The Predictive Power of Fedex

FedEx is down over 22% today which is on pace for its largest daily decline ever (IPO was in 1978). Before today its largest loss was -16% on Black Monday (October 19) in 1987. $FDX

— Charlie Bilello (@charliebilello) September 16, 2022

It is often said that Fedex (FDX) is an economic bellwether. As one of the world's largest transportation companies it's operations are to the economy what the heart is to the body. In the same way that the heart supplies oxygen to body by pumping blood Fedex helps keep the economy in motion by transporting goods from shippers to recipients. In light of the record decline in the Fedex stock price (and because I spent 7 years of my life as an employee there) I thought it might be of benefit to test the common wisdom and determine if Fedex is indeed the economic bellwether it is proclaimed to be.

In order to test said wisdom I thought it best to observe the Fedex stock price in relation to the stock prices from some of the more heavily weighted members of the current Dow Jones Index. These companies include: Mcdonalds (MCD), Goldman Sachs (GS), Home Depot (HD), Caterpillar (CAT), and Apple (AAPL). The idea here is to sample as diverse a set of industries as possible from within the index.

Additionally, since we are in a "technical recession," I thought it best to compare the relationships between the stock prices of Fedex and the other companies during periods of recession since it seems like we are heading in that direction today. The objective was to see with what frequency Fedex' stock price declined before the other stocks in our sample and by how many days. Additionally, we will observe whether Fedex front runs recessions and, if so, by how many days.

Please note that Fedex' stock price is being used as a proxy for the company's performance since it declined markedly in response to comments from CEO Raj Subramaniam which indicated that the preliminary earnings outlook for Fedex was unfavorable and that he expects a global recession (being from India where the Central Bank of India is burning through FX reserves to try and defend the rupee, he may have solid insights on what is going on in the rest of the world as well).

We will begin our study by observing each recession separately, going back to 1980 (Fedex did not IPO until 1978 so it makes sense to begin there). We will then aggregate the data at the end to try and make sense of what we discover. Let's get started.

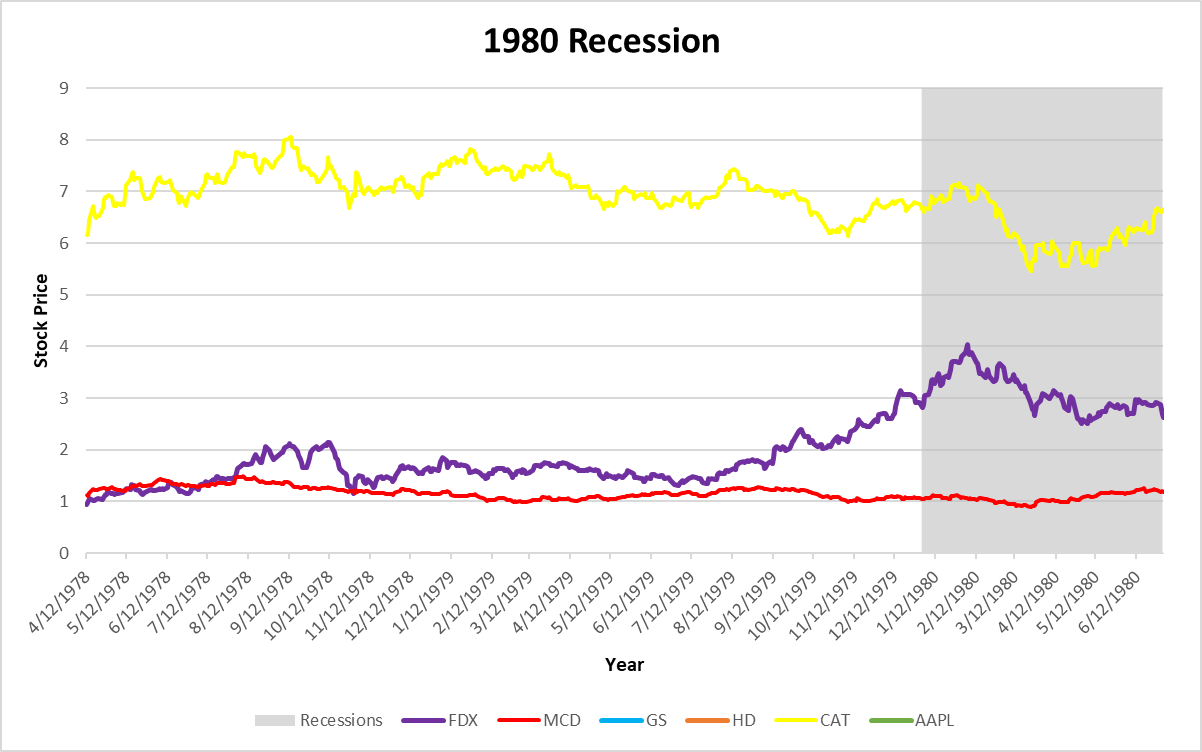

1980 Recession

The 1980 recession was the first recession Fedex went through as a publicly traded company. During this period, only McDonalds and Caterpillar were also being publicly traded. Leading into the recession, Fedex did not begin it's bear market decline until well after the others, beginning it's descent an average of 528 days after McDonalds and Caterpillar had begun theirs.

In terms of Fedex' ability to predict the recession itself it was unable to do so during this time, entering a bear market 35 days after the 1980 Recession had begun.

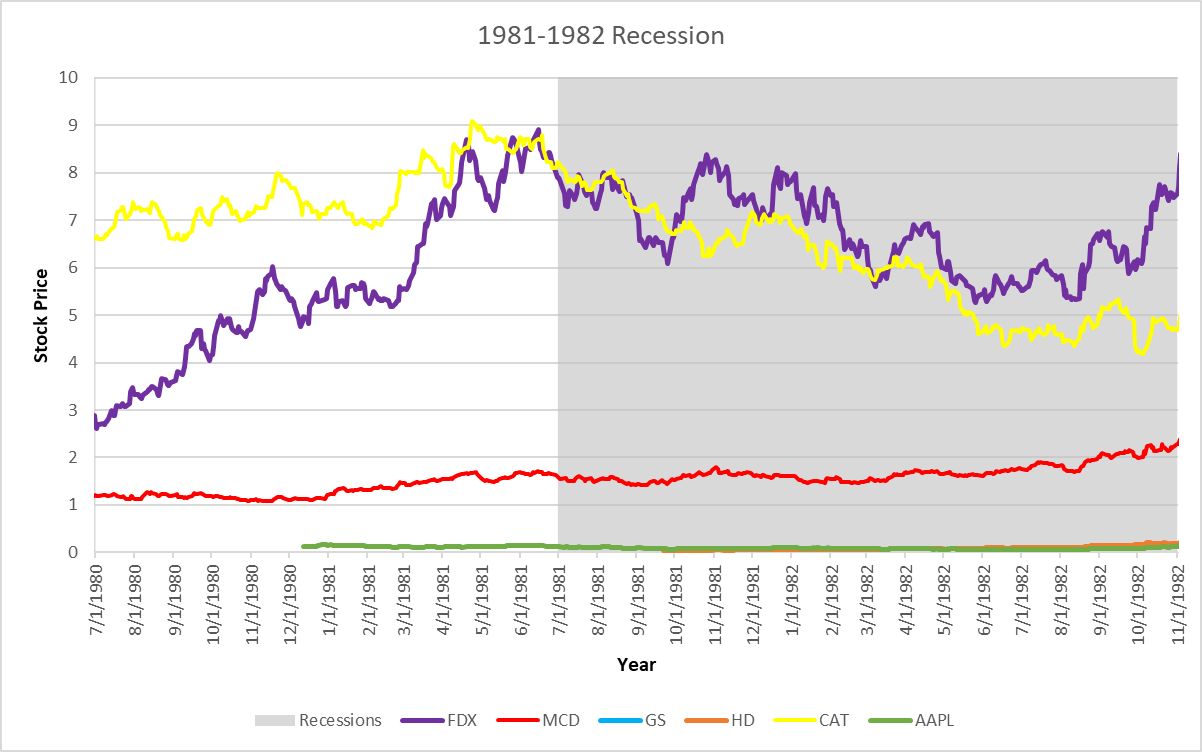

1981-1982 Recession

By the time of the 1981-1982 recession Apple was now being publicly traded as well. While Fedex faired better in it's predictive capacity than it did in 1980 it still fell short. Fedex, again, did not begin it's bear market decline until well after the others, beginning it's descent an average of 73 days after McDonalds, Caterpillar, and Apple had begun theirs.

However, unlike during the 1980 recession, Fedex' stock price began it's bear market descent 16 days before, not after, the start of the 1981-1982 Recession.

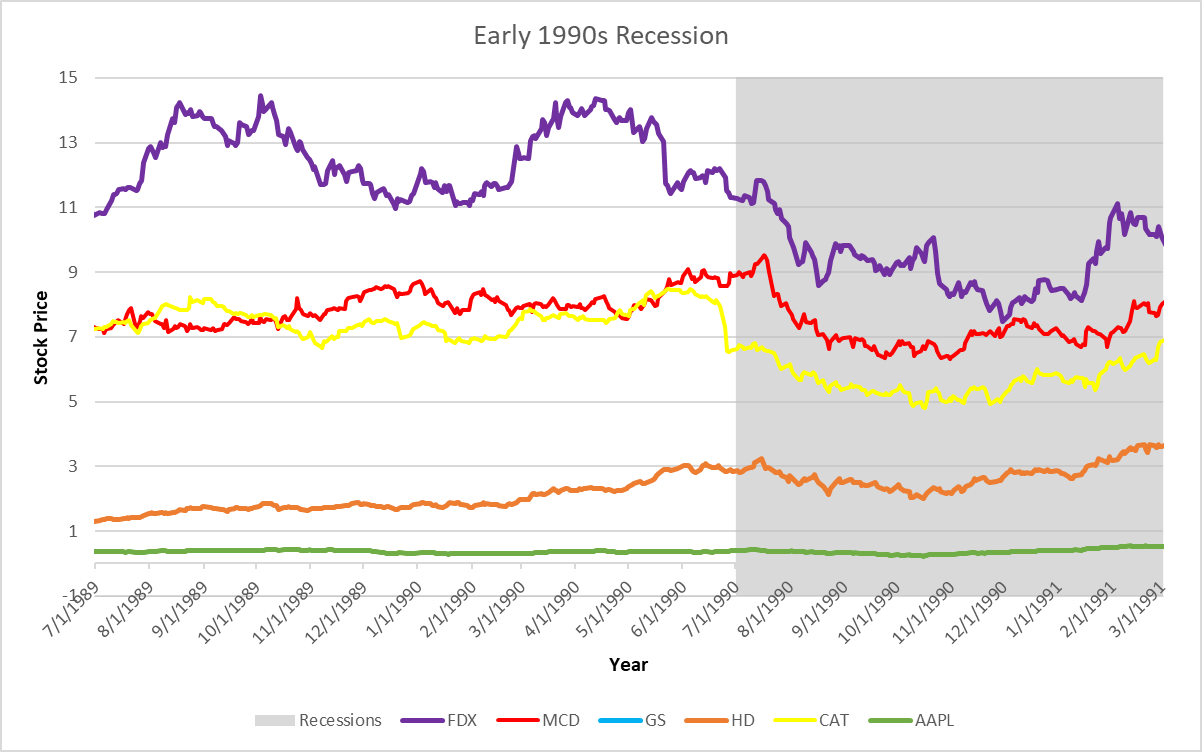

Early 1990s Recession

In addition to our stocks from the 1981-1982 recession Home Depot was now being publicly traded. Of the 4 stocks that are now in our sample only Apple entered a bear market before Fedex. However, with the stocks from the index combined, Fedex entered a bear market 158 days earlier than the average of the other 4 stocks in our sample.

Additionally, Fedex' stock price began it's bear market descent 271 days before the start of the 1990 Recession.

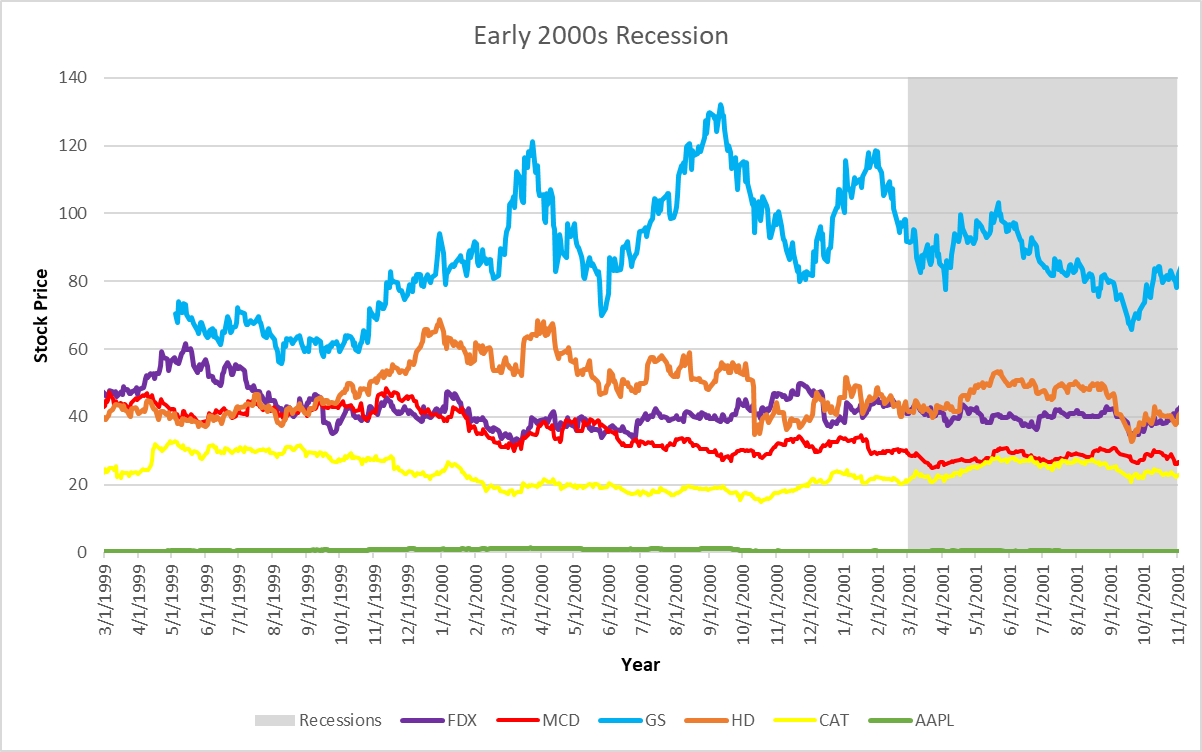

Early 2000s Recession

By the year 2000 all of the stocks in our sample were being publicly traded. Of the stocks being measured against Fedex only Caterpillar entered a bear market earlier. However, with the stocks from the index combined, Fedex entered a bear market 240 days earlier than the average of the other 5 stocks in our sample.

Additionally, Fedex' stock price began it's bear market descent 658 days before the start of the early 2000s Recession.

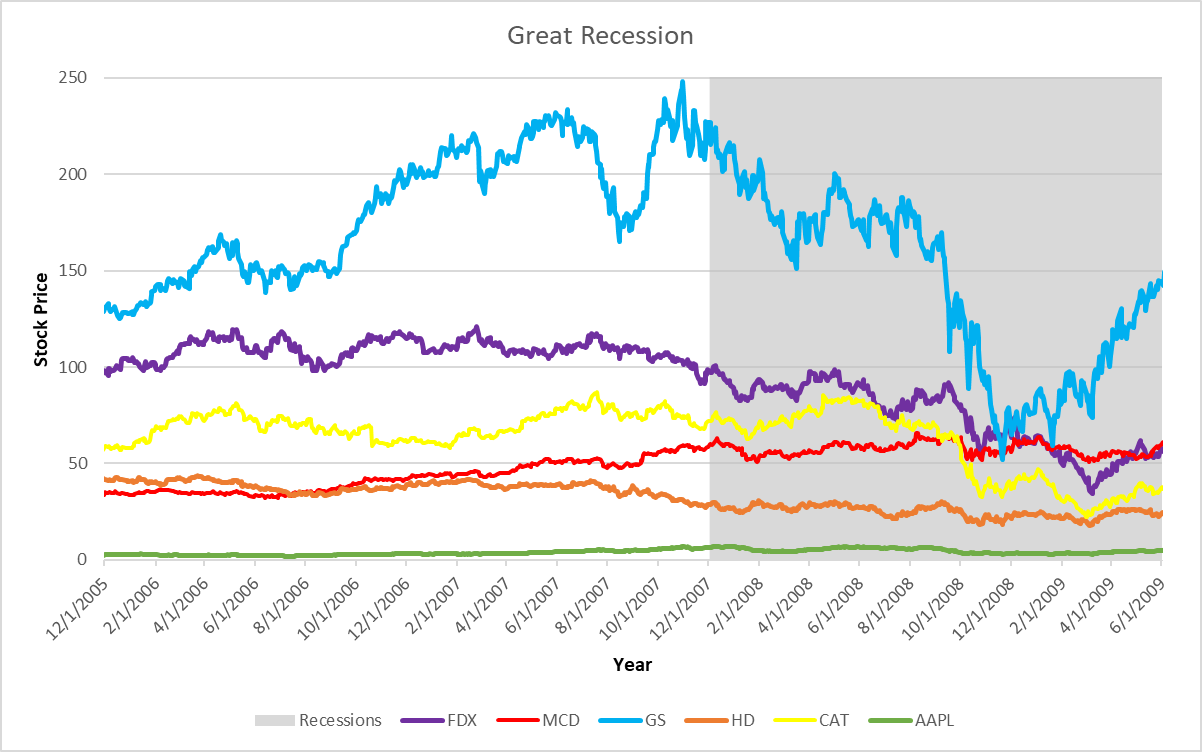

Great Recession

Of the 5 stocks, only Home Depot (imagine my surprise) entered a bear market before Fedex. However, with the stocks from the index combined, Fedex entered a bear market 113 days earlier than the average of the other 5 stocks in our sample.

Additionally, Fedex' stock price began it's bear market descent 281 days before the start of the Great Recession.

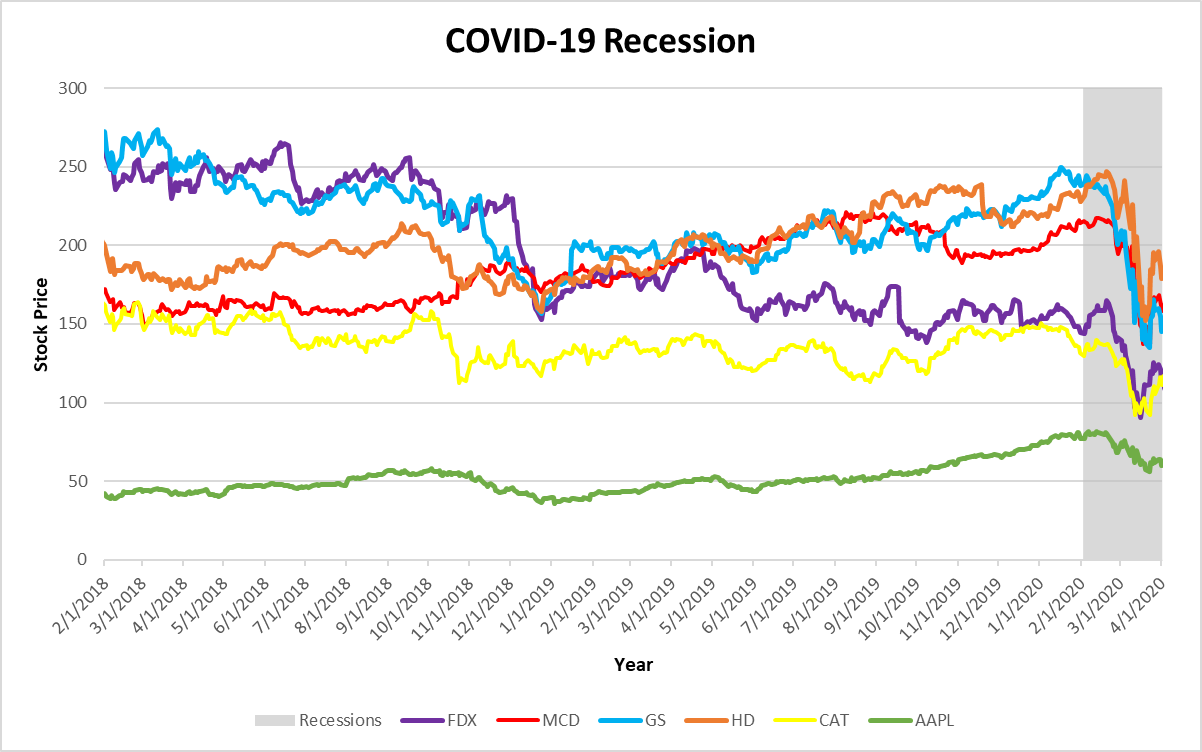

COVID-19 Recession

During the short COVID-19 both Goldman Sachs and Caterpillar entered a bear market before Fedex; however, Fedex still managed to improve upon it's predictive abilities entering a bear market 269 days earlier than the average of the other 5 stocks in our sample.

Many establishment pundits blame the COVID-19 Recession on COVID-19 alone but that is simply not the case as evidenced by the 2019 Fed pivot as well as the rupture in the repo market which also occurred in September of 2019. Either way, Fedex' stock price managed to sniff out all these problems, as well as the recession itself, a remarkable 599 days before it began.

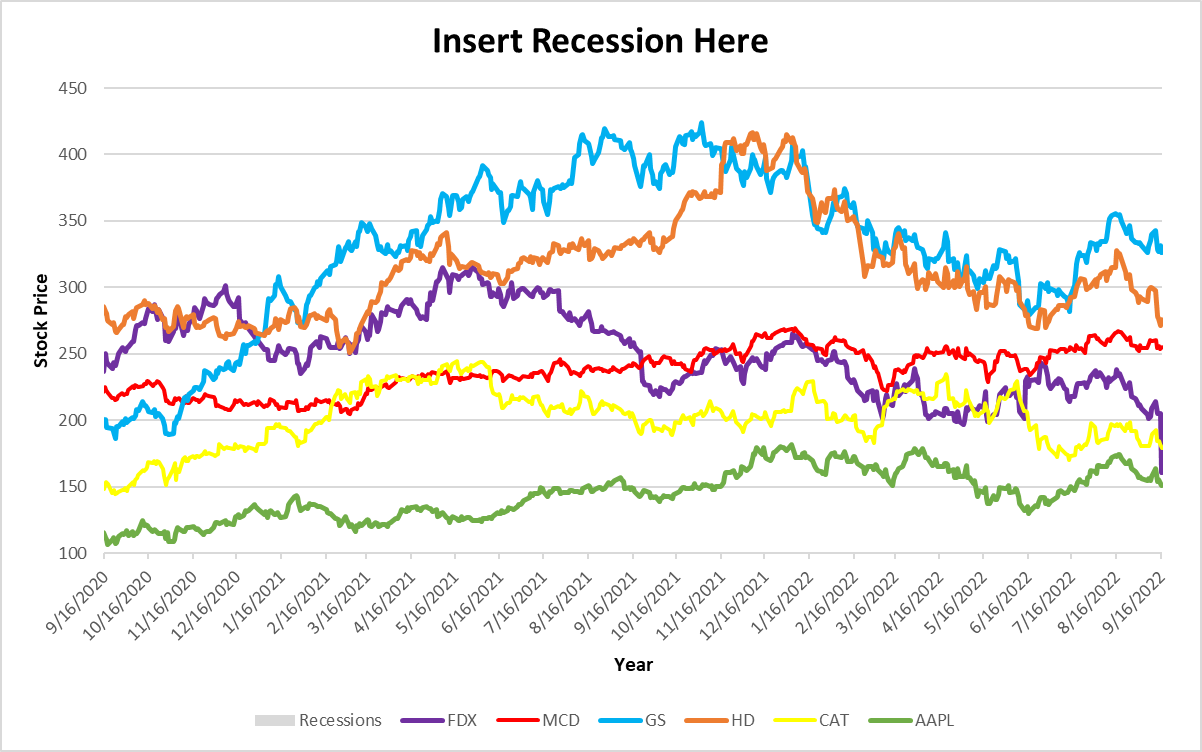

[Insert Recession Here]

Based on the abundance of negative economic data that has come out since the beginning of this year I will presume that we are either in a recession or just about to enter one. With that said, only Caterpillar entered a bear market before Fedex. Nonetheless, with the stocks from the index combined, Fedex entered a bear market 158 days earlier than the average of the other 5 stocks in our sample.

Despite two quarters of negative GDP growth to begin 2022 (Q3 GDP figures are not out yet), there has been no official declaration of recession per NBER. It should be noted, however, that Fedex' stock entered a bear market all the way back in May of 2021 so one is likely to be forthcoming if not already upon us.

Key Takaways

Strength as a Bear Market Indicator

Fedex' stock price entered a bear market before the other stocks in our sample 62% of the time. If we remove the recessions from the early 1980s from our sample it's predictive power increases to 75%.

On average Fedex' stock entered a bear market 48 days before the collective bear markets began for the other stocks in our sample. If we remove the recessions from the early 1980s Fedex stock entered a bear market an average of 188 days before the collective bear markets began for the other stocks in our sample.

Strength as a Recession Indicator

Fedex' stock price entered a bear market an average of 298 days before the start of recessions. If we remove the recessions of the 1980s the average increases to 452 days.

The Predictive Power of Caterpillar (CAT)

One of the more interesting takeaways involved the performance of Caterpillar in our study. Caterpillar managed to predict recessions before Fedex in 5 out of 7 instances. Caterpillar manufactures construction equipment, mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives which means that if underlying economic conditions are poor, Caterpillar has a tendency to be one of the first to know.

Final Thoughts

Fedex' stock price does an admirable job of frontrunning both bear market downturns and recessions, however it should not be the sole indicator that one utilizes to try and make financial decisions. As we saw with the Caterpillar stock price, companies in industries such as industrial manufacturing, logistics, and shipping should also be included in any analysis such as the one performed in this study due to their sensitivity of market forces.

In addition, I think it would be fair to remove the 1980s recessions from our data, instead giving preference to the data from the 1990 recession forward, due to the fact that Fedex did not even IPO until 1978 and was thus in it's infancy during the 1980s recessions. In my opinion, removing those early recessions from our study provides a more accurate picture of Fedex' ability to predict market downturns.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in