbabwe and Venezuela have had two of the most famous, and destructive, hyperinflationary periods of the last century in a desperate attemtpt to try and cope with the consequences of their failed land redistribution policy. The economic situation is already dire in South Africa, with roughly 1/3 of their citizens unable to find work, and a radical policy such as the one being discussed would be catastrophic.

South Africa Central Bank Interest Rate and Fed Funds Rate

The South African central bank removed another 25 basis (1/4 of a percent) points from its benchmark interest rate on July 23, extending record low rates to 3.5%. As is the trend among global central banks, the rate cuts have been the preferred tool for trying to arrest the fallout from the coronavirus pandemic. Always keep in mind that artificially low interest rates are a zero sum game in which savers are punished with lower saving rates at the bank and debtors benefit by being able to service their debt more cheaply.

South Africa Central Bank Balance Sheet

The South African central bank has tripled the size of their balance sheet in the last decade, with particularly noteworthy increases in 2016 and 2020. In 2016, China experienced a significant economic slowdown which decreased its demand for commodities concomitantly. Since South Africa relies on exports of its commodities to maintain growth in their economy China's slowdown had a dramatic impact on South Africa. It was during this time that the South African Rand hit an all-time low against the dollar. It would be just a few years until the rand would record another all-time low against the dollar, during 2020 in response to the pandemic.

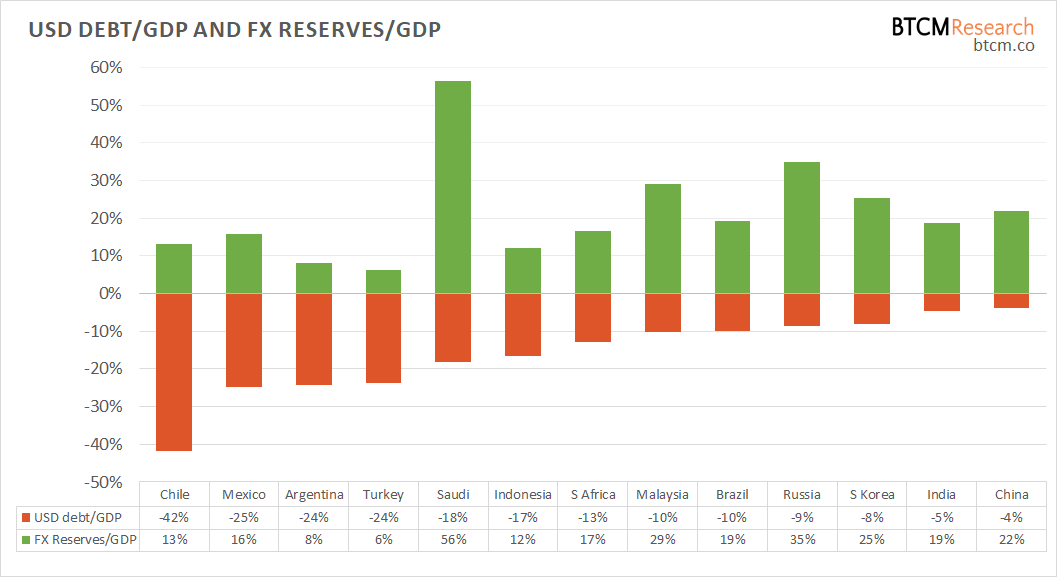

Dollar Denominated Debt and FX Reserves for South Africa

South Africa is in relatively good shape when considering their dollar debt versus their Forex reserves (ability to pay back said debt with reserves on hand). Also of note is South Africa's gold reserves and gold deposits in the country.

South Africa and Gold

The price of gold in rand has increased by roughly 300% in the last ten years. Instead of investing in risky assets, such as those found in the domestic stock market, a safer and more profitable decision for South Africans would have been to accumulate gold. The next chart shows the historic level of gold reserves held by the South African central bank.

Though South Africa is known for its gold mining, sporting 2 of the top 10 largest gold mines in the world, there has been almost no growth in gold reserves held by the South African central bank in the last decade (0.3%). A total wasted opportunity. It would make sense for the central bank to make a consistent habit of acquiring gold in the good years, and yet the bank appears to have no interest in taking advantage of one of the nations’ important national resources which lies in close proximity.

US Dollar versus South African Rand

Over the course of the last decade, the dollar appreciated an average of 8.5% per year against the rand, the two worst periods for the rand being 2016 and 2020 as detailed above. Following the 2016 crisis, and stretching into 2018, the rand surprisingly rose against the dollar due to the contraction of South Africa's money supply during the same time that interest rates were being held constant.

Bitcoin versus South African Rand

The price of bitcoin in rand is within 20% of its 2017 all-time high. Though not in the group of countries with record P2P (peer to peer) purchases (Argentina, India, and Mexico), it is only a matter of time before South Africa joins that group. Surprisingly, even with the country's long history with gold, bitcoin is the better fit for South Africans because of the extremely high crime rates and state-sponsored seizures of property. Transporting, receiving, or holding gold for the common citizen is very risky while bitcoin offers a weightless digital delivery and storage option that allows the common man to stack sats (1 sat=100 millionth of a bitcoin) little by little.

Furthermore, bitcoin giant Bitmex has made a significant investment in South Africa’s largest exchange, VALR, which means liquidity prospects should improve a lot over the next year.

Takeaways on South Africa

- South Africa is a key member of the BRICS

- Interest rates at record lows

- Central bank balance sheet has tripled in 10 years

- Dollar debt versus FX reserves is stable

- Rand has steadily depreciated versus USD, gold, and bitcoin

- Crime and State-sponsored seizure is a problem, property rights are constantly in flux

- Bitcoin is perfect for high crime regions

- Large companies in the bitcoin space are investing in the South African market

Further decreases in the purchasing power of the rand against the dollar should be expected. A way to play this is to look at options strategies using index funds such as EZA. We look to open longer dated short positions during EZA rallies to levels 10% above its 50-day moving average. In other words, selling rallies because downward pressure on the market will be the trend for the foreseeable future. For those in South Africa, Bitcoin is the obvious choice. Bitcoin is already at all-time highs against the Argentine Peso and Turkish Lira and my bet would be that South Africa is the next emerging market domino to fall. Lastly, pay special attention to any and all developments concerning land confiscation in South Africa.

Kent Polkinghorne

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in