The Fed Manages Expectations...Not Interest Rates

As the great debate between inflation and deflation rages on it has led to a complimentary debate, a debate that centers around the Federal Reserve's ability to set interest rates. Conventional wisdom on the topic suggests that interest rates are controlled by the Fed via its federal funds rate. In order to set the fed funds rate, the Fed will target an interest rate range it desires and then use either the purchase or sale of bonds to move its fed funds somewhere within the target range. Ultimately, the Fed hopes that by moving its fed funds rate either up or down that interest rates in the bond market will follow its lead, at least that's the idea.

Through a number of charts I am going to show you how the conventional wisdom has it backwards. Instead of the Fed controlling interest rates, and the bond market by proxy, it is actually the bond market that controls the Fed. We will also talk briefly about a tool the Fed does use to some success, a tool colloquially referred to as "expectations management," but we will first begin by observing the relationship between the fed funds rate and both short and long term interest rates.

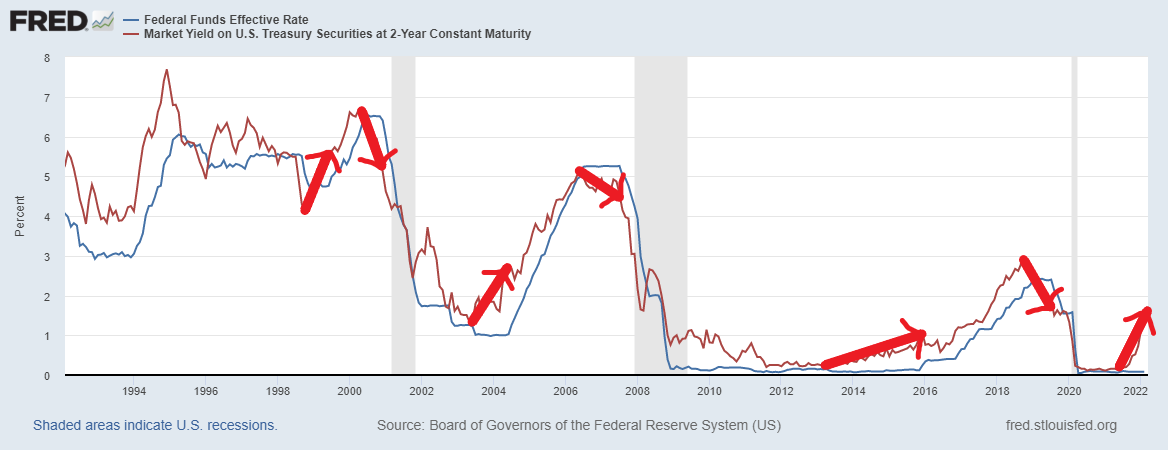

Fed Funds vs. Short Term Rates

For our short term rate we have chosen the 2-year treasury. In the chart above, the blue line represents the fed funds rate and the red line represents the yield on the 2-year treasury. Since the fed funds rate is itself a short term rate we would expect it to have a more profound impact on short term interest rates. What we find in the chart above however is that the fed funds rate has virtually no impact whatsoever. Instead, it just follows the rate changes set by the bond market as indicated by the red arrows. The distance between the beginning and end points of each arrow indicates the length of time it took for the Fed to change its interest rate policy and follow what the bond market was already doing.

To further illustrate how ineffectual the fed funds rate is on the overall bond market have a look at the red arrow on the far right. The Fed has been purchasing $120 billion a month in treasury and MBS (mortgage backed securities) in an attempt to hold rates down. Despite this intervention, the rate on the 2-year treasury has gone absolutely parabolic. While $120 billion in purchases each month may seem like a large number, it pales in comparison to the overall size of the bond market, last estimated to be over $40 trillion in size (from a 2017 estimate). (Edit: to no one's surprise, at least those reading this blog post, the Fed approved a rate hike of 25 basis points at its March 16 meeting which supports our thesis that the bond market walks the Fed. There has been an inordinate amount of attention around this event as one might expect.)

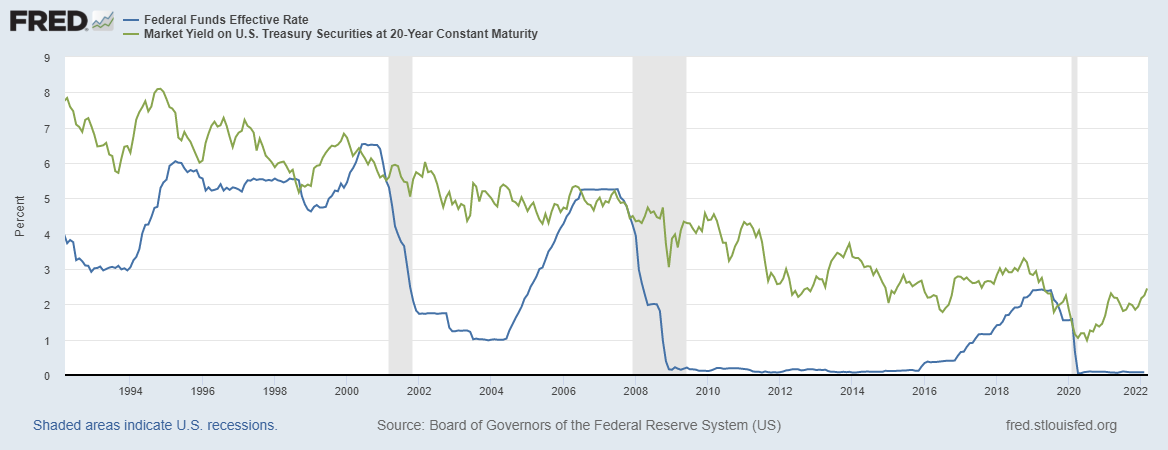

Fed Funds vs. Long Term Rates

As far as the relationship between the fed funds rate and the 20-year treasury is concerned (I just picked a random long term bond), there is basically no relationship to speak of. The interest rate on the 20-year treasury has been on a downward trajectory for more than 30 years regardless of what the fed funds rate was or was not doing. There is little more that need be said here.

At this point we have clearly shown that the fed funds rate is all bark and no bite. I chose this particular expression for a reason. Contained within it is the operative word "bark," i.e. being vocally aggressive or assertive, which will make more sense as we discuss the topic of expectations management in the next section.

Expectations Management

"The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country." - Edward Bernays

To Bernay's point, by convincing the public that it controls interest rates the Fed is able to not only shape public opinion but influence its behavior as well. Unbeknownst to many, the Fed is more of a PR machine than anything else and uses its power of influence to set expectations in the market. Though there have been many hiccups along the way the Fed's forward guidance, i.e its communication to the public about the most likely future path of its monetary policy, has done a masterful job shaping both the opinions and behaviors of the public, especially since the 2008 GFC. Here is a snippet from a 2013 speech by then Fed chairman Janet Yellen discussing the importance of expectations management (courtesy of Joe Carlasare):

.@SecYellen in 2013 speaking some truth. The Fed’s success is dependent on convincing the public that they still are the center of the universe and can control the economy.

— Joe Carlasare (@JoeCarlasare) March 13, 2022

h/t @JeffSnider_AIP pic.twitter.com/PtE3MrveAM

In essence, the key to the Fed's power truly lies in its ability to shape expectations because, as we indicated above, it is unable to effectively influence interest rates with its policies. However, the ability to manage expectations in the economy is all good and well but what happens when the rubber meets the road? What I mean by that is what happens when expectations come into conflict with reality?

At the end of 2018, in the midst of a large stock market correction and the worst December for stocks since 1931, Jerome Powell famously referred to the Fed's ongoing balance sheet reduction as being on "autopilot." The implication being that everything in the financial markets would be just fine, the Fed had it under control. Unfortunately for Jay, the limitations of the Fed's expectations management were in the process of being exposed. While the bond market had reversed course in early November, sending interest rates and the prospect of looser lending conditions down with it, the Fed had continued to hike rates. However, by January of 2019 the Fed's rate hikes were permanently put on pause, and its balance sheet reduction program would end the following summer. By August of 2019, the Fed had already begun decreasing its fed funds rate yet again, merely following what the bond market had been signaling for the previous 9 months.

The reason the Fed is never held to account for its miscues lies in the fact that very few people pay attention to interest rates at all, unless a spokesman from the Fed goes in front of the camera, to much fanfare, and brings attention to it (supported by a complicit financial media which supports its message). In a 2017 press conference, former Fed chairman Janet Yellen confidently remarked that the process of the Fed's balance sheet reduction would be like "watching paint dry" meaning that it would be automatic and nothing to worry about. Fast forward five years and the Fed's balance sheet is now more than double what it was at the time of her speech but she, nor the Fed, has ever been held accountable for this miscue. In fact, she is the Secretary of the Treasury today.

Conclusion

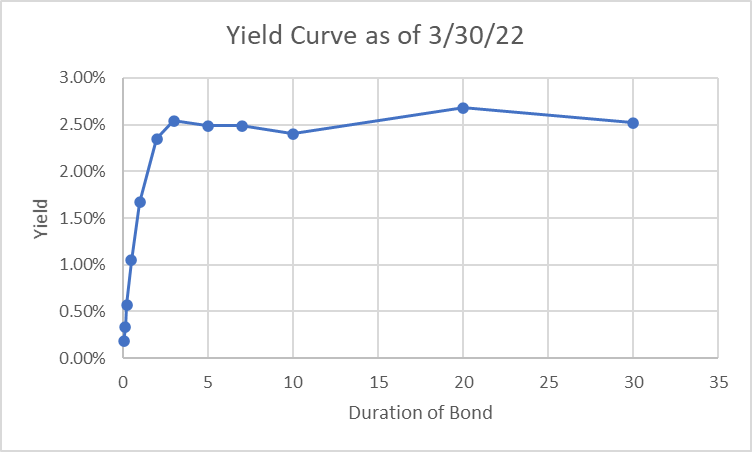

While Michael Jackson didn't invent the moonwalk he effectively made it his own through rigorous self promotion. Likewise, while the Fed doesn't actually control interest rates they are able to convince the public that they do through their extensive use of expectations management. For example, the Fed has been signaling (key word here) for months now that it intends to hike its fed funds rate multiple times in 2022, the latest expectation being 7 hikes in total. This has caused investors to begin selling the short end of the yield curve in anticipation but has had virtually no effect on rates for bonds beyond the 2-year treasury, they continue to remain relatively flat.

Aside from the miniscule rate hike a few days ago the Fed has done literally nothing to tangibly influence the recent rate increases on short end of the curve. This fact lends credence to the idea that the Fed's interest rate policy is ultimately impotent and that any short term moves in the rate of interest are simply a function of the Fed’s expectations management.

The moral of the story here is that increases or decreases in the fed funds rate are immaterial. In the long run, it is ultimately the bond market that sets the rate of interest.

Enjoying these posts? Subscribe for more

Subscribe nowAlready have an account? Sign in